The Mother Of All Stock Market Invalidations

Let’s start today’s analysis with a question that I just received:

Now that gold, silver and the miners are oversold, what kind of a bounce do you expect? Why not take profits and re-short at a higher level?

Well, I’m fine with everyone using my opinions on the market in any way they see fit (as long as they are not viewed as “investment advice”, that is). This means that one is free to take profits now and re-open the short positions at higher levels after a rebound… that is, if a rebound does indeed take place and one is really able to get back in their short positions at higher prices.

The question starts with an assumption that gold, silver, and miners are oversold, and that I expect a bounce.

But are they indeed oversold?

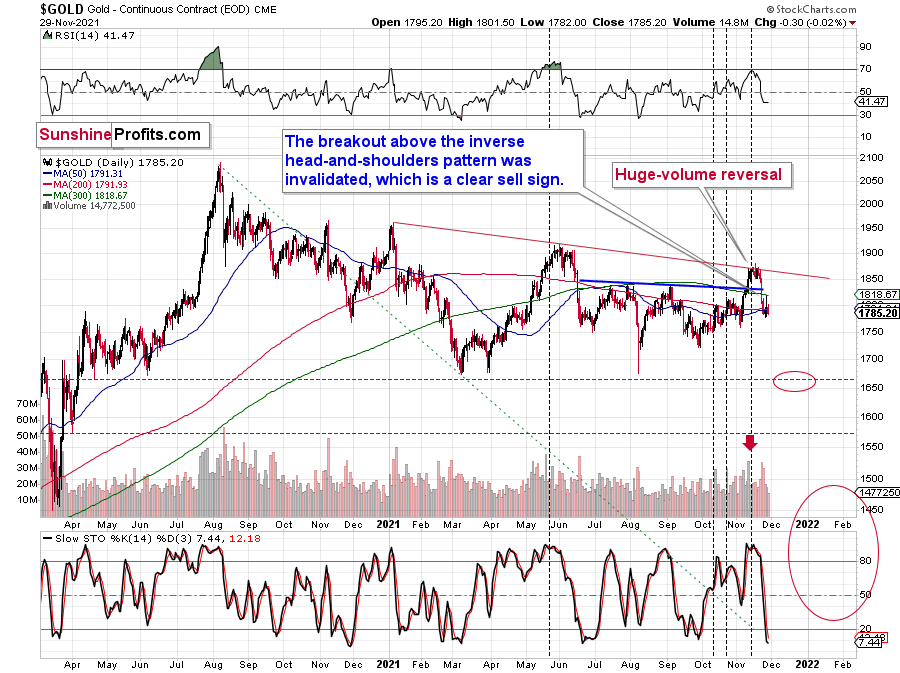

The Stochastic Indicator based on gold (lower part of the above chart) moved below 20, so it is in the oversold territory, but the RSI (upper part of the chart) is slightly above 40, and only levels below 30 are viewed as oversold.

Is the Stochastic Indicator reliable enough to trigger a rebound on its own? Well, it might or might not be the case. In January 2021, the move below 20 in Stochastic triggered a small rally, and the same happened in late February, but the corrections were not very significant. In early March, when the indicator moved below 20, the decline still continued.

Gold’s price is slightly above the previous highs, and it’s trading close to its 50- and 200-day moving averages. That’s quite a normal performance.

