Soy Bean Update: Despite Record US Crush & Solid Exports, Demand Issues Remain

Market Analysis This winter’s spreading Coronavirus health issues and the economic and financial impact on the world and individual country economies has dominated both the equity and agricultural markets. The upcoming US quarterly grain stocks and planting intentions are important USDA guideposts on the prospects for 2020 grain and oilseed prices. However, the lifting of COVID-19 cloud on the world’s population remains an even more important factor on the wellbeing of our plant. Hopefully, the current measures will speed our recovery to a healthier environment for all.

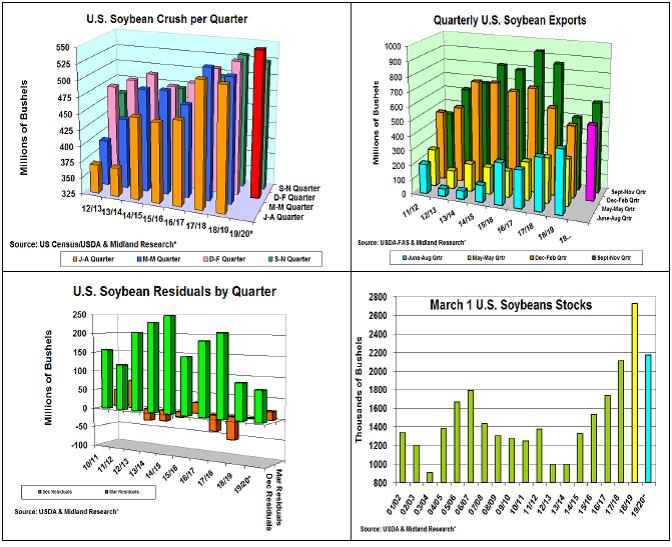

After a slight dip in the fall, the US soybean processing industry has rebounded sharply this winter. The latest US National Processor (NOPA) report for February revealed a 166.3 million bu. crush, up 11.8 million bu. from 2019 and the third monthly record during the last quarter. This year’s second quarter crush will likely be 550.5 million bu, a 21 million rise from last year. Overall, this year’s 1st half crushing level is 14 million bu. larger than last year and a new semi-annual processing record.

Soybean’s 2019/20 export demand has been impacted by the US/China trade negotiations. After a 23% yearly gain during last fall, overseas shipments have slowed, particularly during February as Brazil’s harvest ramped up. Overall, this last quarter’s shipments were 515 million bu, just 4% higher than 2019. To achieve their Phase 1 trade commitments, China needs to sharply pickup their purchases to hit these expanded trade levels with the US.

Given this year’s 20% smaller crop size and 4% rise in soybean quarterly disappearance, 2020’s March 1 stocks are likely to be 2.170 billion bu. This will be down 557 million from last year, but similar to the two years ago. Last fall’s 76 million bu. residual, the smallest level since 2005, suggests this winter’s disappearance may increase by 20 million bushels to 96 million as beans move into the seed companies stocks which is outside of the normal commercial channels.

What’s Ahead: The USDA’s March 1 soybean stocks will be the first check if 2019’s crop size is on target. This quarter’s residual & June’s quarterly stocks will determine if this is needed. 2020’s planting intentions might get more market attention, but Covid-19 & Chinese pricing could be bigger price factors. Up old-crop sales 10% at $8.78-83 & another 10% at $8.95-$9.05 & begin 2020 sales at 10% at Nov’s $8.90.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more