Teranga Gold Corp: Making Money, Adding Ounces, Staying Cheap

TM Editors' Note: This article discusses one or more penny stocks and/or microcaps. Such stocks are easily manipulated; do your own careful due diligence.

Traditionally, value investors stay away from mining companies. Similar to what Warren Buffet must have realized after acquiring the original Berkshire Hathaway, a textile factory company, was that capital goods enterprises are, well, very capital intensive. Investors sink in tremendous amounts of money for a relatively small ROIC (return on invested capital) as well as costly assets that depreciate quickly. Another issue with the mining companies was that they are homogeneous - the end product they produce is the exact same a their competitors. A gold ounce extracted in South America is the same as a gold ounce extracted in Canada. Thus, no competitive advantage of a product "moat", a classic value criteria (when a company has a protected competitive advantage that competition cannot replicate - a proprietary patent for example). Not to mention historically mining is an ugly and poor business. They have finite resources - every ounce taken from the ground today is an asset that is gone forever.

So who would invest in these assets cannibalizing extremely expensive, moat-less, and dirty businesses?

The madman contrarian, of course.

If one has kept reading after understanding all the downsides the sector has, and is still somewhat interested, there are some very good aspects.

For starters, no other business besides commodity businesses can potentially have the price of the product they're selling rise every other day. For instance, Nike (NKE) doesn't have the luxury of increasing the price of their shoes at the end of each week without losing to competition. But if the market price for gold goes up 3% each week, every mining company benefits from those thicker margins. Imagine the cash flows when gold rose from $250 in 2003 to over $1900 eight years later ($206.25 per annum average or 82% per year). How would Starbucks (SBUX), Nike, or Apple (AAPL) do if the very things they sold rose 82% each year?

Of course, this is a double edged sword: just as prices can rise each year, they can fall - just as fast if not faster. Thus, this author realized that to have a margin of safety within the mining sector, one must find companies that can produce each ounce cheaper than the industry average. Commodity companies, as history shows, generally have a price floor. This is simply because if the price falls so low that companies cannot generate profit or justify continued exploration to renew depleted reserves, they will cease production. And without production, there is no supply. And without supply the prices bottom until demand outpaces available supply. This then pushes prices higher as a signal for the market that the resource is needed and production can come back online. In the real world though this cycle takes years to manifest (boom, peak, bust, bottom, boom, repeat). For example, a mining company in the face of falling prices will ramp up production to make up for the loss of revenue through quantity (similar to the fracking oil companies in 2015), adding even more supply. Many companies can also temporarily grit their teeth and operate at a loss, expecting prices to rebound. Thus investors who dare to enter the mining sector must be aware of this commodity cycle and what stage they find themselves in. Being too early or too late can lead to nauseating losses.

So far this article has made 3 important statements: mining investors must absolutely be aware of where they are in the current cycle. The investor must also understand the mining sectors all-in sustaining cost (AISC) average compared to the company of interest. And the investor must have a contrarian mentality. Not everyone can be contrarian, because if the crowd could be, then there would be no such thing as being contrarian.

With all this in mind, one company in particular has stuck out: Teranga Gold Corp (TGCDF).

