The Markets In Review

SPX MARCH REMINDER – I’ve been saying since March that I am expecting 2 strong daily cycles to possibly run to 3200, and then we need to be alert for the Bull to return, or a bear market to start. At that time I favored a bear market with this COVID Pandemic stifling the economy.

(Click on image to enlarge)

SPX –That first daily cycle was strong, believable, and yet fits my above chart exactly. It ran to about 2900+ and I think we just did a quick dip to the dcl, so now I will watch the next daily cycle unfold ( should be bullish also).

(Click on image to enlarge)

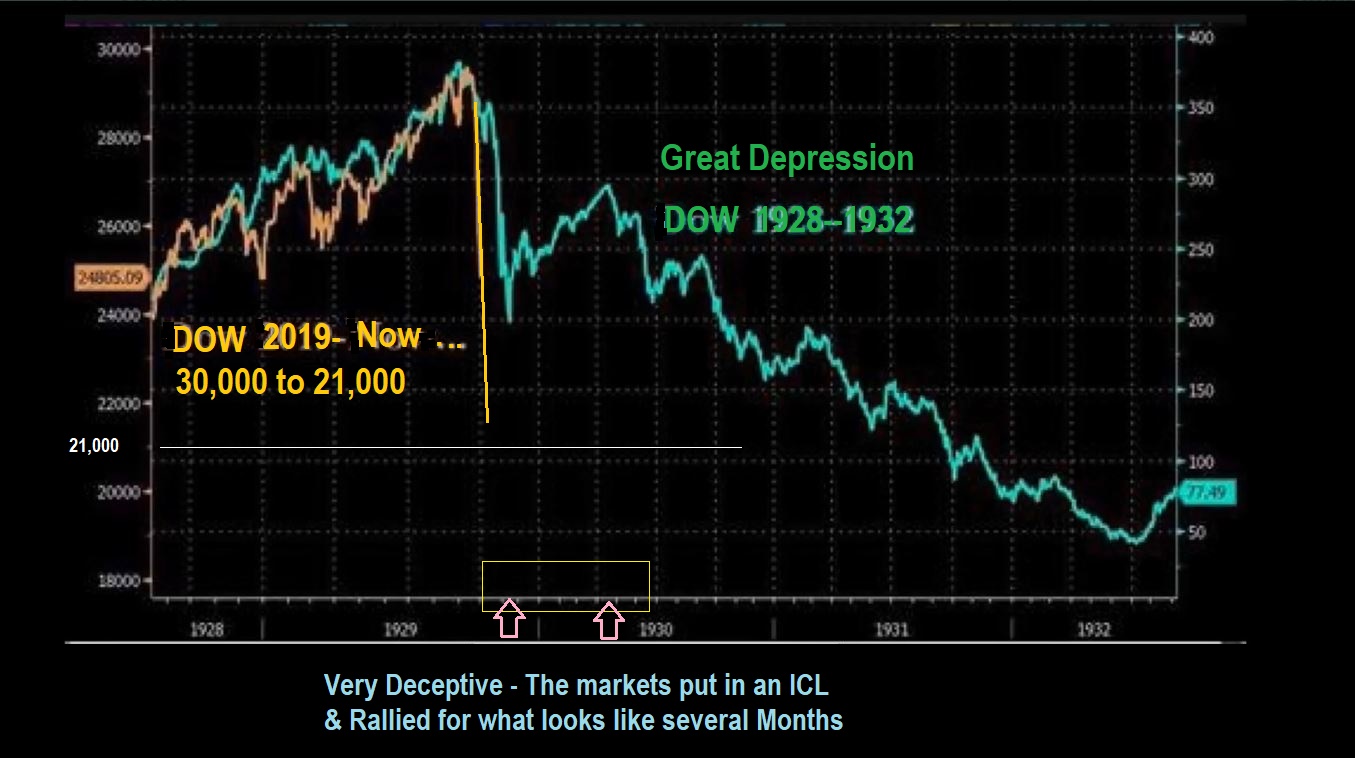

DJIA – I want to show you that the Industrials had a similar rally. Please read the chart now. The reason that I want to follow the DOW also, is because …

(Click on image to enlarge)

.

DJIA 1929 crash, bounce bear: This is the ‘template’ or model that I am looking at since we had a very similar crash and then a ‘believable rally’ for months in 1929. That 5-6 month RALLY turned into an H&S and a bear market began. Now when I look at this…

(Click on image to enlarge)

.SAME CHART: Now when I look at this, I would say that this was 3 daily cycles higher to form the H&S, so I’ll keep an open mind, but my thinking in March was ” SELL IN MAY AND GO AWAY”, an old wall street expression indicating weaker markets in the summer months.