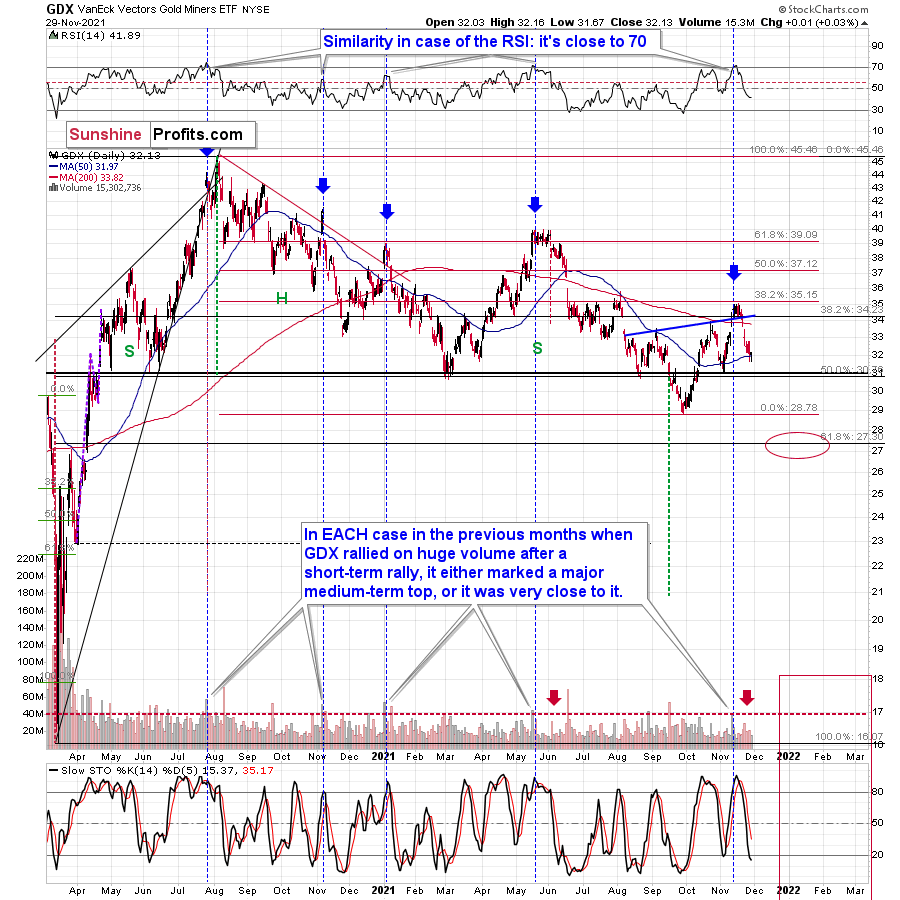

Given that gold-based RSI recently touched the 70 level and then gold declined sharply, the current situation is similar to what we saw in January 2021. Gold was also trading close to its 50- and 200-day moving averages at that time. The pullbacks were relatively small in the case of gold, and… they were even smaller in the case of mining stocks.

The very short-term back and forth movement that we saw in January wasn’t really worth trading – the risk of not being able to get back in at higher prices was too big. It seems to be quite high also at this time, especially when we consider what’s going on in the stock markets. And yes, I mean stock markets, not just one. Let’s take a look at “world stocks”.

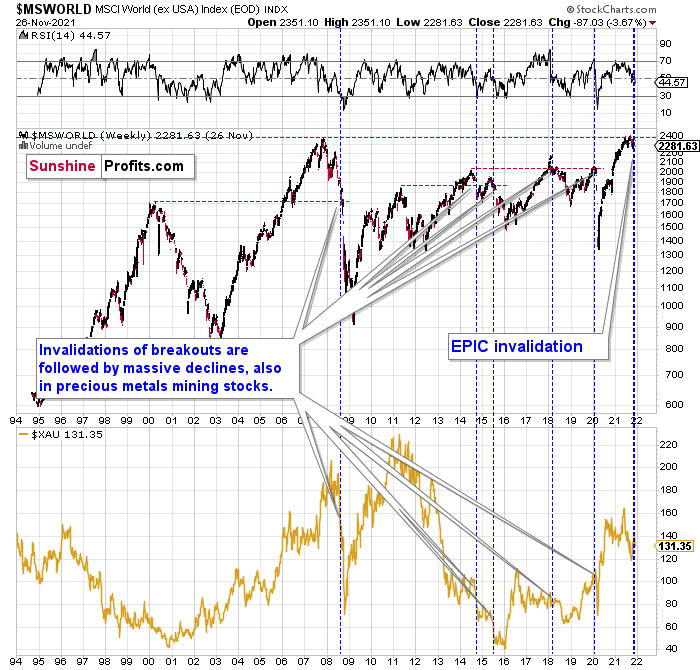

In the chart below, you’ll find the Morgan Stanley Investment International (MSCI) index on world markets, excluding the USA.

Something truly epic is happening in this chart. Namely, world stocks tried to soar above their 2007 high, they managed to do so and… they failed to hold the ground. Despite a few attempts, the breakout was invalidated. Given that there were a few attempts and that the previous high was the all-time high (so it doesn’t get more important than that), the invalidation is a truly critical development.

It's a strong sell signal for the medium- and quite possibly for the long term.

From our – precious metals investors’ and traders’ – point of view, this is also of critical importance. All previous important invalidations of breakouts in world stocks were followed by massive declines in the mining stocks (represented by the XAU Index).

Two of the four similar cases are the 2008 and 2020 declines. In all cases, the declines were huge, and the only reason why they appear “moderate” in the lower part of the above chart is that it has a “linear” and not “logarithmic” scale. You probably still remember how significant and painful (if you were long that is) the decline at the beginning of 2020 was.

Now, all those invalidations triggered big declines in the mining stocks, and we have “the mother of all stock market invalidations” at the moment, so the implications are not only bearish, but extremely bearish.

What does it mean? It means that it is time when being out of the short position in mining stocks to get a few extra dollars from immediate-term trades might be risky. The possibility that the omicron variant of Covid makes vaccination ineffective is too big to be ignored as well. If that happens, we might see 2020 all over again – to some extent. In this environment, it looks like the situation is “pennies to the upside and dollars to the downside” for mining stocks. Perhaps tens of dollars to the downside… You have been warned.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more