The Status Of Gold’s “True Fundamentals”

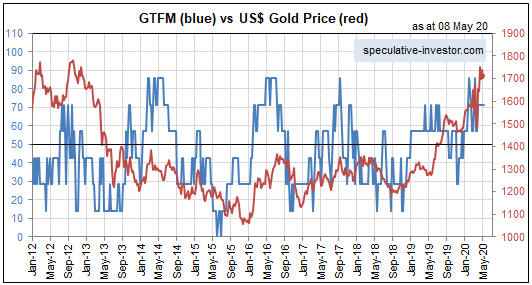

According to my Gold True Fundamentals Model (GTFM), the gold market’s “true fundamentals” most recently shifted from bearish to bullish in December of last year. As indicated on the following weekly chart by the blue line being above 50, at the end of last week they were still bullish. This means that the fundamental backdrop is still applying upward pressure to the gold price.

As previously explained, I use the term “true fundamentals” to distinguish the fundamentals that actually matter from the largely irrelevant issues that many gold-market analysts and commentators focus on.

According to many pontificators on the gold market, gold’s fundamentals include the volume of metal flowing into the inventories of gold ETFs, China’s gold imports, the amount of “registered” gold at the Comex, India’s monsoon and wedding seasons, jewellery demand, the amount of gold being bought/sold by various central banks, changes in mine production and scrap supply, and wild guesses regarding JP Morgan’s exposure to gold. These things are distractions at best. For example, a gold investor/trader could have ignored everything that has been written over the past 20 years about the amount of gold in Comex warehouses and been none the worse for it.

On an intermediate-term (3-12 month) basis, there is a strong tendency for the US$ gold price to trend in the opposite direction to confidence in the US financial system and economy. That’s why most of the seven inputs to my GTFM are measures of confidence. Two examples are credit spreads and the relative strength of the banking sector. The model is useful, in that over the past two decades all intermediate-term upward trends in the gold price occurred while the GTFM was bullish most of the time and all intermediate-term downward trends in the gold price occurred while the GTFM was bearish most of the time.

However, upward corrections can occur in the face of bearish fundamentals and downward corrections can occur in the face of bullish fundamentals. For example, there was a sizable downward correction in the gold market in March of this year in the face of bullish fundamentals. Such corrections often are signalled by sentiment indicators.

Right now, the fundamentals are supportive while sentiment is warning of short-term downside risk.

- As long as the fundamentals remains supportive, any short-term decline in the gold price should be ‘corrective’, that is, it should be within the context of a multi-year upward trend.