The Elephant In The Gold Room

We will start this off with a pet peeve. Too often, one is reading something about gold. It starts off well enough, discussing problems with the dollar or the bond market or a real estate bubble… and then bam! Buy gold because the dollar is gonna be worthless! That number again is 1-800-BUY-GOLD or we have another 1-800-GOT-GOLD in case the lines on the first number are busy!

Whether the writer is a bullion dealer, or whether just some HODLer (a term from bitcoin—it means Holding On For Dear Life) hoping for a higher price and an opportunity to unload some gold to make profit$, it matters not. The “buy gold” message undermines the economic point. Perhaps the economics (or pseudo-economics) point bolsters the buy-gold message, but it certainly hasn’t over the last 8 years.

Faulty Logic

On to our topic for today, this economics point often takes the form:

- Defect X causes currencies to fail

- The dollar has defect X

- Therefore the dollar will fail…

- …And that means people want to pay gold to merchants

Gresham’s Law states that if two forms of money have equal monetary value set by the government, then the one that is undervalued will not circulate. It is often taken to mean that if a precious metal coin and a base metal coin are both legal tender, then the base metal will circulate and people will hoard the precious metal. That is true, but its application is broader than that.

The Coinage Act of 1792 established an official policy of bimetallism. A dollar was defined to mean 24.75 grains of pure gold or 371.25 grains of pure silver. It fixed the ratio of gold to silver at 15 to 1.

The market ratio was closer to 15.5 (of course, it was not a fixed ratio, but moved as all market prices do). 15, being a lower number, overvalues silver slightly. That is, the monetary value of silver was a bit higher than its commodity value. And the opposite for gold.

Predictably, silver circulated and gold did not. Gresham’s Law was in full force and effect.

A more well-known case occurred in 1965 when the US Mint switched from silver to base metal (a copper-nickel alloy) for quarters and dimes. We had read an excerpt of a speech by President Johnson (which now seems to be offline), in which he promised that the old silver coins would circulate alongside the new slugs. But it did not work out that way. It cannot. And Gresham tells us why not.

Why Gold Does Not Circulate Today

Today, despite vast quantities of gold and silver coins, they do not circulate. Gresham is not quite the explanation. Although the US one-ounce silver coin is stamped with a legal tender value of $1, people are not stupid. These coins are freely bought and sold based on the market price of silver (plus a premium for being manufactured into a recognizable coin).

So why does no one pay the restaurant tab in silver Eagles, or pay debts in gold Eagles? (Yes, yes, we know about the legal tender laws, not relevant here).

We have said many times, that some people may be happy to be paid in gold or silver, but no one wants to pay gold or silver out.

We are not going to describe here the reasons why people value gold and silver, or why they expect the dollar to continue to be debased. The steady desire to hold a gold coin is something entirely different than the weak desire to hold a dollar. Even dollar proponents will often say “cash is trash”. That expression would not have been popular (or even understood) during the gold standard.

Suffice to say that once they own a gold coin, people prefer not to let go of it. When it comes to paying for a steak dinner, or a home repair, they will take out the credit card but leave the precious metals hidden and safe.

So gold does not circulate. We have repeatedly said that the only force capable of pulling gold out of hoards and into circulation is: the payment of interest (we plan to issue the first gold bond soon—denominated in gold ounces, with interest and principal paid in gold). Gold comes out, to earn a return (if the return is sufficient to justify the risk). And otherwise is hoarded. It may be sold to take (dollar) profits, or when there is need for liquidity, but otherwise it is held out of the market. Vast, vast amounts are off the market. Virtually all of the gold mined in thousands of years of human history, in fact.

That elephant is lifting its trunk, trumpeting a fact to all who would listen. While the debate (and innovative business models) keeps going. What’s the fact? What is the elephant in this room?

Gold is capital.

A Dollar Income

No one (well, other than the Prodigal Son) wants to spend his capital. People want to spend their income, not their capital. So the gold is kept offline.

No one (except for gold miners, and Monetary Metals clients) has income in gold. Income for everyone else is exclusively dollars.

