Stocks And Precious Metals Charts - Stocks Rally Higher

"Free market economic 'literature' as economists call it — and their papers frequently are works of fiction — gave succor and intellectual respectability to the decades of deregulation and tax cuts that have bankrupted the country. Congress is compromised, to be sure, but lobbyists and members need economic studies as cover for what they are doing.

The United States is a plutocracy, with an income and wealth distribution that rivals South America’s worst cases, but economists refuse to acknowledge that these outcomes are attributable to ill-advised public policies on taxation, regulation, trade, and education spending over the last several decades.

Economists bleat about 'globalization' as though it were inevitable rather than a set of deliberate policy choices. Markets are political creations, so results produced by them are not inviolable or free from question." - Lee Sheppard, Economists' Malign Influence on Taxes, Forbes, May 3, 2012

Stocks managed to rally higher and hold their gains for the most part.

The biggest driver was Tesla TSLA, which is receiving an order for 100,000 vehicles from Hertz.

After the bell, Facebook FB missed its revenue estimates and gave a soft revenue forecast for the future.

I tend to look at the revenue numbers first, as a good CFO with a flexible accounting structure can make short-term profits do just about anything they want.

Remember Cisco CSCO, which famously beat their earnings number by one penny, quarter after quarter?

Actually, this whole market reminds me of 1999-2001.

It is more than a bubble; it is a Ponzi scheme.

Facebook pledged a $50 billion stock buyback program though, so all was quickly forgiven, or at least forgotten.

Gold and silver managed to rally today even as the Dollar slightly strengthened.

And the band played on.

Have a pleasant evening.

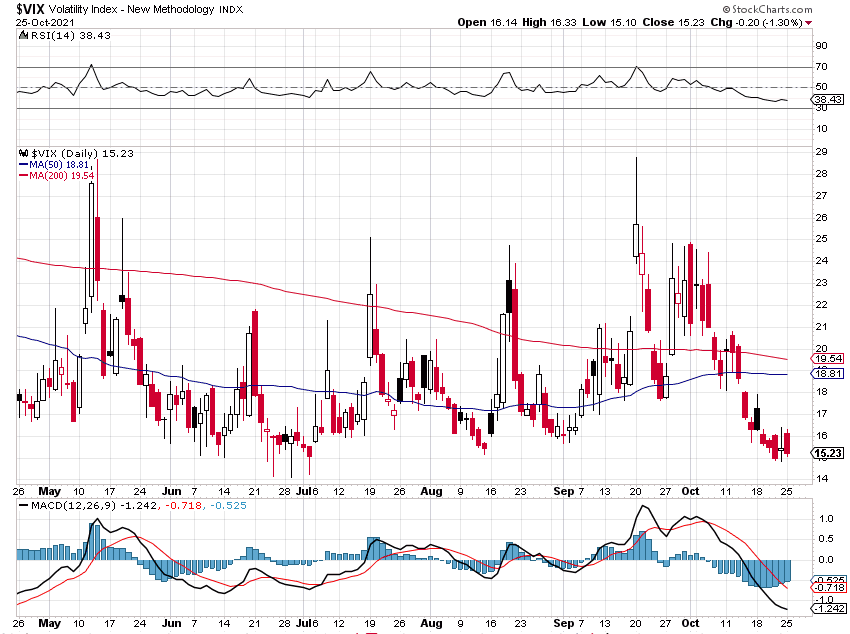

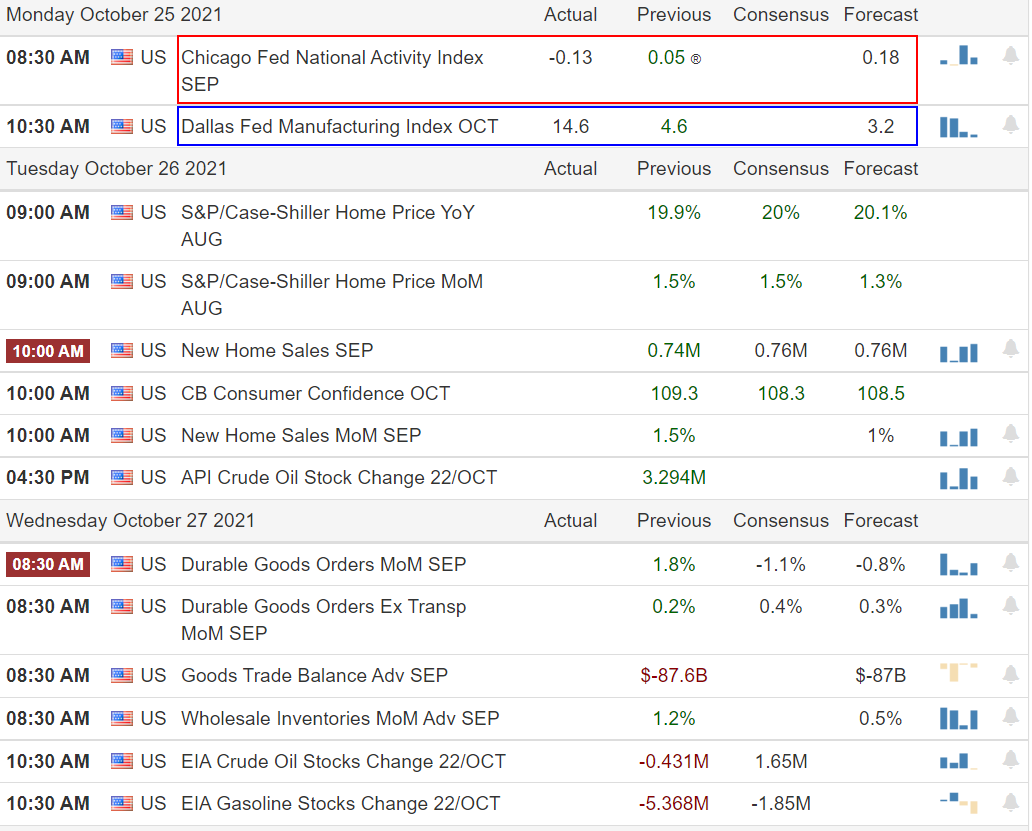

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

Disclaimer: These are personal observations about the economy and the markets. In providing information, I hope this allows you to make your own decisions in an informed manner, even if it is from ...

more