Stocks Slump On Poor Google, Samsung Earnings; China Slowdown Fears Return

US futures were flat, while European equity markets and Asian stocks slipped on Tuesday as weak Chinese business surveys dampened appetite for risk,. A disappointing outlook and earnings at Samsung, the world’s biggest phone maker, and an ad revenue slowdown at Google sent tech stocks lower.

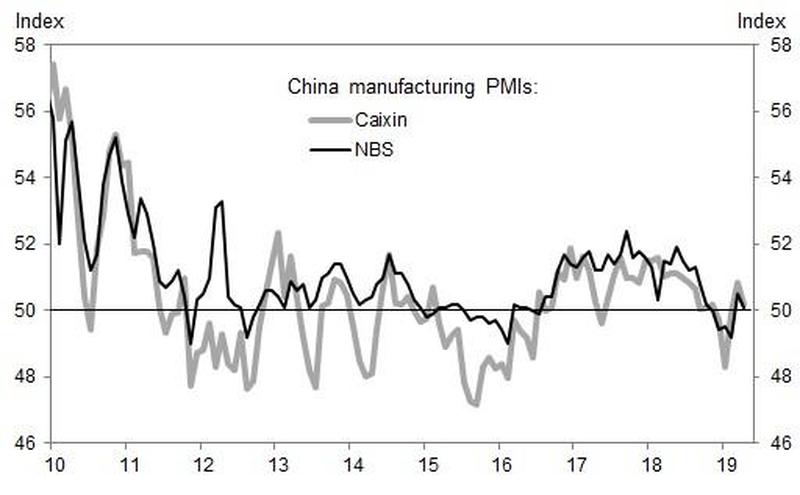

European shares followed Asian peers into the red after surveys on China manufacturing and services missed forecasts - another sign that Beijing’s efforts to spur growth n the world’s second biggest economy had yet to bear fruit, and that the rebound indicated by the spike in China's PMI print last month was premature. As reported overnight, both official and private business surveys suggested slower Chinese factory growth this month, dashing hopes for a steady reading or even a faster expansion. Data also showed a slower expansion in its services sector. The full details again:

- Chinese Manufacturing PMI (Apr) 50.1 vs. Exp. 50.5 (Prev. 50.5).

- Chinese Non-Manufacturing PMI (Apr) 54.3 vs. Exp. 55.0 (Prev. 54.8)

- Chinese Caixin Manufacturing PMI (Apr) 50.2 vs. Exp. 51.0 (Prev. 50.8)

And visually:

Asian markets fell after the poor Chinese data amid thin trading. MSCI’s index of Asia-Pacific shares outside Japan was off 0.5%. Bourses in South Korea and Hong Kong both fell.apan’s financial markets are closed throughout the week as Japanese Emperor Akihito prepares to abdicate in favor of his elder son, Crown Prince Naruhito.

The latest Chinese data underscored questions over prospects for the Chinese economy despite a record credit injections who impact appears to have fizzled early, while investors across the world are on edge over growing signs of a two-speed global economy where a robust United States outpaces its peers.

Adding to China's economic disappointment were tech stocks, which slumped following Alphabet’s worse-than-expected results after the Monday close, and after Korean smartphone giant Samsung Electronics’s profit missed analysts’ recently reduced estimates and shared a worse than expected outlook. Equities in Hong Kong, South Korea and Australia all dropped, though trading was quieter than usual thanks to a holiday in Japan. As usual, bad news was good news, and shares rose in Shanghai despite poor Chinese manufacturing data.

The Asian weakness initially spread to Europe, where the Stoxx 600 index was off 0.2%, with British shares down 0.2% and bourses in Germany and France down 0.1 and 0.4% respectively in early trading, while futures on the S&P 500 also pointed to a soft open in New York.

The Stoxx Europe 600 nudged into the red, led by declines in telecommunication and mining shares, as futures on the S&P 500 also pointed to a soft open in New York. France reported steady growth for the first quarter, while Spain’s economy also grew faster than expected. Chipmaker AMS jumped 16% after beating forecasts for first-quarter profit. AMS is a supplier to Apple, which is due to report its results later. Banks dragged heavily on the Stoxx 600. Danske Bank, hit by money-laundering scandals, fell more than 6 percent after lowering its outlook for 2019, while No. 1 euro zone bank Santander also slipped after first-quarter net profit. In contrast, Standard Chartered climbed after unveiling plans for share buybacks of up to $1 billion, its first in at least 20 years. The euro added to gains after regional GDP beat estimates and inflation in some of Germany’s regions accelerated in April.