Dollar-earners would have to exchange their dollars for gold. Then pay the merchant. Since gross margins are usually very tight, the merchant would have to sell most of the gold to pay its vendors, payroll, rent, etc.

Regular readers will be thinking: the round-trip through gold, from dollars to gold to dollars, incurs a frictional loss. That loss is the bid-ask spread. For retail investors, that spread is likely 1% or more (some online accounts are less). This spread is dollar-earner’s loss. Why would anyone want to take a loss—on purpose?

They don’t. And gold is not used as a payment by dollar-earners. It’s that simple.

Ideal Medium of Exchange

One can write at length about the problems of the dollar—we do every week—but that does not alter the fact that the dollar is a great medium of exchange. It is perfect, in fact. Let’s state that again for emphasis.

The dollar is a perfect medium of exchange.

This is because it trades at no spread. There is no loss to use the dollar, it always trades at par.

The dollar will fail one day, it is inevitable. That will be a catastrophe to make a mere caldera like Krakatoa seem a walk in the park by comparison. Millions of people will die, and the survivors will be impoverished almost beyond comprehension of Americans today. But economics operates the way that it operates. This is economics’ revenge against the dishonesty of irredeemable currency and inflation—i.e. the counterfeiting of credit. Each economic actor seeks to maximize his gains and minimize his losses. No one acts to “try to bring a better system” (other than a few entrepreneurs, and they are seeking profit anyways). No one says “let me pay out my gold because it will be good for the economy”, or “good for society”, or “it’s honest money.”

They pay out dollars because they are paid in dollars, and there is no loss to pay them out. They may buy some gold as savings, but they don’t pay out their savings. They pay out their income. Dollars.

And they will continue to do so until they have an income in gold.

Now that he’s been acknowledged, maybe this elephant can calm down and stop making such a racket!

Supply and Demand Fundamentals

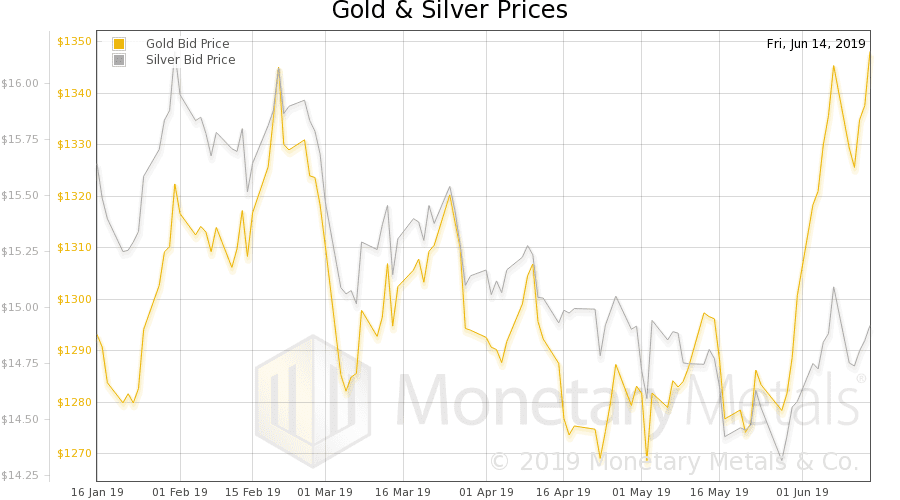

The price of gold went up a buck, but the price of silver dropped back 13 cents. And the gold-silver ratio marches further upwards.

Keith spoke at a conference this week, about how to analyze the fundamentals of supply and demand in gold and silver. He talked about the basis of course. Another speaker spoke later, about the supply and demand fundamentals of silver. He covered all the topics we eschew—solar, increasing use of sensors and electronics in automobiles, etc. And at the end of his presentation, he had two graphs.

