The Latest Cold Front Is Heating Up Natural Gas Options

It’s always funny to read about energy prices going up whenever there’s a cold front. It’s like people forget that there’s such thing as weather and (depending on where you live) it changes with the seasons.

As the temperature starts cooling in the fall, you’ll often see headlines like “Heating Oil Prices Up on Colder Weather” or something similar. These types of news items make it seem like no one is prepared for it actually to get colder in the winter. Could trading seasonality really be that easy?

Like everything in the market, nothing is ever as easy as it seems. Sure, there are times when the old trading tropes work just fine. However, the investment-related headlines you see are probably misleading in their simplicity.

It’s not cold weather in the winter that makes heating oil/natural gas prices go up; it’s colder than expected weather that causes the distortion. It’s not that a cold front is hitting the East Coast (for example), but that the cold front is hitting in October instead of January. It takes some unexpected news to cause a real shift in commodity or equity prices.

Speaking of a cold front hitting in October, that’s exactly what’s happening in several regions across the U.S. We’re seeing blizzards and snow in places that normally don’t get that sort of activity until the deep winter months.

What’s more, we’re starting to see natural gas producers cut back on production due to lower than expected prices. In the past, shale producers have pushed through with production despite any glut in inventories. Now it seems, some companies are going to slow production in the face of very low prices.

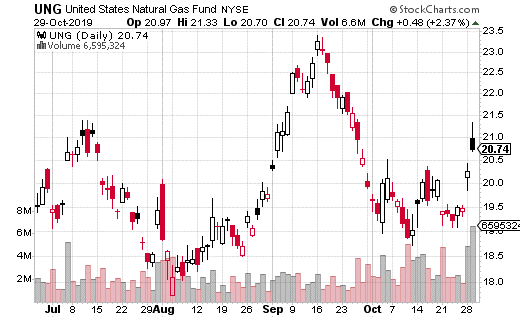

As a result, natural gas prices are up over 12% in the month of October. The price still has a way to go to be positive for the year, but could this be the start of a bigger trend? Let’s look at the options for more data.

The easiest and most popular way to trade natural gas is by using the US Natural Gas ETF (UNG). UNG averages over 2 million shares traded per day and 16,000 options. However, one day this week, over 100,000 options traded with over 90% of the activity considered to be bullish.

Clearly, the options crowd believes in the bullish case for natural gas. For example, one trader purchased 2,500 19 calls expiring in January with UNG trading at $21 per share. These are considered in-the-money calls, and they basically move the same as the stock itself. At $3.30 paid per contract, this block costs a total of $825,000.

The amount spent on the trade (the premium) is also the max loss possibility (should UNG drop below $19 at expiration). So why spend so much money to purchase in-the-money options? First off, with the stock $2 above the strike price, there is less risk of losing the full amount of premium even if the trade doesn’t work out.

On the other hand, the trader is still taking advantage of the leverage of using options. Buying 2,500 calls is still akin to purchasing 250,000 shares of UNG but at a much lower price. Anywhere above $22.30 in UNG by January, and the position can generate $250,000 per dollar higher.

If you are bullish on natural gas, using an in-the-money call strategy like this is a reasonable way to take a bullish position while using leverage. It’s more expensive than other, more common bullish options strategies, but also can be quite a bit less risky.