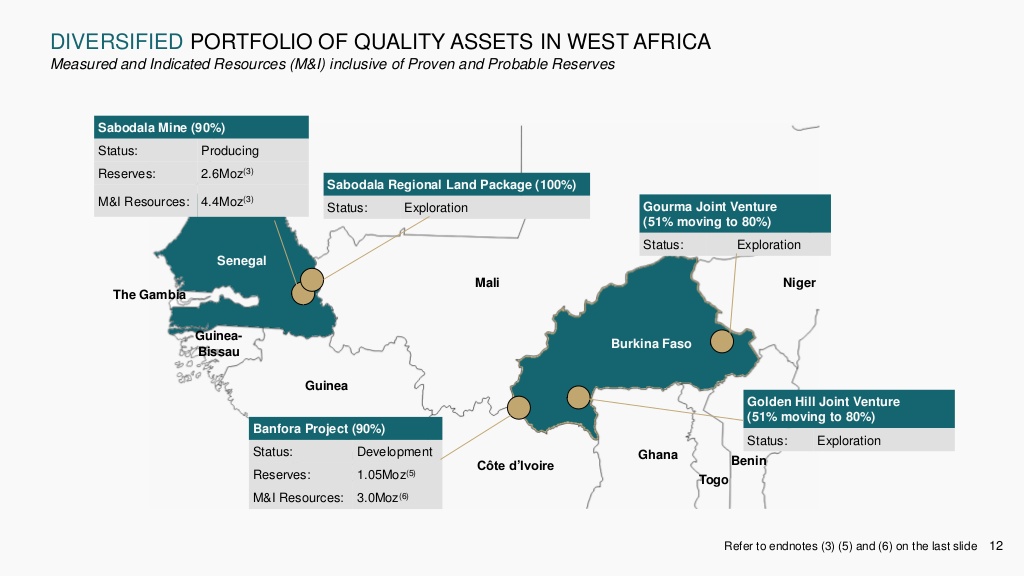

Teranga is a gold producing company on the border of Senegal, next to Mali. The company operates a large area, producing roughly 200-230k ounces of gold a year from their 90% owned Sabodala Mine. The company has a huge land package and interesting early stage projects in a gold rich area that still needs exploring. They have roughly 4.5 million ounces of gold measured and indicated (M+I) and another 390,000 ounces stockpiled.

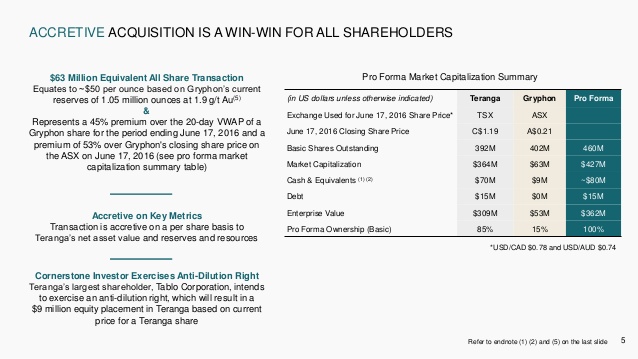

In June 2016, Teranga and Gryphon Minerals (GPHYF) agreed to engage in an all share transaction takeover, a compelling addition for Teranga and home for Gryphon. Gryphon Minerals brings $8 million in cash, 0 debt, and a 3+ million M+I ounce property (the Banfora Project) in Burkina Faso to Teranga's shareholders - all for $63 million in shares. This equates to paying slightly less than $26 per ounce of acquired M+I reserves in the ground. The two companies combined will give shareholders of Teranga stock 9 million ounces, with more room to expand.

Teranga has plans to start producing from the newly acquired Burkina Faso deposit by 2019. The company has a clean balance sheet of no long term debt ($15 million pulled from a credit facility) and will have about $80 million in cash with a solid EV/MKT VALUE difference.

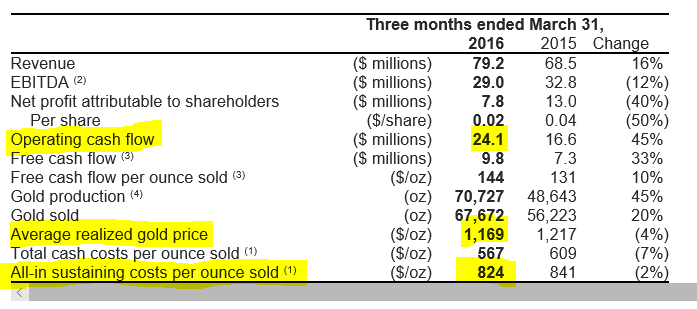

The best part for this author is the long life asset with AISC per ounce of gold at less than $950. Teranga already made a wonderful first quarter in 2016, generating $10 million in free cash flow. If one reads between the lines, there was a pleasant surprise that went unnoticed. Teranga's 'averaged realized gold price' for the quarter (ended 03/31/2016) was $1169, much below the current price of $1330. If Teranga generated $10 million free cash flow (or rather $144 per ounce cash flow) then, imagine what potential they have when Q2 numbers are posted. Teranga has made each ounce count, generating a high ROIC per ounce. Cash is king, as always.

