Technical Tuesday – Recovering Already?

4,500 infections.

That's a 60% jump since yesterday's official count and clearly, we're over 5,000 now in real-time but "only" 106 deaths, so down to 2% but, to be fair, new infections are happening so fast the deaths can't catch up with them so quickly. China is already working on a second 1,000-bed hospital for the Coronavirus Patients – that should tell you enough right there. Also, they've already run out of testing kits – so the number of patients could be substantially higher than estimated.

Again, I don't want to be in the position of being the prophet of doom but my job is to point out potential concerns that lie ahead for the market and this is a very big one at the moment. That guy is walking around with a fire stick – FIRE! When you need to burn out an infection – it's probably serious…

Hong Kong has 8 virus cases and will be implementing a broad series of restrictions aimed at controlling the spread of the coronavirus by limiting the number of mainland Chinese travelers entering the territory. The restrictions, which included the suspension of high-speed and other train services between Hong Kong and the mainland, a 50 percent reduction in the number of flights, and a ban on tourist visas for many travelers, were announced by Carrie Lam, the city’s chief executive.

In major cities like Beijing and Shanghai, many people have to stand in line in the wee hours of the morning to secure appointments with doctors. When they do get an appointment, patients get only a couple of minutes with a doctor. During the flu season, residents set up camp overnight with blankets in hospital corridors. Videos circulating on Chinese social media show doctors straining to handle the enormous workload and hospital corridors loaded with patients, some of whom appear to be dead.

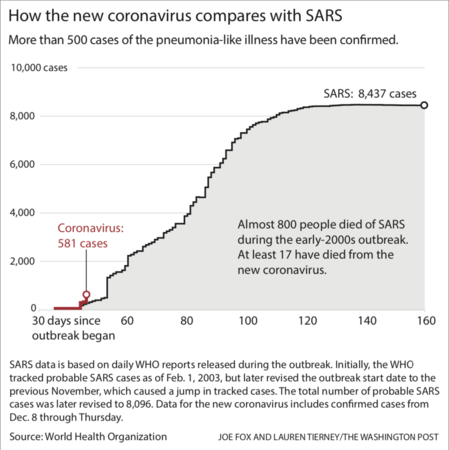

Again, I am sorry to dwell on this as it's depressing but the Government and the media, for the most part, are playing this down but here's a very simple illustration to let you know how serious this is. Last week, when only 581 people were infected through Thursday, we looked at this chart and saw the virus was tracking the SARS infection rate at the 45-day stage. Yet here we are, just 5 days later, and we're already at 4,500 cases – where SARS was after 90 days!

That is, as they say in the medical profession – NOT GOOD!

17 people were dead as of Thursday, 106 people are dead today, that's up 500% in 5 days – NOT GOOD!

Yet the complacency in the markets is simply astounding. Even the WHO, who failed to declare the Coronavirus a Global Emergency last week, has now upgraded the Global Risk Assessment from "moderate" to "high", which is just one notch below "PANIC".

I'm a numbers guy so I just watch the progression of deaths and infections to see if things are getting better or worse but up 500% (more on infections) in 5 days is certainly worse and, until we see those numbers begin to level out – it's probably not the best time to go bargain shopping.

Not that there's nothing to play. Yesterday we called for a bottom on Oil Futures (/CL) at $52.50 and we're at $53.50 so that's up $1,000 per contract (you're welcome!) and our long trade idea for the Oil ETF (USO) is also playing out nicely. This morning, we're liking Natural Gas (/NG) Futures as they cross back over the $1.90 line – with tight stops below that line. Having the flu doesn't make you sit in a cold house, does it?

So, speaking of options plays now is a good time to add the Natural Gas ETF (UNG) as it sits below the $15 line at $14.64. With Natural Gas, you want to capture the hurricane season so we can make the following trade for our Short-Term Portfolio (STP):

- Sell 20 UNG 2021 $15 puts for $2 ($4,000)

- Buy 40 UNG 2021 $13 calls for $3 ($12,000)

- Sell 40 UNG 2021 $15 calls for $2 ($8,000)

That's net $0 on the $8,000 spread and all UNG has to do is be higher than $15 on Jan 15th, 2021 and we get $8,000 back. Ordinary margin on the short puts is $3,300 so it's a nice, efficient way to make $8,000 in a year – perfect for our $100,000 STP. The downside risk is having to buy 2,000 shares of UNG for $15 ($30,000) and I'd keep the loss on the short puts to $2,000 ($3/contract) to avoid it getting ugly but UNG would have to be about $13 for that to happen (in the short run).

Be careful out there.

Click here to try Phil's Stock World free. Try PSW's ...

more