The Ghost Of The Feds Past: Rate Hikes, Rate Cuts, And The Great Collapse

Brief Introduction:

Just as this author had addressed beginning of summer in an article regarding oil and the Ghost of the 1985, it appears oil is going to further its decline. But then again, everything is going to decline - courtesy of the Federal Reserve. It appears no matter what tricks or delays the elites use, a bust is always inevitable.

Yellen: Delussional

In December, the Fed led by Janet Yellen lifted rates for the first time in nearly a decade. College graduates that went to work on Wall Street during 2006 thus have never even been on the trading floor during a rate hike. So what could anyone expect?

Here are some of the points she made from her much awaited press conference (full transcript; 12/2015).

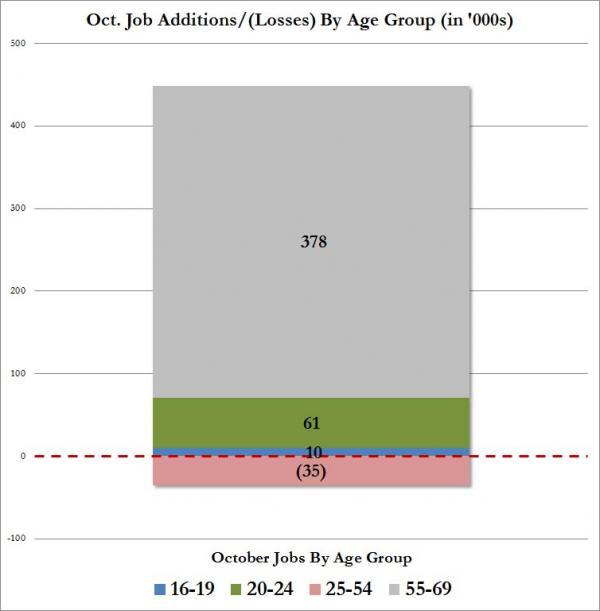

Point 1. "The labor market has clearly shown significant further improvement toward our objective of maximum employment...The unemployment rate, at 5 percent in November, is down 0.6 percentage point from the end of last year and is close to the median of FOMC participants’ estimates of its longer-run normal level," said Yellen. If the Fed wanted maximum employment, the government could simply hire individuals to dig then refill ditches. What happened to achieving max productivity, not max employment? Flashback to take a look at the October 2015 Jobs from the BLS report to gauge employment quality:

It appears more than roughly 75% of the jobs went to individuals aged 55-69, while individuals 25-54 of age actually lost jobs. Also, the labor participation rate is at a 40 year low - thus lowering the percentage further.

Also important to note with the energy market all but on life support and significant major job layoffs from major oil companies such as BP, Halliburton (HAL), Chesapeake (CHK), Shell, and countless many small companies - how will this affect other markets. How will this affect oil states in the long term? These were high paying salaried jobs which are being put to rest and low paying hourly jobs replacing them through service sector and retail.

According to Graves & Co., an industry consultant, oil and gas companies have laid off more than 250,000 workers around the world, a tally that will rise if oil prices remain in the dumps.

Conclusion: one could logically deduce that older individuals needing part time work to pad their savings for retirement are taking advantage of the holiday season and working as a Walmart Greeter (unfortunately this was temporary as today Walmart announced mass layoffs totaling around 16,000 employees and shutting down 269 stores). Same with Macy's which recently announced many store closures and large labor force cuts with it.

Through the Feds eyes - the economy is recovering so rapidly that individuals can now go to higher end stores instead of Walmart (WMT) and Macy's (M), taking away from cheap goods business.

Point 2. "The Committee currently expects that, with gradual adjustments in the stance of monetary policy, economic activity will continue to expand at a moderate pace and labor market indicators will continue to strengthen," says Yellen. But what economic data is the Fed looking at? Because this author could not find anything remotely close to that bullish stance. In fact, the Atlanta Fed cut GDP expectations for the third time in a month, now at a poultry 0.6% for the 4th quarter. The weather will be blamed of course. Also the Chicago PMI "unexpectedly" dropped sharply, showing further business contraction.

The Chicago purchasing manager index unexpectedly plunged to 42.9 in December, its lowest reading since July 2009. Any reading below 50 signals a contraction in business activity.

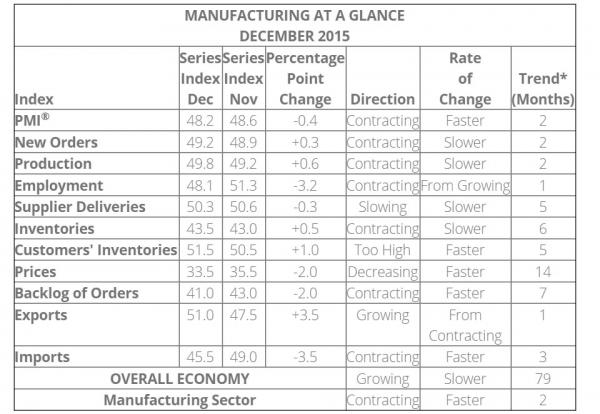

And it gets worse - the ISM manufacturing index slipped down further again to its lowest since the 2008 recession. And things are only going to get worse. Investors should look for themselves:

Charts: Bloonberg

Conclusion: The Fed could not have picked a worse time to raise rates when the economy needed liquidity the most. When data was this bad before not only did the Fed cut rates to 0%, they included heavy doses of QE aswell.

