Silver Prices, FOMC, Options Expiry And The Reddit Phenomena

Introduction

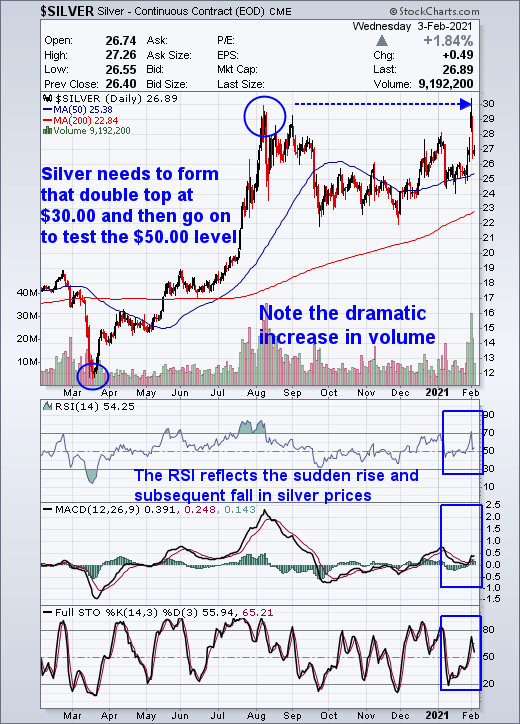

Silver prices have experienced a period of the volatility of late so today we will take a quick look at the possible reasons that could be driving such activity. Starting with the chart below of silver progress we can see that since the advent of the Covid-19 Virus which hit all sectors of the market, as well as causing a sell-off in the silver space. However, since then silver has made erratic progress characterized by numerous oscillations in price movement for a myriad of different reasons.

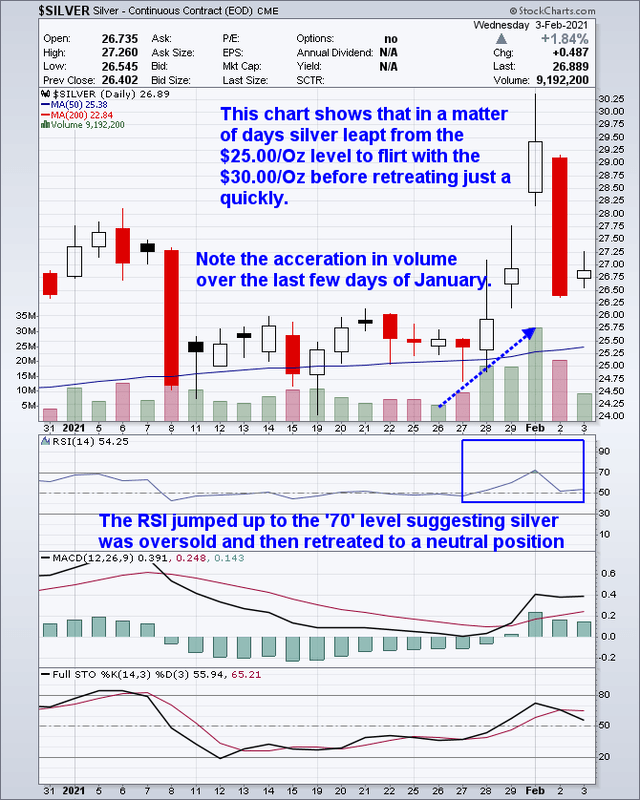

If we now zoom in and focus on the activity so far this year we can see that those oscillations have been dramatic to say the least.

The RSI jumped up to the '70' level suggesting silver was oversold and then retreated to a neutral position.

Possible Reasons For Silvers Erratic Behavior

There could be a myriad of explanations behind such a move by silver, however, we believe the main influencers to be as follows; the FOMC, Options expiry, and the 'Reddit' effect.

The Federal Reserve held their two-day monthly meeting at the end of January and more or less concluded that Quantitative Easing would continue, and interest rates would remain low for the immediate future. This means that the creation of Fiat money out of thin will continue thus eventually diluting the value of the US Dollar, stimulating the search for hard assets in the process.

The options Expiry time is usually a difficult time for silver and gold as any rise in the price would result in considerable losses for the issuer, so it is not in their interest to have silver rallying to higher ground.

The Reddit Effect is a new phenomenon to occur in the silver space. This group of investors has very successfully been able to reverse the fortunes of publicly quoted companies with their sheer determination and collective financial muscle as witnessed by the recent events surrounding GameStop Corp. (NYSE: GME) This stock was being short sold and the Reddit members were able to utilize their buying power to drive the stock price up by many multiples of its price in a matter of days, causing many of the shorters to cover their positions by entering the market of the buy-side. There was some discussion on the Reddit website regarding the short position on silver and on some of the silver stocks. Now I do not know how many of the Reddit members decided to get involved on the buy side, but the conversation was enough to light a fire under silver and most of the stocks driving them both higher in short order. Since then, prices have eased, however, the takeaway is that Reddit is a force to be reckoned with and their pockets may well be the deepest in any trading strategy they choose to get involved with. If they do decide to pile into silver with some gusto then the shorters could well be driven out and we may experience true price discovery and that would be a welcome change.

Conclusion

Reddit is a new entry into the precious metals space and should not be ignored.

This is a Bull Market for silver and the shorters have had a broadside and may think long and hard before exposing themselves to any great extent.

Physical silver is an investment, silver stocks are speculation, but they do offer leverage to silver so both should be acquired.

Supply and demand are very important factors too, but they will be the subject of another article.

Disclosure: I am/we are long KL WPM SSRM SAND. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from SA). I have no business ...

more