Stocks Snap Win Streak; Dow, Nasdaq Log Worst Day Since 2020

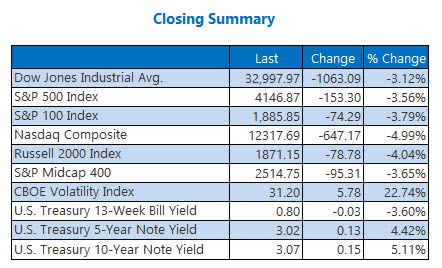

Wall Street's selloff intensified midday and didn't let up, as the major benchmarks all snapped a three-day win streak. The Dow finished Thursday more than 1,000 points lower after the 10-year Treasury yield surged back above 3% and labor productivity fell at its sharpest quarterly rate in nearly 75 years. The S&P 500 also closed firmly in the red, while the Nasdaq suffered a massive triple-digit loss, as interest rates dented growth-focused tech stocks. Ultimately, the Dow and Nasdaq each logged their worst day since June 2020.

The Dow Jones Average (DJI - 32,997.97) shed 1,063.1 points or 3.1% for the day. Every Dow component walked away with a loss today, and Salesforce.com (CRM) paced the bottom of the list with a 7.1% dip.

The S&P 500 Index (SPX - 4,146.87) fell 153.3 points, or 3.6% for the day, and the Nasdaq Composite (IXIC - 12,317.69) lost 647.2 points, or 5% for the day.

Lastly, the Cboe Market Volatility Index (VIX - 31.20) added 5.8 points or 22.7% for the day.

GOLD EKES OUT WIN AFTER TRADING ABOVE $2,000 EARLIER

Oil prices moved higher on Thursday, as the European Union (EU) moved closer to banning Russian crude imports. Additionally, the Organization of the Petroleum Exporting Countries and its allies (OPEC+) agreed to a increase monthly oil output by a modest amount, despite the recent price rally. June-dated crude added 45 cents or 0.4%, to close at $108.26 per barrel.

The Treasury yield's surge, a rising U.S. dollar, and Wall Street's selloff gave gold futures a small victory today. Specifically, June-dated gold added $6.90, or 0.4%, to settle at at $1,875.70 an ounce, after trading above $2,000 per ounce earlier.