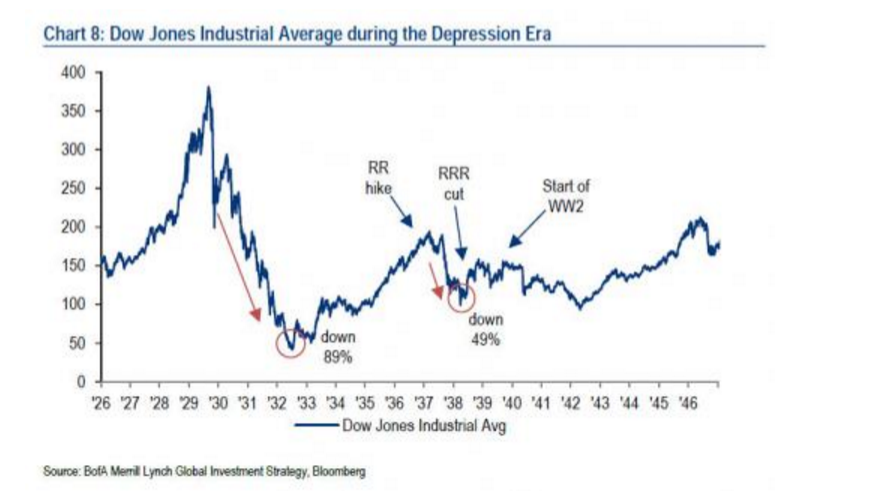

Sidenote: Things are eerily similar to 1936 when the Fed thought the economy was healing after the Great Crash of 1929. To summarize - the Fed hiked rates in the winter of 1936 due to a somewhat recovering economy, and the following summer during 1937 the DOW started its collapse which would end up totaling -50%:

It appears the Ghost of 1936-37 is howling.

Point 3. "I’d like to underscore that the forecasts of the appropriate path of the federal funds rate, as usual, are conditional on participants’ individual projections of the most likely outcomes for economic growth, employment and inflation, and other factors. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data. Stronger growth or a more rapid increase in inflation than we currently anticipate would suggest that the neutral federal funds rate was rising more quickly than expected, making it appropriate to raise the federal funds rate more quickly as well. Conversely, if the economy were to disappoint, the federal funds rate would likely rise more slowly," Says Yellen. Well, this point is simple - clearly the data is showing that we are will be in a recession. So expect a rate cut at the very least, but this author still believes negative rates are upon us.

Final Words

To summarize: China is collapsing, Brazil is Crashed, the EU is pumping and to trying replace solvency with liquidity, US stocks are collapsing, markets are becoming iliquid, there are numerous bubbles such as auto debt, college debt, corporate debt that need attention. And the next Bigger Short will be U.S. fracking companies in the junk bond market (although it appears to already be).

Recalling the introduction of the article, this author will do a follow up piece highlighting the very worst of the oil stocks in the U.S., using an analogy these will be equivalent to the CCC - D rated subprime CDOs in the housing debacle of 07; giving investors short ideas. Digging up companies with no cash, maxed out revolving credit line, disgusting amounts of debt, massive writedowns on previous reserves, and worst of all - unprofitable at oil below $60.

For investors, there is more downside in markets until the fed will inevitable be forced to cut rates, increase QE doses, or even turn rates negative. All roads point to a cheapening of the US dollar, which conversely benefits gold.

Reiterate from a previous article: Long precious metals, short the Central Bankers and Elites.

Try not to drown out there.

- Adem Tumerkan

This is a column I wrote in my recent newsletter issue.

Even if Yellen did seem too overly optimistic about the state of the economy when she decided to raise interest rates, I still believe that whatever turbulence we are seeing now in the stock markets are not as a result solely of that rate hike. China was and still is extremely volatile, oil continues to spiral downwards, and the US dollar is stronger than almost any other currency which makes US exports expensive and pressures the US economy in a myriad of ways.

I also dont think it is the sole reason either.

But mentioning China, they had a similar volatile and our markets also plunged in August, just as the crowd as positive the Fed would hike rates - then they didnt and markets rocketed.

The data is clear, we are in a recession.

Alot of the issues you just named are symptoms of a strong dollar in my opinion (or atleast the strong dollar added to the damage).

Agreed, well done.

Amazing that.25 percent hike is destroying liquidity. Must be a pretty fragile financial system.