Tech stocks were hit following Alphabet’s worse-than-expected results after the Monday close, and after Korean giant Samsung Electronics’s profit missed analysts’ recently reduced estimates. Equities in Hong Kong, South Korea and Australia all dropped, though trading was quieter than usual thanks to a holiday in Japan. Shares rose in Shanghai despite poor Chinese manufacturing data.

“It’s not a stellar reporting season -- I don’t think anyone expected that,” said Nick Nelson, head of European equity strategy at UBS, on Bloomberg television. “But it’s certainly better than the fourth quarter. And that fits with some of the stabilization in the broader data in the euro zone, in emerging markets and in China.”

Emerging-market stocks and currencies were weaker Tuesday following the disappointing Chinese PMI data and as investors awaited further news on progress in trade talks between the U.S. and China. Still, MSCI’s gauge of developing-nation equities remained on track for a fourth successive monthly gain, the longest streak since January 2018. The currency index, however, is set for a third consecutive drop. Seasonal data complied by Bloomberg suggests both measures may retreat in May, as they have in seven of the past 10 years.

In FX, the euro strengthened for a third day as the euro-area economy expanded more than forecast in the first quarter. The pound shrugged off a report that said U.K. Prime Minister Theresa May faces a challenge from activists within her own party opposing her leadership, and GBPUSD rose above 1.30 for the first time in a week. AUDUSD swung to a loss after an official release showed Chinese manufacturing PMI missed.

Elsewhere, South Korea’s won led currency declines, falling to a two-year low after a weak earnings report from Samsung. The Philippine peso was firmer after the country’s credit score was lifted one step at S&P Global Ratings. Turkey’s lira fluctuated as investors pondered the latest statements by central-bank chief Murat Cetinkaya. The focus now turns to the Federal Reserve policy meeting on Wednesday.

In rates, Treasuries unexpectedly reversed direction around the time Europe opened, and reversed gains that came on the back of weaker-than-forecast China manufacturing growth.

In commodity markets, oil prices reversed losses after Saudi Arabia said a deal between producers to withhold output, in place since January, could be extended beyond June to cover all of 2019. Brent crude futures were last at $71.25 per barrel, down 0.4 percent.

In overnight geopol news, North Korea's Vice Foreign Minister said that their resolve for denuclearisation is unresolved, adding that denuclearisation will be possible only if the US changes their current calculations. If the US fails to present new positions the US will then see unwanted consequences.

In the latest Brexit news, UK PM May is said to be facing a grassroots vote demanding her resignation with Conservative party local chairman and activists calling for an extraordinary meeting with PM to demand her resignation. May’s office thereafter downplayed the significance of the meeting, suggesting that it would not be legally-binding and the outcome of the meeting wouldn’t necessarily be passed. Furthermore, there will have to be a 28-day wait until such a meeting is held.

Looking ahead, traders will be looking for signals from economic data, a Fed policy meeting on Wednesday and earnings reports from the likes of Apple and McDonald’s. Meanwhile, the next round of trade talks between the U.S. and China will get under way this week with significant issues still unresolved. But enforcement mechanisms are “close to done,” according to Treasury Secretary Steven Mnuchin, although this has been said on countless times before.

