The Calm Before The USDX Storm. May It Harm Gold?

With the completed inverse H&S formation, the USDX will likely soar, which is very negative for gold. Are these the last calm moments at the PMs’ sea?

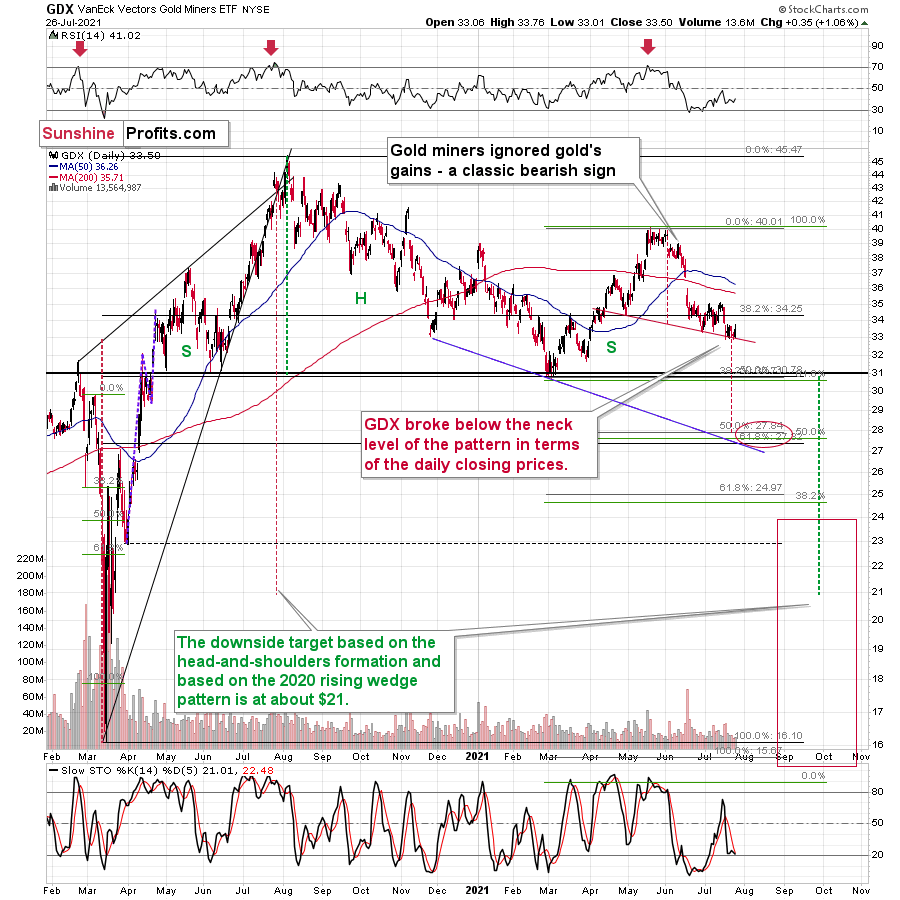

Gold Miners

Yesterday’s (Jul. 26) session might have seemed to be something important or game-changing, as miners moved higher. But it wasn’t.

But miners moved higher while gold moved lower! Wasn’t that the opposite of what you described as very bearish?

It was, but the context was different. The magnitude and time frame were different. The miners’ underperformance that I had described took place over the previous weeks, and what happened yesterday was limited to… well, yesterday.

Consequently, miners’ strength seems to have just been a blip on the radar screen – a tiny correction in the moves in prices and ratios that have been taking place for many weeks.

It didn’t change anything from the technical point of view either.

Senior miners even corrected before the end of the day.

