The OPEC Limbo

Energy

“You’ll hear beautiful news tomorrow” – those were the comments from the new Saudi Oil Minister as he left the first day of OPEC meetings. So far there has been very little official clarity, with yesterday’s meeting dragging on into the late hours of the night. As a result, the usual press conference which follows was cancelled. Full details are expected later today, following the OPEC+ closed-door meeting.

However, reports suggest that OPEC has agreed to increase output cuts by 500Mbbls/d. If this is the case, it will also need to be agreed by the larger OPEC+ group today. Then the bigger struggle of how these cuts will be allocated between members needs to be tackled. Unsurprisingly, this is reportedly where there has already been disagreement - all members want the group to cut, but no one really wants to carry the burden themselves.

The key question is whether these reported cuts will actually reflect fresh cuts, and so help to reduce the surplus in 1Q20, or whether they will just formalise the over-compliance that we have seen from the group as a whole (thanks to Saudi Arabia). Obviously, if it is the latter, the market will be disappointed, as this will do little to eat into the surplus over the first quarter. This appears to be being reflected in early morning trading today, with both ICE Brent and NYMEX WTI lower.

Metals

After a volatile start to the week, LME metal prices were relatively range-bound yesterday with the market awaiting further news on trade discussions. LME aluminium retreated a little over 0.6% yesterday, as a falling physical premium in Japan signalled falling demand for the metal due to uncertainty over the US/China trade deal and the ongoing slowdown in the automobile sector.

Bloomberg reported that at least one Japanese buyer finalised a quarterly premium for 1Q20 at US$83/t (down 14% QoQ). Spot physical premiums continue to trade at a 1-year low of US$65.5/t. On the other hand, the LME aluminium forward curve has traded deeper into backwardation this month, with the cash/3M spread increasing to a 1-year high of US$23/t earlier in the week - although it has weakened to a backwardation of US$4.50/t currently.

Looking at the week ahead, China’s trade data (headline data) is due to be released over the weekend. The market will be watching this release, including iron ore imports, for more hints on the current demand picture from the steel sector. Meanwhile, exports of aluminium products also remain crucial to watch. These have been slowing over the last couple of months, sending worrying signals about future demand.

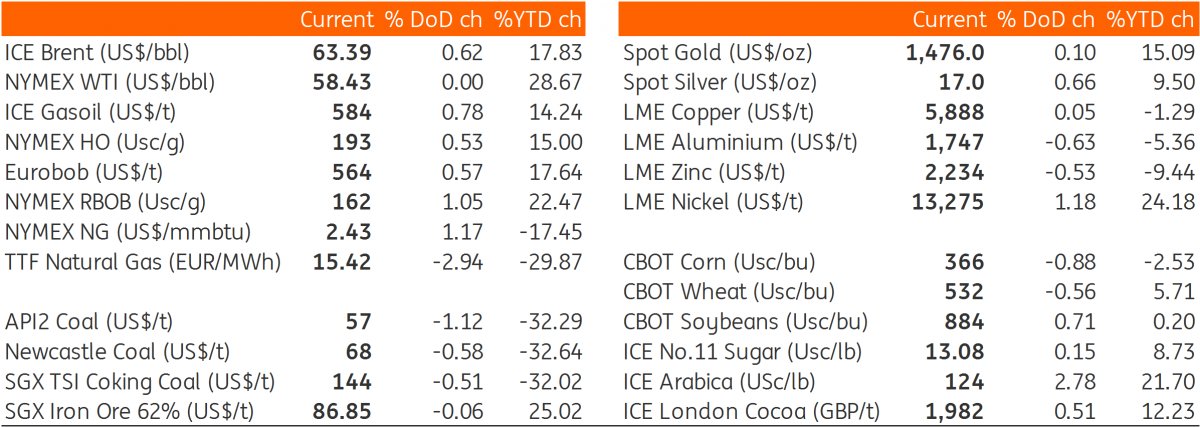

Daily price update

(Click on image to enlarge)

Source: Bloomberg, ING Research

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more