(Click on image to enlarge)

.

DJIA – The first daily cycle for the DOW was up and choppy sideways, so I’m also going to see if we go ‘Up’ to the 200 SMA, and then chop sideways again, or will this 2nd leg up be stronger? I could see this as a 1-2-3-4-5 wave up. I could see this also as an a-b-c and then drop, so again, I want to keep an open mind and just let this play out. So far, it is playing out exactly as expected, so it has been successfully traded.

(Click on image to enlarge)

WTIC – Oil also continues to act as expected after bottoming. It could become a vicious ‘shake out & recovery’.

(Click on image to enlarge)

USD DAILY – I stopped covering the USD when it stopped affecting our trading. I don’t feel that the USD is really affecting GOLD right now, but it has chopped sideways after a strong rally when the Markets crashed. This could chop & drop from here as Gold continues higher though.

(Click on image to enlarge)

.USD WEEKLY – The Weekly Chart shows a rising channel. Often when price overshoots in one direction or the other, it will snap back inside the channel and head for the opposite side. IF THAT HAPPENS HERE, that would be a USD Drop. That said, this chop does look a bit like a bull flag but either way, I’m not really concerned, just watching it play out for possible future monitoring.

(Click on image to enlarge)

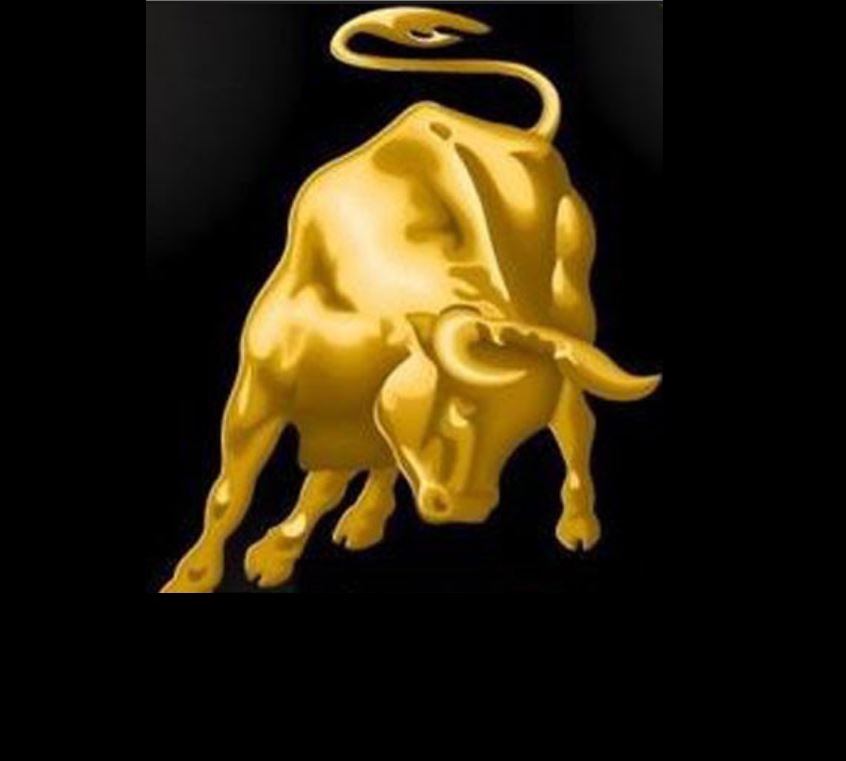

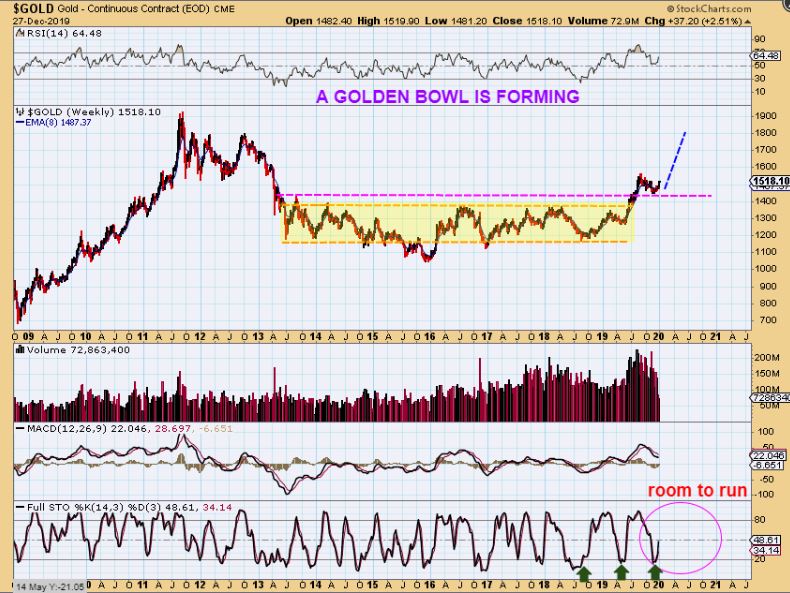

HOW IS GOLD LOOKING THESE DAYS? A picture is worth 1000 words.

GOLD DAILY – We have been discussing this Bull Flag/Triangle and expecting a break higher, and this week was very rewarding. With a conservative short term target of $1879 or $1900, this can run to the $1900+ area very quickly if it doesn’t pause and do a ‘back test.’ This is NOT overbought and the MACD is about to cross bullishly. so…

(Click on image to enlarge)

GOLD WEEKLY – We have chewed through the resistance areas that I have been pointing out and this final run has little resistance above $1800 -$1900 really. I do not expect Gold to double-top near 1900, the long term targets are onward and upward, and I expect this sector to start trending higher.

With GOLD near all-time highs, I get very excited when I see Silver …

(Click on image to enlarge)

SILVER is still near the lows/base! We had a big move in Silver & Silver stocks this week, but do you see the potential here? That move this week looks tiny compared to the upside potential. And this was a Bullish development this week, because when we zoom in…

(Click on image to enlarge)

.SILVER WEEKLY – On the daily I have pointed out Silvers break & ride above the 50sma, but on the weekly chart?

1. Notice that former resistance has now been broken and a run to the $20 area is within reach.