The interesting thing about Teranga is that 40% of their costs are denominated in Euros. This means the weaker the Euro, the larger the 'real' return is. For instance, Teranga mines an ounce of gold, which is sold on the market for US dollars, which is then converted into Euros to pay fixed costs. When the dollar is strong and the Euro is weak, the company benefits from the currency conversion. Another note, the major cost for Teranga's operating expenses is oil. And as oil falls and stays below $50, that is substantial savings.

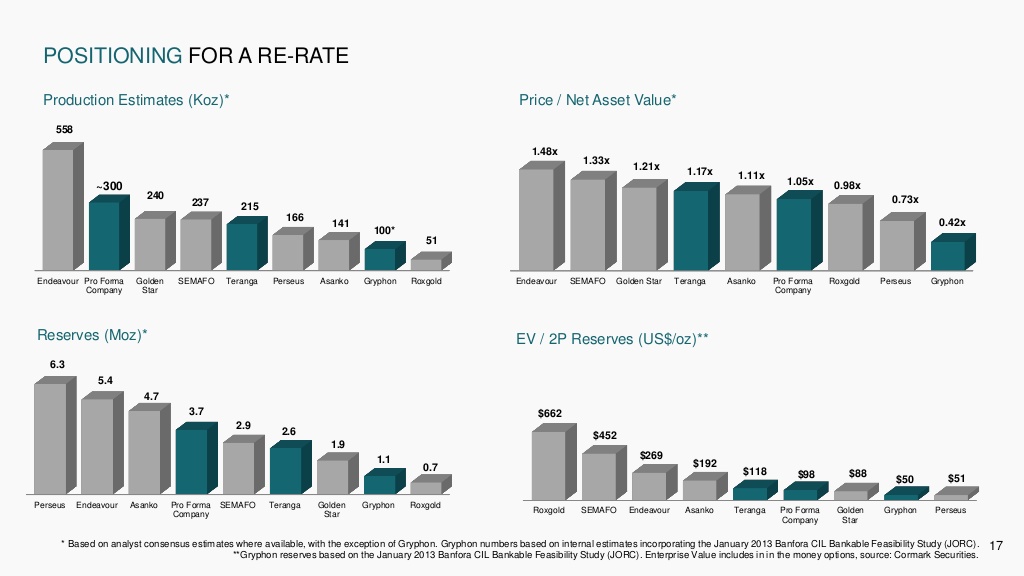

This is just a quick summary of Teranga, which is up well over 200% since this author's first BUY rec. from an earlier article in January (see more in the most recent article about this) but still relatively cheap (market cap only around $450 million). Expect a followup after next week's Q2 earnings report (July 28).

The company is cheap compared to other mining companies, generates cashflow, long life asset, and strong production profile. Contrarian enough and value-laden enough with a strong margin of safety for this author.

The logical idea is that with a much higher gold price and weaker Euro since the Q1 earnings report, and with the addition of 3 million ounces + $8 million cash from Gryphon Minerals, Teranga is positioned to be largely profitable and needs a re-pricing - for the upside.

Remember, yesterday's junior becomes tomorrow's senior. Goldcorp (GG), Barrick (ABX), and all the other majors started from somewhere.

DISCLOSURE: This author did not receive payment or any incentives for writing this article. It was done out of own free will. Author owns shares of Teranga Gold Corp ...

more