Market Snapshot

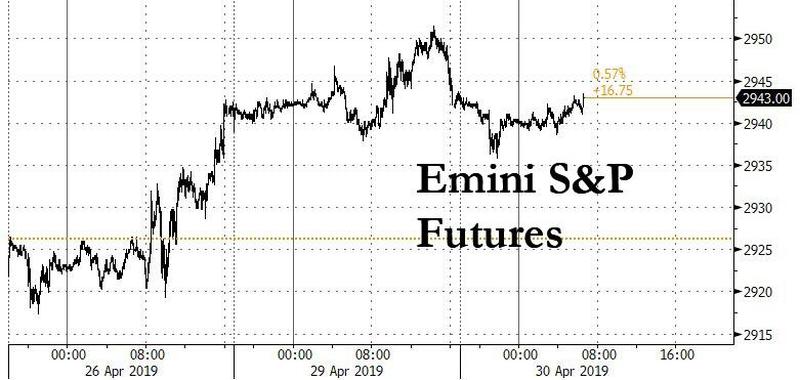

- S&P 500 futures down 0.07% to 2,941.00

- STOXX Europe 600 down 0.2% to 390.65

- MXAP down 0.1% to 162.36

- MXAPJ down 0.5% to 538.26

- Nikkei down 0.2% to 22,258.73

- Topix down 0.2% to 1,617.93

- Hang Seng Index down 0.7% to 29,699.11

- Shanghai Composite up 0.5% to 3,078.34

- Sensex down 0.6% to 38,840.30

- Australia S&P/ASX 200 down 0.5% to 6,325.47

- Kospi down 0.6% to 2,203.59

- German 10Y yield rose 2.7 bps to 0.03%

- Euro up 0.2% to $1.1203

- Brent Futures up 0.3% to $72.27/bbl

- Italian 10Y yield unchanged at 2.213%

- Spanish 10Y yield rose 2.0 bps to 1.033%

- Brent Futures up 0.3% to $72.27/bbl

- Gold spot up 0.4% to $1,284.33

- U.S. Dollar Index down 0.2% to 97.65

Top Overnight News from Bloomberg

- Yield-starved investors outside the U.S. are abandoning their currency hedges on American assets, and that’s good news for dollar bulls.

- Economic growth in the euro area strengthened more than expected in the first quarter, buoyed by resilience in France and Spain.

- Markets aren’t adequately pricing in the risks from higher oil costs, according to Morgan Stanley Wealth Management. Rallies in stocks and Treasuries that have taken the S&P 500 Index to a record high and 10-year yields down to around 2.5 percent illustrate that investors are complacent about crude prices.

- The first official gauge of China’s manufacturing sector fell in April, signaling that the economic stabilization seen in the first quarter remains fragile

- President Donald Trump sued to block Deutsche Bank AG and Capital One Financial Corp. from complying with congressional subpoenas targeting his bank records, escalating the president’s showdown with Democratic lawmakers investigating his finances

- U.K. Prime Minister Theresa May will face a challenge from activists in her Conservative Party after enough signed a petition opposing her leadership and Brexit strategy to force an emergency vote on her future

- The U.K.’s opposition Labour Party’s ruling council will seek to thrash out a Brexit strategy Tuesday as leader Jeremy Corbyn tries to head off a split that threatens to derail his election plans

- A week after the U.S. flagged tighter sanctions on Iranian crude and spurred oil higher, prices are back down to where they were before the announcement

- U.K. traders are ignoring risk of a hawkish BOE, JPMorgan says

-

Asian equity markets traded mostly lower following weaker than expected Chinese PMI data and as the region digested a heavy slate of earnings. ASX 200 (-0.5%) was negative in which commodity names led the declines seen across a broad range of sectors due to its high exposure to China and the disappointing factory activity, while KOSPI (-0.6%) suffered amid losses in index heavyweight Samsung Electronics after the Co.’s final Q1 results showed operating profit fell around 60% Y/Y. Elsewhere, Hang Seng (-0.7%) and Shanghai Comp. (+0.5%) diverged with Hong Kong dampened after Chinese Official Manufacturing, Non-Manufacturing and Caixin Manufacturing PMIs all fell short of estimates which overshadowed the earnings releases including the profit growth amongst the Big 4 banks, while the mainland remained afloat on month-end and pre-holiday position squaring as well as the increased hopes for more accommodative policy in the aftermath of the weak Chinese data.

