The "Smart Money" Continues To Sell Stocks And Buy Gold, As Retail Investors Go Berserk

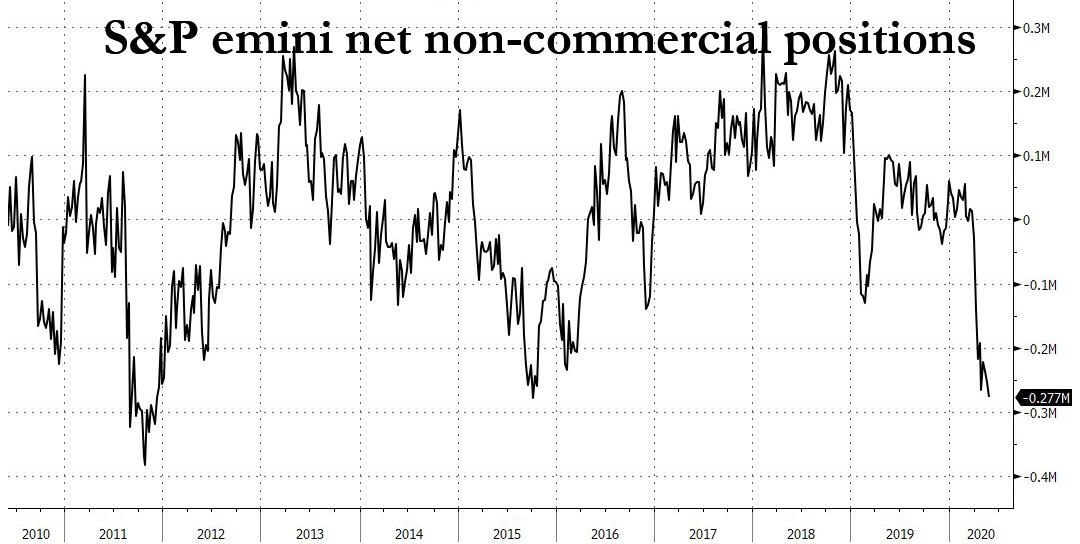

Another week, another remarkable increase in the net short position in Emini S&P non-commercial futures - even as the S&P hits a new post-crisis high, closing the week at 3,044 - which in the latest week increased by 24k to a net -277K, nearly 3 standard deviations below the recent average and tying the biggest net-short since the oil crisis and manufacturing recession of late 2015.

(Click on image to enlarge)

Separately, Bank of America today confirmed this trend of "smart money" selling stocks, with the bank's "private" high net worth clients not only selling stocks for 7 consecutive weeks but last week recording the largest week of equity selling since June 19.

What are the private clients doing with the newly released cash? Why buying gold, with BofA's Michael Hartnett writing that over the "past four weeks exclusive buying of gold' as well as several other products including healthcare (COVID hedge), TIPS (inflation hedge), and IG (fed-backstopped).

(Click on image to enlarge)

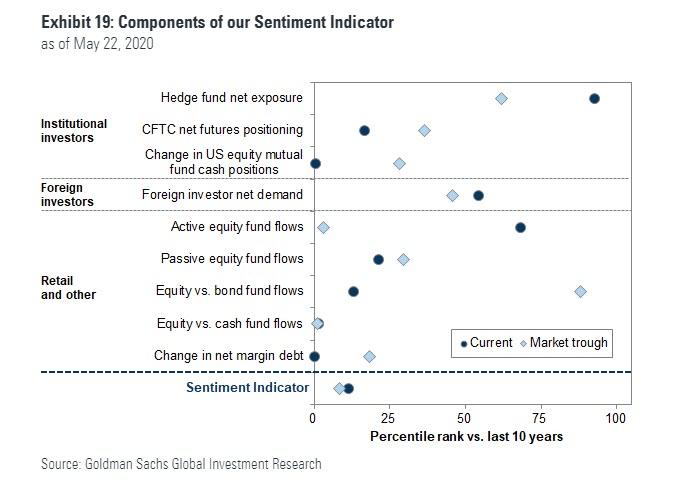

Incidentally, the continued bearish bias of institutional and high net worth clients is often cited as a key driver to the continued upward momentum for the broader market, with Goldman earlier today noting that "institutional investors, such as mutual funds, are among the investor categories with the most room to increase their equity allocations. CFTC net futures positioning has continued to decline from levels at the market trough and mutual fund cash positions jumped to a two-year high in March. US money market funds have experienced effectively no reversal of the $1.2 trillion of inflows experienced during the past three months. Money market mutual fund assets now total $6.0 trillion. Reduced outflows from active mutual funds could also support equity purchases by this cohort."

Which is not to say that every type of investor is bearish: in contrast to institutions and HNWs, hedge funds and retail investors "already appear relatively optimistic on the current market outlook" according to Goldman, which notes that while hedge funds have historically cut leverage and been left underexposed for the ensuing rebound, during the recent sell-off funds cut net leverage by less and stopped cutting at a higher level of exposure compared with previous drawdowns. As a result, net exposures calculated by GS Prime Services currently rank in the 92nd percentile in the past 10 years.

