The Commodities Feed: Gasoline Cracks Rally

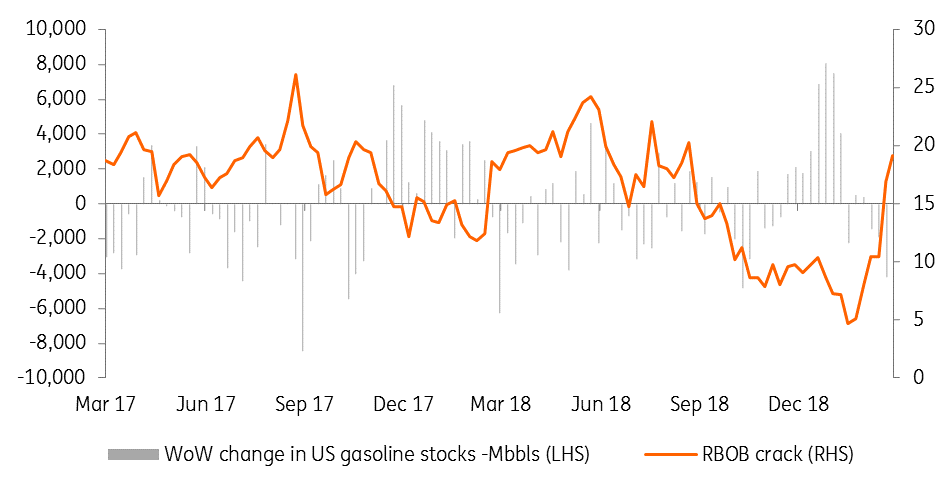

Weekly change in US gasoline inventories vs. RBOB gasoline crack

Source: EIA, Bloomberg, ING Research

Energy

US crude oil inventories grow: The EIA yesterday reported that US crude oil inventories increased by 7.07MMbbls over the last week, which was broadly in line with the 7.29MMbbls the API reported the previous day, but significantly higher than the 1.45MMbbls the market was expecting. Crude oil imports increased by 1.08MMbbls/d to average 7MMbbls/d over the week, with flows from Saudi Arabia increasing by 351Mbbls/d to 697Mbbls/d, which is the largest weekly import number since mid-January.

Refined product developments were more constructive, with the EIA reporting that gasoline and distillate fuel oil inventories declined by 4.23MMbbls and 2.39MMbbls, respectively. The gasoline draw was significantly larger than the 391Mbbls drawdown that the API reported the previous day, and this decline has been clearly bullish for gasoline cracks, which have been trending higher in recent weeks since bottoming in late January/ early February. We believe that margins will be fairly well supported over March on the back of refinery maintenance.

Metals

Peru copper output: The latest government data from Peru shows that copper production in the country totaled 201,217 tonnes over the month of January- a 7% increase year-on-year, however a 12.6% decrease month-on-month. In the refined market, LME spreads continue to suggest a fairly tight market, with the LME cash/3 month spread remaining well backwardated, whilst inventories continue to edge lower. However, it is a very different story in China where copper premiums continue to fall, hitting US$52.50/t this week, which is the lowest level since April 2017. Meanwhile, SHFE copper inventories continue to grow, increasing from less than 100kt at the beginning of this year to around 227kt at the moment.

Platinum market surplus: The World Platinum Investment Council forecasts that the platinum market will see a surplus of 680kOz in 2019, larger than their previous forecast of 455kOz, as well as the 645kOz surplus they estimated for 2018. A temporary increase in output from South Africa, along with a pickup in recycling is expected to push global supply up by 5% YoY. Global demand is also expected to grow by 5% YoY on the back of strong investment demand and stable consumption from the industrial sector. With the platinum/palladium price ratio currently at multi-year lows of 0.54, it makes a compelling case for increased investment in platinum.

Agriculture

Brazilian soybean exports: The latest government data from Brazil shows that soybean exports from the country over February totaled 6.09mt, up 113% YoY. Unsurprisingly, the bulk of this increase was driven by China, with 5.02mt of these exports destined for the country, representing a 134% increase YoY. Cumulative total exports so far this year total 8.2mt- up 85% YoY, with 6.99mt of that destined for China.

Indian sugar output: The latest data from the Indian Sugar Mills Association shows that cumulative production so far this season (1 October to end of February) totals 23.18mt, up almost 7% YoY. However despite the strong year-on-year performance in production so far, final output this season is expected to come in at around 30.7mt, below the 32.5mt produced last year.

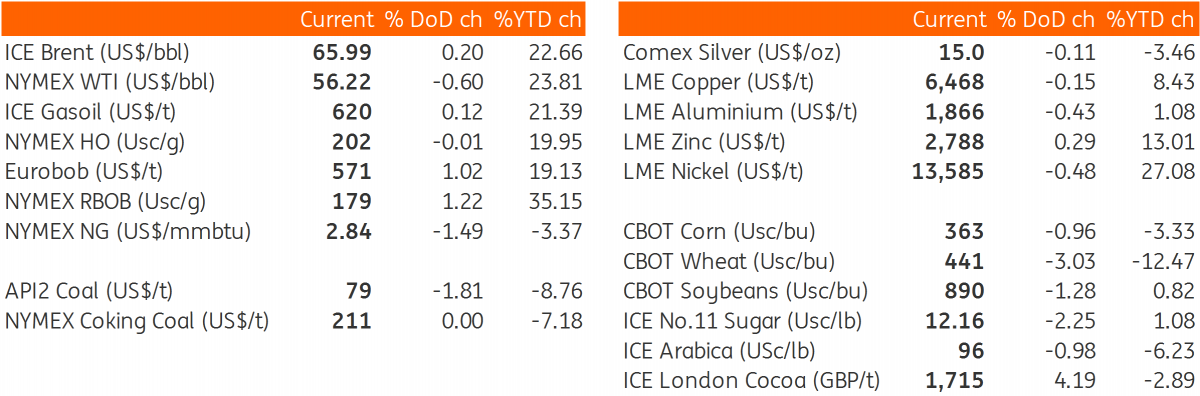

Daily price update

Source: Bloomberg, ING Research

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more