Top Asian News

- Jokowi Wants Indonesians to Have Say Picking New Capital City

- Warning Signs Are Flashing in China Stock Market After Surge

- China Triple Whammy Sees Stocks, Bonds, Yuan All Sink in April

- Breaking Up: Asian Stocks Fall Out of Lockstep With U.S. Market

-

Major European bourses have drifted marginally lower since the EU open [Eurostoxx 50 -0.3%], following a mostly downbeat Asia-Pac lead and as the region digested a slew of pre-market earnings.Sectors are mixed with Telecom names lagging after France’s Orange (-3.5%) missed revenue forecasts and tumbled to the foot of the CAC 40. On the flip side, the energy sector is faring well amidst price action in the oil complex which aided BP (+0.4%), Shell (+0.2%) and Total (+0.1%) climb back into positive territory. Back to earnings, Standard Chartered (+5.7%) extended on opening gains after optimistic earnings coupled with a USD 1.0bln share buyback programme which is expected to reduce its CET1 ratio by around 35bps in Q2. Elsewhere, DSV (+6.8%), Beiersdorf (+2.3%), MTU Aero Engines (+2.2%), and Caixabank (-3.9%) are amongst the movers post-earnings. Finally, Danske Bank (-8.2%) shares fell to the foot of the Stoxx 600 after FT reported that Brussels vows to pursue a probe into the bank’s money laundering scandal.

Top European News

- Greenpeace Norway Says Activists Have Left West Hercules Rig

- Santander’s Bets on Latin America Pay off as Europe Stumbles

- Biggest Nordic Banks Hit by Selloff After Bleak Results

- Tria Says VAT Hike Could Be Inevitable Without Cuts: Il Fatto

-

In FX, the Dollar is softer across the board after Monday’s soft PCE inflation data and with rebalancing models for the last trading day of April flagging sells signals to varying degrees. Hence, the DXY has slipped back from 98.000+ levels again, and this time the index is probing somewhat deeper blow chart supports that were tested towards the end of last week, but not breached. If 97.544 (50% Fib) and 97.500 fail to hold, 97.460 is next on the radar before a stronger downside target and low from last week looms at 97.258.

- GBP - The Pound is the best G10 performer and biggest beneficiary of month end Greenback weakness with one bank signalling especially strong Cable buying to balance portfolios. Subsequently, the pair has extended recovery gains from the low 1.2900 area to circa 1.2986 and through several DMAs including the 10, 100 and 200 levels (at 1.2940 and 1.2961 coincidentally).

- EUR/JPY - Vying for 2nd place in the major ranks and both impacted by data, albeit diversely, as the single currency draws encouragement from firmer than forecast Eurozone GDP and inflation to reclaim the 1.1200 handle. However, the Jpy has now overcome strong resistance at 111.37 to peer above 111.30 in wake of disappointing Chinese PMIs overnight that spurred some risk-aversion and demand for the safe-haven Yen.

- NZD/CHF/CAD - The next best G10s or gainers due to the more pronounced Usd downturn, with the Kiwi hovering near the top of a 0.6681-56 range and Franc back over 1.0200 within 1.0199-75 trading parameters, while the Loonie is pivoting 1.3350 ahead of Canadian data in the form of monthly GDP and PPI. Note also, BoC Governor Poloz and Wilkins are slated to speak later, and then NZ Q1 jobs and labour costs for Q1 are on tap before attention turns to Wednesday’s FOMC.

- AUD - The Aussie is lagging on the aforementioned PMI misses from China and in particular the official and Caixin manufacturing reads that only just avoided stagnation. Aud/Usd is straddling 0.7050, as the Aud/Nzd cross slips a bit further below recent peaks of 1.0600+ towards 1.0565.

- EM - The Try has been volatile again with further weakness vs the Usd in the run up and during the early part of the CBRT’s inflation presentation, but a partial recovery within a 5.9335-9835 band ultimately as Governor Cetinkaya clarified last week’s post-policy meet statement and guidance to maintain that tightening is still an option if upside inflation risks materialise.