Without the ability to reproduce them here, we will just summarize them. One showed the correlation of silver to gold, copper, and oil. It showed a very noticeable correlation to gold, and not so much copper, and virtually none with oil. The second showed, for each trading day over a period of time, a gold-colored up-bar if silver traded with gold, or a gray down-bar if it traded with other commodities. By eye, it looked like over 99% of days, silver was with gold.

In other words, you can safely ignore all the talk about industrial uses of silver. And mine production. And recycling. Demand for silver, as with gold, is monetary reservation demand. Silver is still money (whew, right?!)

So why a ratio over 90:1? Those who demand gold for monetary reserve are a different group than those who demand silver. As always, gold is owned by those rich enough to afford it. An ounce of gold is several weeks of the wages of an unskilled laborer or more than a week of the wages of the median worker in the US. And more than that outside America.

Institutions, including central banks, demand gold almost exclusively, with little silver other than perhaps family offices and hedge funds that may have a broader charter.

A 90:1 ratio tells us that the wage-earners who cannot afford gold are either not able or not willing to increase their monetary reservation demand. At least this is true relative to the asset owners (who are near peak levels of equity after so many years of bull markets).

For a $20 silver (and 75:1 ratio, assuming gold is priced at $1,500), look not to a great increase in consumer electronics or industrial demand. Look to a shift in either mindset or capacity to buy silver among the wage-earners. And maybe a shift in sentiment among wealthier savers who have the option of using silver—and who may be attracted to the relative bargain.

However, from the look of that chart we’ve been updated (see below, under silver) today is not that day.

Now let’s look at the only true picture of supply and demand for gold and silver. But, first, here is the chart of the prices of gold and silver.

(Click on image to enlarge)

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio rose further.

(Click on image to enlarge)

Here is the gold graph showing gold basis, co-basis and the price of the dollar in terms of gold price.

(Click on image to enlarge)

The dollar was basically unchanged. The scarcity (i.e. co-basis) dropped a hair.

The Monetary Metals Gold Fundamental Price dropped slightly to $1,402. It’s a bit above market, but not a lot.

Now let’s look at silver.

(Click on image to enlarge)

The July silver contract approaches expiry, and it’s no surprise that it has tipped back into backwardation, with a sharp increase in the co-basis. However, the silver basis continuous shows a slight drop in scarcity.

The Monetary Metals Silver Fundamental Price dropped back to $15.49.

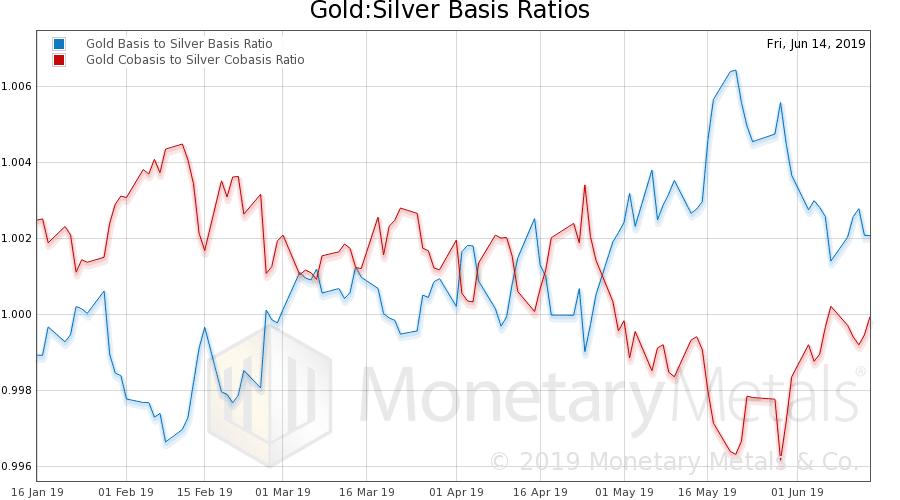

Here is an update of the ratios of the gold to silver basis and co-basis. Higher basis ratio means gold basis is above silver basis, which means silver is less abundant.

(Click on image to enlarge)

There is a move favoring silver (i.e. silver being the scarcer metal in current market conditions), but this week it was a small one.