Streaming Companies - Part I

Streaming companies as a whole have been the best performing sector within the metals and mining industry, easily outperforming the TSX and DOW and some outperformed even gold.

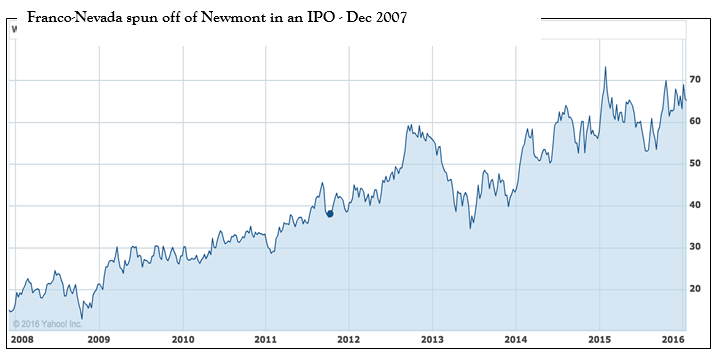

The following table and charts illustrate this performance:

This new Series is dedicated to Streaming Companies – what they are about and how we value them.

Streaming Companies are exposed to commodity prices however they have little in common with the actual miners. Streaming companies do not own or operate mines, have little overhead and for the most part no debt - all attributes making them far more resilient to low commodity prices.

HOW STREAMING WORKS

Streaming companies make agreements with exploration and development and mining companies to purchase all or part of their production at a low, fixed, predetermined price that is far below the market price. The streamer can then sell the metal for a profit.

The mining company gets much needed capital by immediately monetizing part of its future production and the streaming company buys metal at fixed prices without having to invest in exploration, development, or operations of the project.

This model has proven to be extremely lucrative for the streaming companies since scarcity of capital during downturns put miners in a position to cut overly sweet deals for the provider of capital. The streaming companies were able to buy significant amounts of gold and silver at extremely high discounts to the spot price especially as commodity prices took off. Miners have raised US$4.2 billion from 11 stream sales in 2015 which is nearly double the US$2.2 billion raised in 2013, which is the second biggest year on record.

2015 was one of the worst years for major mining companies; metal prices continue to fall in the aftermath of years of expensive acquisitions, heavy borrowing and high cost of operations. Major miners such Barrick Gold (ABX), Glencore (GLCNF), Teck Resources (TCK) and Vale SA (VALE) all sold streams in 2015.

The streaming model was created by Silver Wheaton (SLW) in late 2004 and the biggest players in the streaming space are Silver Wheaton, Franco-Nevada (FNV) and Royal Gold (RGLD):

ADVANTAGES OF THE MODEL

Advantages for the Streaming Company

- Higher market value - the market values gold in the ground and gold produced by a traditional miner lower than gold attributed to a streaming company

- Asset diversity - participation in multiple mines without the ongoing management of the mines

- Fixed operating and capital costs - delivery payments are typically 75% or more below spot price

- Commodity price upside - cash costs are fixed for life of mine

- Exploration and Development Upside – In a typical streaming deal the miner has agreed to sell a fixed percentage of all future production from a mine meaning that if any additional gold is discovered or production levels increased the streaming company is entitled to their share of that gold with no requirement to fund any of the exploration or development costs

An example of an extremely lucrative stream is one completed by Silver Wheaton on the San Dimas mine in Mexico. In 2004 they acquired a stream from Goldcorp for all of the silver, which would be produced from the mine for an upfront payment of $US $336 million in cash and shares. Subsequently Goldcorp sold the mine to Primero (2010). The streaming arrangement entitled Silver Wheaton to purchase all of the silver produced from the San Dimas mine for approximately $US $4.00/oz. To date Silver Wheaton has received net cash flows totaling $US 950 million from the purchase and sale of 68.2 million ounces of silver and continues to generate approximately $US 60 million annually.

Advantages for the Mining Company

- Non dilutive financing in the near-term by immediately monetizing future production

- Access to capital when other sources withdraw (equity funding and bank loans)

- Favorable to the balance sheet

- Light on debt covenants

- Typically less interference with existing debt covenants

- Structured as a deposit (deferred revenue) rather than long term debt

- Better credit rating and leverage

- Tax benefits

DISADVANTAGES OF THE MODEL

Disadvantages for Mining Companies

- Long-term equity dilution - the immediate non-dilutive financing comes at the expense of future returns, damaging the company’s longer-term appeal for equity investors. While metal streaming financing allowed companies to commence production, they could also consume the precious cash flow often to the point of jeopardizing operations.

- Metal price upside taken away - miners give away substantial upside when metal prices rise. To take an extreme Silver Wheaton was purchasing silver from some companies at less than US4$ per oz in 2011 when silver prices were reaching as high as $50 per oz – transferring significant wealth away from the miners’ existing equity holders.

- Damaging for exploration upside - another major concern is that streams take away the exploration upside form companies. In a typical streaming deal the miner has agreed to sell a fixed percentage of all future production from a mine; this creates a disincentive to make a new discovery on the property and boost or extend mine life.

Disadvantages for the Streaming Companies

Without a doubt some streaming agreements have been rather predatory. To an extent this is justified with the risks that they take on:

- Asset risk – a potential mine closure or production shortfall could wipe out the investment substantially or completely

- Metal price risk – although not as acute there is a risk factor here too - if the metal price fall too much streamers can lose money too

One example of the perils for the streamer is the streaming agreement made in 2009 between Sandstorm and Luna Gold on the Aurizona Mine in Brazil. Sandstorm invested approximately $US $20 million upfront in exchange for 17% of the life of mine gold production to be delivered at $US 404/oz. Throughout 2013 Sandstorm contributed an additional $US 6.5 million towards their share (17%) of Phase 1 Expansion bringing the total invest to $US 26.5 million. In 2014 Aurizona Mine returned a total of $US 55 million in net cash flows to Sandstorm ostensibly a good return on their investment, however burdened with negative cash flows, Luna Gold had no development capital left. Sandstorm provided an additional $US 20 million loan and $US $20 million in equity financing to Luna at $1.02/share in 2013-14 bringing their total investment to $US $66.5 million. In early 2015 Luna Gold announced that it was shutting down operations at the Aurizona Mine and as a result Sandstorm will receive no further gold streams until such time as Luna can be re-capitalized enough to re-open the mine. In late March 2015 Luna announced plans to restructure the stream with Sandstorm. The stream was replaced with an NSR of at least 3% and a $US $30 million debt facility. That may not be enough to solve Luna’s problems however. The shares continued to tumble and the mine is yet to be re-opened.

The following chart shows the performance of Luna Gold with a few key milestones noted.

With over $US $50 million in debt on the books, a 3% NSR still owing to Sandstorm and a recent market capitalization of less than CDN $13 million, it appears that Luna gold may need further debt restructuring in order to raise the capital required to re-open the Aurizona Mine. It is clear to see that this will leave very little for the equity shareholders that invested the roughly $US $150 million that built Luna into the mining company with a market capitalization of over CDN $380 million in early 2013.

The following chart shows the negative impact of the mine shut down on Sandstorms’ share price.

In the weeks following Luna’s announcement of the mine shutting down, Sandstorm lost over 30% of its market value.

The key to mitigating project risks as a streaming company is discipline and diligence in assets selection. Investing in quality assets avoiding excess for the sake of growth mitigates project risk and allows for far more equitable streaming arrangement with the mining companies themselves so that existing and future shareholders can be rewarded and supportive alongside.

Disclaimer Cipher Research Ltd. is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst, or underwriter and is not affiliated with any. There is no ...

more