-

In commodities, energy markets are trending higher, albeit remain relatively choppy in early EU trade following comments from Saudi Energy Minister Al-Falih who (in-fitting with reports) said that the Kingdom is ready to meet shortfalls caused by the expiry of Iranian oil waivers on May 2nd.However, with the upcoming JMMC meeting on May 19th (ahead of the OPEC+ meeting on June 26th) the Saudi Energy Minister also noted that a majority of the cartel’s oil ministers are tilting towards extending the global output deal. Analysts at BNP highlight that there is a “good chance” that OPEC countries and allies will decide to extent the supply curb deal in June, although some changes may be made to the current deal. The energy minister also noted that the nation’s oil output will be significantly lower than 10mln BPD (last recorded around 9.8mln BPD) until May-end, whilst exports will be below 7mln BPD (currently just under 7mln BPD). Meanwhile, IFX reported that Russia’s April oil output stood at 11.23mln BPD, slightly lower than March’s 11.3mln. This, coupled with a receding Dollar aided WTI and Brent futures to climb comfortably above USD 64.00/bbl and USD 72.50/bbl respectively. Elsewhere, precious metals are also benefitting from the weaker Greenback with spot Gold meandering just below its 100 and 200 DMAs at 1293.11 and 1297.40 respectively. Meanwhile, turning to base metals, downside seen from disappointing China Manufacturing data has been offset by the softer Dollar with copper now closer to intraday highs and just a whisker away from its 50 DMA at 2.9054.

US Event Calendar

- 8:30am: Employment Cost Index, est. 0.7%, prior 0.7%;

- 9am: S&P CoreLogic CS 20-City MoM SA, est. 0.2%, prior 0.11%; 20-City YoY NSA, est. 2.95%, prior 3.58%

- 9:45am: MNI Chicago PMI, est. 58.5, prior 58.7

- 10am: Pending Home Sales MoM, est. 1.45%, prior -1.0%

- 10am: Conf. Board Consumer Confidence, est. 126.8, prior 124.1; Pending Home Sales NSA YoY, est. -4.0%, prior -5.0%

- 10am: Conf. Board Present Situation, prior 160.6; Conf. Board Expectations, prior 99.8

-

DB's Craig Nicol concludes the overnight wrap

The first couple of days of the week here in the UK have required a strict routine recently. Get through Monday avoiding all social media involving Game of Thrones until the evening when you can then rush home and watch it, and then speculate all day Tuesday with your colleagues about what happens next. As Jim was waiting for his house move to start series 8, we’ve had to remain tight-lipped but the flood gates have now opened since he’s been off, especially after last night’s blockbuster. We’ll politely refrain from saying any more and spoiling the plot for those who haven’t yet watched it.

Markets are stuck in a similarly welcome routine of their own at the moment as US equities continue to nudge higher to fresh record highs. Last night’s +0.11% close for the S&P 500 was the third new closing high for the index in the last week while the NASDAQ (+0.19%) likewise closed at a new high - though it is trading lower overnight after Google’s tepid earnings. The DOW (+0.04%) is still -1.02% off its own all-time high; however, it does feel more like when rather than if it’ll eclipse that level. The VIX ticked +0.38pts higher to 13.11, but remains near the bottom of its year-to-date channel. Remarkably, the VIX has traded in an intraday range of just 3.36pts for all of April. The last time we had a smaller range during a month was February 2017. One key market indicator that has snapped out of its recent range is the US 2s10s yield curve, which rose +1.9bps yesterday to 23.7bps. That’s its steepest level since November, and it was accompanied by a general rise in yields yesterday. Yields on Treasuries and Bunds rose +2.8bps and +2.5bps, respectively. This helped bank stocks, which powered equity gains on both sides of the Atlantic, with bank stock indexes equally gaining +1.32% in both the US and Europe.

Anyway, a soft PCE inflation report in the US yesterday – albeit one which was largely baked in post Friday’s data – got the ball rolling; however, the relatively muted price action likely better reflected what is still an exhausting week ahead of big macro events and earnings.

Indeed, this morning we’ve had China’s PMIs for April where both the official (50.1 vs. 50.5) and Caixin (50.2 vs. 50.9 expected) manufacturing readings have disappointed. They also dropped from 50.5 and 50.8, respectively, last month. The official non-manufacturing reading also declined half a point to 54.3 (vs. 54.9 expected) leaving the composite 0.6pts lower at 53.4. The good news is that the composite reading is still higher than the five months prior to March, while the manufacturing reading is above 50 for a second consecutive month, with underlying components including new orders looking healthy. So, consolidation following a big bounce in March is probably the most appropriate way to describe the data.