(Click on image to enlarge)

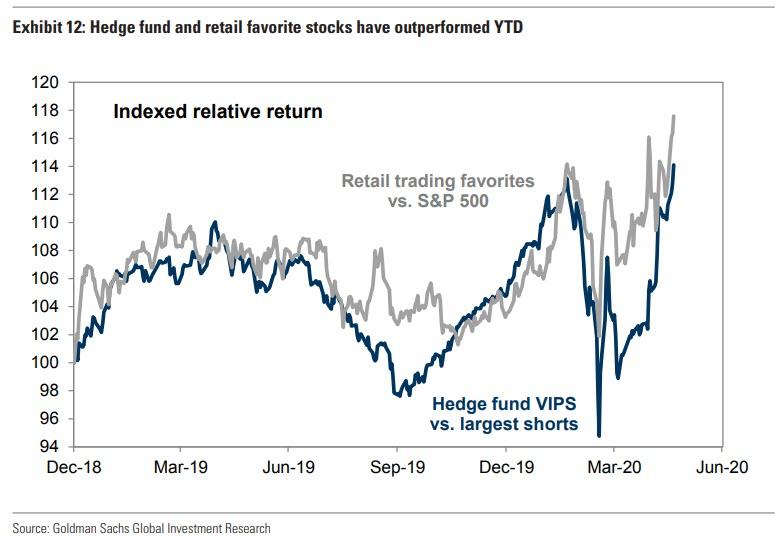

Yet while hedge funds are clearly turning bullish, they are merely eating retail investors' dust, who as we showed this week, have outperformed (!) hedge funds YTD, with the basket of "retail trading favorites" outperforming solidly outperforming a hedge fund index.

(Click on image to enlarge)

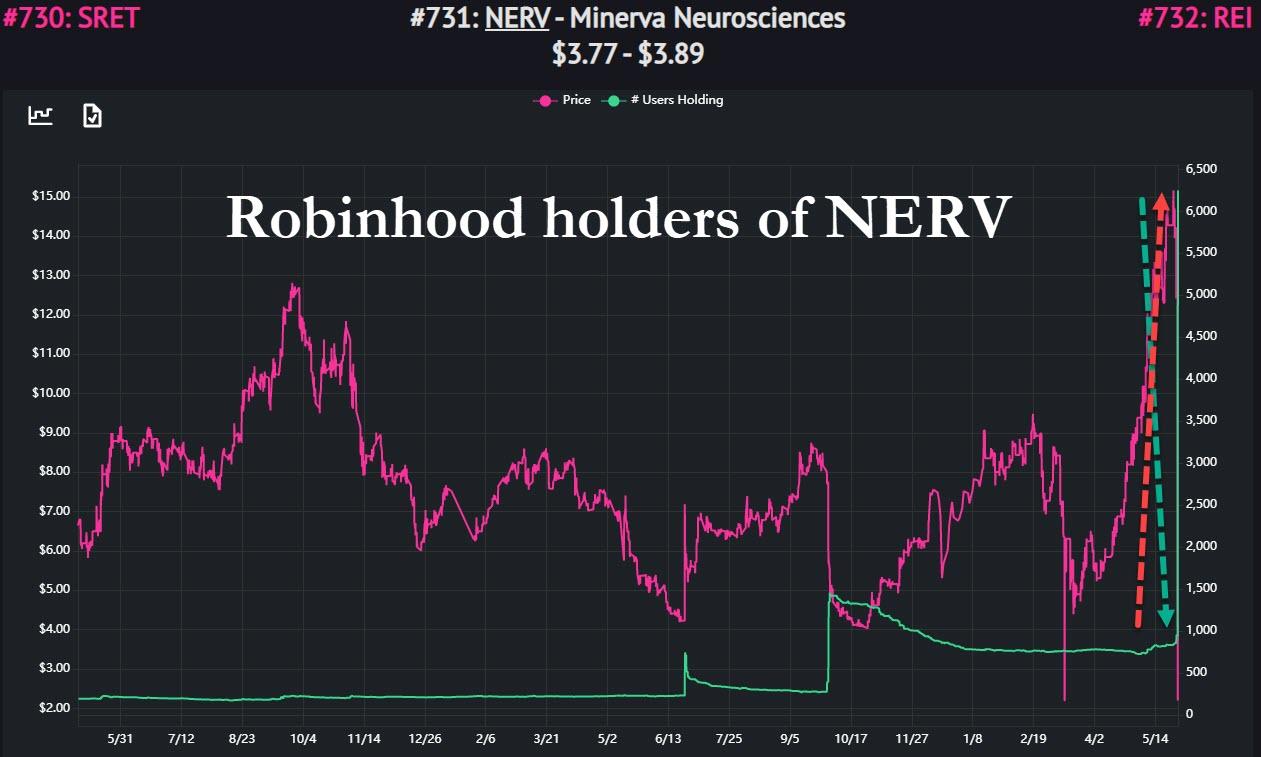

So what's one to do in this bizarro, centrally-planned world, where the smart money is selling and buying gold, where the "dumb money" is now the new "smart money" and outperforming those who are paid 2 and 20 for their massive market intelligence and historical track record? Well, if you can't beat them, join them and ride the momentum until everything crashes again. Which means simply keeping track of which way the retail herd is moving on any given day. To do so, merely keep track of what are the most popular stocks du jour on Robin Hood and buy a basket of the Top 10 most popular names and sit back as the money printer goes brrrr.

(Click on image to enlarge)

Just be ready to weather disasters such as Hertz, which despite the bankruptcy keeps drawing in more and more retail bagholders...

(Click on image to enlarge)

... and the latest implosion du jour which retail investors just can't get enough of.

(Click on image to enlarge)

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more