3. This is NOT overbought, The RSI is just now crossing 50%, so …

3. DO NOT SELL your silver stocks yet. ( I had someone ask me if I sold anything to lock in Gains Friday. No, I expect more upside, and honestly, the daily reports have actually reflected that).

(Click on image to enlarge)

.LET ME REVIEW SOMETHING IMPORTANT WITH YOU, ESPECIALLY IF YOU ARE NEW HERE AT CHARTFREAK.

#1. GOLD 2019. Last year I told my readers in the 2019 Summer rally, “DO NOT SELL MINERS HERE, because if we break this base, we may pause (dcl) and then swiftly run to the solid resistance above.”READ THE CHART FROM JULY 2019.

(Click on image to enlarge)

#2 GOLD. Then it broke the base & ran. The run from that base was extremely swift and it ran right to resistance of 2012. Some of our Miners doubled and tripled last year.

(Click on image to enlarge)

#3 GOLD 2019. After the run to 2012 resistance, I sold my Leverage but continued to ride Miners in case we go higher, but I recommended using a stop because this could also now drop and back test that base. LOOK AT THIS CHART…

(Click on image to enlarge)

#4. After running to the resistance area, Gold did drop &back tested that base. This was playing out exactly as hoped for as GOLD began to build the giant golden bowl. And off Gold went from our ICL to the next resistance, as shown. WHY AM I REVIEWING THIS STEP BY STEP? Because of the next chart …

(Click on image to enlarge)

SILVER WEEKLY – DO YOU SEE WHAT I AM GETTING AT? Silver is still at the Base and The 2012 Resistance is ahead. The move can be swift when it comes, so we will continue to monitor Silver very closely going forward, with our Cycle timing guiding us along the way. Right now I have SILVER toward $20 as my next target, but $26 could shortly follow.

(Click on image to enlarge)

Now we get to GDX and even though we chopped sideways for the last 2-3 weeks, this looks straight up from the ICL and is also heading toward its resistance point from 2012. So again, we see how swiftly the move can be from that base to the resistance of 2012. Well, guess what? …

(Click on image to enlarge)

#1 GDXJ was lagging and is still in its’ base. It might be ready to play catch up in a big way. It is not at the 2012 Resistance area yet, like GDX, and you know how FAST these Juniors can run, right?…

(Click on image to enlarge)

.GDXJ #2 – So I am expecting a strong run in the Juniors, as seen here, Whether that run takes place right now or in the very near future after a pause, it is a very bullish setup.

(Click on image to enlarge)

If you think that this type of technical analysis, cycle timing, and reporting could help you with your investing, why not give us a try?