Equity markets in China are a little higher post that data with the Shanghai Comp up +0.43% and CSI 300 up +0.19%. Positive trade comments from Mnuchin appear to also be helping. He said on Fox News that the US has “made more progress than ever before” towards a real agreement. A reminder that Mnuchin and Lighthizer travel to Beijing today. Meanwhile, the rest of Asia is a little softer with the Hang Seng (-0.48%) and Kospi (-0.55%) down. The latter seems to be suffering following an earnings miss for Samsung. In FX, Sterling is little changed overnight after the Sun reported that more than 10% of chairmen and women of local parties had signed a petition calling for PM May to resign, thus meeting the threshold for an emergency meeting.

Meanwhile, after the close last night Alphabet’s results came in a bit soft, with revenues surprisingly missing expectations. The company reported overall sales of $29.5 billion, less than the $30.0 billion expected. Profits came in at $6.7 billion, down almost 30% versus the same period last year, but most of that was attributable to a $1.7 billion fine to the European Commission. The stock price, after closing at an all-time high in advance of the earnings report, fell as much as -7% in overnight trading, sending NASDAQ futures -0.25% lower this morning.

Turning back to yesterday, the USD was little changed; however, EM currencies including the Argentinian Peso (+3.50%) had a better day boosted by the announcement from Argentina’s central bank that it would start selling dollars to stabilize the currency. In Europe, the STOXX 600 (+0.08%) recovered from early losses to just about finish onside while the DAX rose +0.10%. Spain’s IBEX (+0.12%) erased losses from earlier in the day to close in line with the rest of Europe after the weekend election result, and 10y Spanish bond yields fell -1.2bps despite the broader bond selloff. Elsewhere WTI oil (+0.32%) rose after declining -4.52% over the preceding three sessions.

Just on the details of that inflation data in the US where the March core PCE deflator was confirmed at 0.0% mom in March compared with expectations for a +0.1% reading. The extra few decimals showed it was a more marginal miss at +0.046%; however, the annual rate, which nudged down from +1.7% to +1.6% yoy was +1.553% with the extra decimal places and so a whisker away from rounding down to an even lower +1.5%. Our US economists noted that the 3-month annualized change is now just +0.7% and the lowest since early 2015 too. Their full thoughts, parsing the various inflation measures and their associated implications for Fed policy, can be found here .

So clearly a soft set of data even if the market had priced much of it in post Friday’s Q1 details. That all being said, our US economists have noted that there are two reasons to expect core PCE to bounce back next month, however. The first is the read-through from the recent bounce in equities for financial services and portfolio management services following a plunge earlier this year, and the second is that core PCE has tended to outperform core CPI in April over recent years.

Other US data didn’t really move the needle. March personal spending rose +0.9% mom versus expectations for a +0.7% rise, but personal incomes rose only +0.1% versus +0.4% expected. Separately, the Richmond Fed manufacturing survey fell -4.9 points to 2.0, a notable decline but still above the negative levels seen in December-January.

Meanwhile, the European Commission’s April confidence indicators were hardly encouraging and underscored the problems facing the manufacturing sector, as the headline economic confidence reading fell -1pt to 104, its lowest level since September 2016. The industrial confidence reading dropped -2.5pts to -4.1, its lowest reading since September 2014. The consumer and services confidence readings were flat and above recent lows, but still a bit off their peaks from last year. Separately, March M1 money supply growth came in better than expected at +7.7%, up from +6.9% in February. Digging into the credit data, however, showed weak corporate loan flows, which pushed the credit impulse to -0.6pp of GDP, its fourth consecutive negative print.

In terms of the rest of the day ahead, all eyes this morning will be on the Q1 GDP reading for the Euro Area where the consensus is for a +0.3% qoq print. We’ll get the data for France prior to that while Italy is due out a little later. Also on the cards today are preliminary CPI data for France, Germany and Italy, while this afternoon we’ve got the Q1 ECI in the US along with the February S&P CoreLogic house price index data, Chicago PMI for April, March pending home sales and April consumer confidence. Away from that we’re due to get comments from the BoE’s Ramsden while Lighthizer and Mnuchin travel to Beijing for more trade talks. The big earnings highlight is Apple after the close tonight, while Pfzier, Merck, McDonalds, Airbus, General Electric and ConocoPhillips are also on the cards. So it should be a busy day.