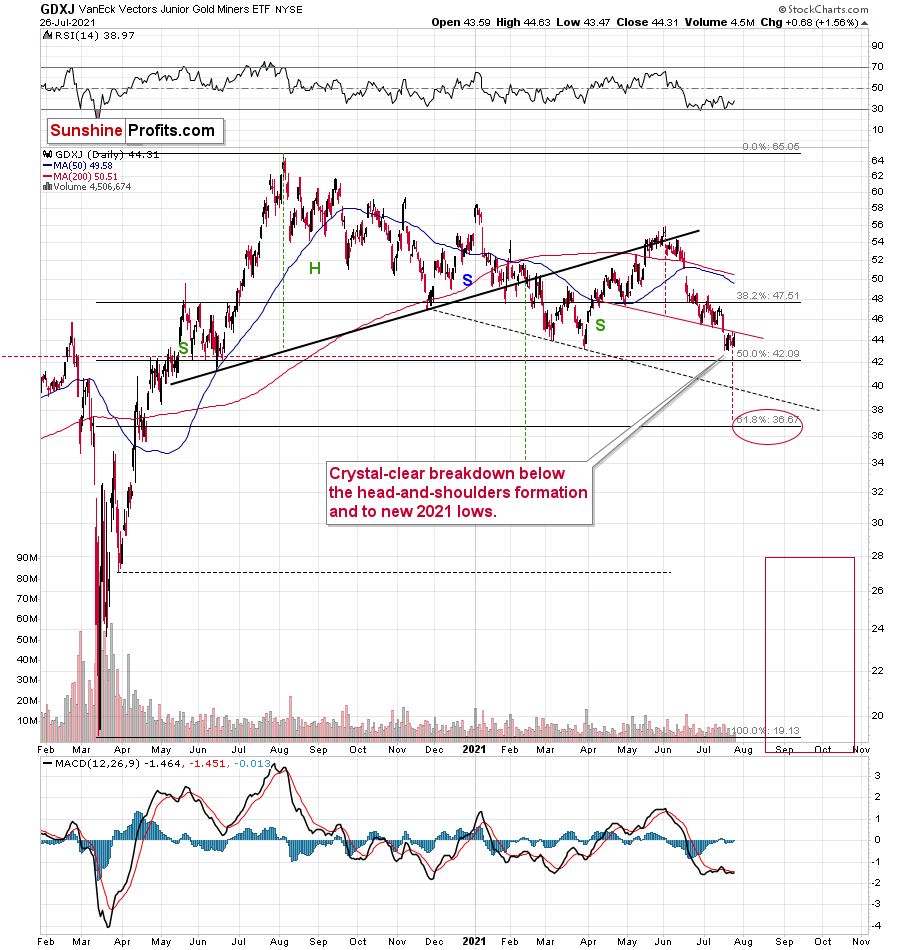

And junior gold mining stocks?

Junior miners (the GDXJ ETF) didn’t invalidate the breakdown below the neck level of the bearish head and shoulders formation. Consequently, the very bearish implications of the breakdown remain intact.

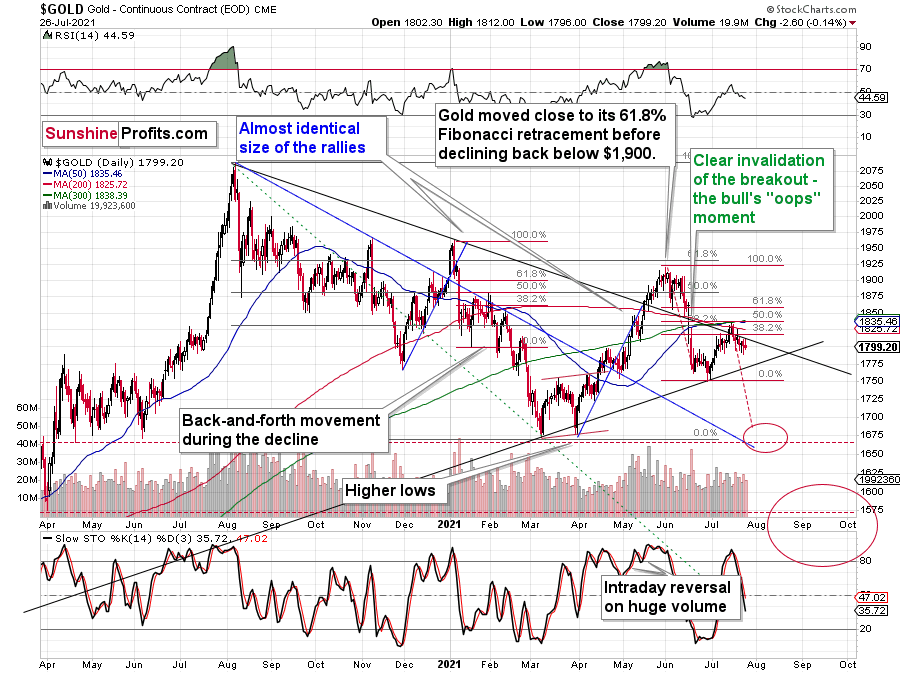

While the last several days were relatively calm in the PMs and in the USD Index, it seems that it’s not only the calm before the storm but also the final part thereof.

As I wrote earlier, gold didn’t do much yesterday – it moved slightly lower. The same is taking place in today’s pre-market trading – gold is about $2 lower. Basically, nothing changed, and gold is likely to move lower based, i.a., on the self-similarity to what happened in 2012-2013 and 2008 (as I discussed yesterday).

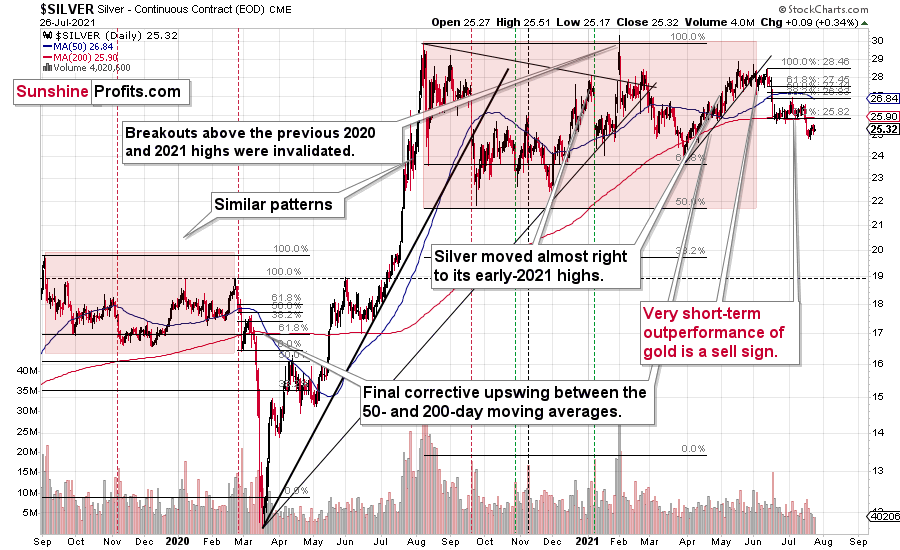

Silver corrected a bit, but it didn’t move back above its mid-June lows, so the breakdown below them was definitely not invalidated. It seems that the next big move in the price of the white metal will be to the downside.

The USD Index

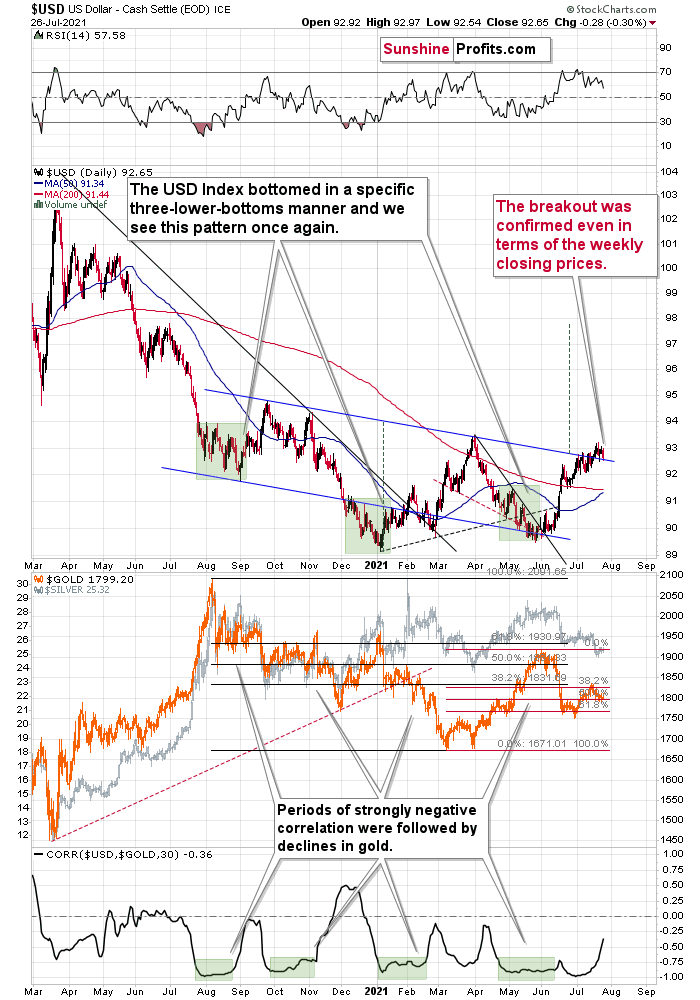

The situation in the USD Index perfectly fits the “final part of the calm before the storm” narrative.

The USDX moved a bit lower yesterday, but this move didn’t take it back below the neck level of the previously broken inverse head-and-shoulders formation. Consequently, the USDX is likely to soar in the following weeks, which is likely to put very negative pressure on the PMs, almost (!) guaranteeing that they will decline in consequence.

Moreover, please note that the correlation between gold and the USD Index (lower part of the above chart) is now moving back toward the 0 level after a long period of being close to -1. This might not seem interesting until one compares it to what happened in gold when that was the case previously. In early September 2020, in mid-November 2020, and in mid-February 2021 we saw the same thing and that heralded short-term declines in gold in all three cases. Thus, the implications are bearish.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more

Now we’re talkin'!