Silver Leading The Way Up

Summary

- You can only suppress the intrinsic value of an asset for so long. The pressure builds up. Gold and silver are reaching the point where they are about to explode.

- We are running out of silver supplies, especially for industrial uses.

- Gold and silver prices are being shorted by hedge funds on the paper market many times over the size of the physical market.

- Given the massive short position in the silver market, the Reddit crowd appears to be testing the new lows and getting on the long side of silver against the short sellers.

Fundamentals

We are still having issues with unemployment. U.S. economic data, which was supportive for gold yet negative for industrial metals demand and silver prices, included the unexpected +13,000 increase in U.S. weekly initial unemployment claims to a four-week high of 861,000, showing a weaker labor market than expectations of a decline to 773,000.

The stock market (E-mini S&P) is coming from a high of 3959.25 at the weekly average. We are at about 3897. Trading below 3897 will activate the weekly Variable Changing Price Momentum Indicator (VC PMI) levels of 3859 to 3839.

Fundamentally, gold and silver should be much higher. Since the start of the year with the new US administration, we have heard stimulus talk. But we only saw one package and it has not yet made an impact. Unemployment is still high and the 10-year note, which is the short end of the yield market, is starting to increase.

Gold traders see the relationship as bearish for gold. This is new territory. We have never had negative interest rates, if you take inflation into account. Europe is lowering interest rates as low as possible. The Commitment of Traders report shows that there is a large number of positions shorting gold and silver.

All of the stimulus is, in the long run, inflationary, which we already are seeing in grains and other commodities. Soybeans are at $14.36. Wheat is at $6.93. This is just the beginning. Main Street has yet to be affected by the increase in prices in the food sector. Crude oil is at $60 a barrel, up from minus $37 just last year. We are up more than $90 a barrel from the lows. Therefore, there is an anomaly between the physical and paper markets in gold and silver.

This is similar to what happened in March 2020 when gold imploded from $1700 to $1450 in about 30 days. The Fed then announced that they would provide unlimited amounts of quantitative easing. They allocated 10% of GDP for such efforts. The market discounted this and assumed that all of the stimulus would be highly inflationary for the US dollar.

We have been exporting inflation to the world since 1971, when we went off the gold standard. This rally that we saw in gold anticipated the potential damage that we are going to see. We are seeing an ongoing battle between the US dollar and gold. Since 1971, gold saw $2089 traded from $35 an ounce, which was the benchmark price back to Roosevelt.

Since 1971, the US dollar has collapsed more than 90% in value against gold. Gold hit $1900 in 2011 and since then paper short selling has kept gold down in price, which props up the US dollar. The Commitment of Traders reports have shown how those shorting the market have written more than 10 times the short paper contracts than are available in the physical market.

Gold and silver are reaching the point where they are about to explode. We are running out of silver supplies, especially for industrial uses. In March, we were low on supplies and the physical market included about a $80 premium for gold and silver over the paper price. In the past, the futures market led the way in price. The physical market is headquartered in London, while the paper market is in New York (COMEX). The Commitment of Traders shows that there are still massive short paper positions in precious metals, in excess of $38 billion, which has kept the price down.

The current environment is similar to the 1970's, when we saw interest rates hit 14% and gold rallied from $130 up to $800 or $900 in 1981. Interest rates can go up as high as the price of gold in an inflationary environment, which is where we are heading. Food and energy, if added to inflation rates, means that inflation is already running at about 10%. The Fed argues that such an effect will be temporary. The government does not include food and energy prices in their inflation rate, which is a way to hide the real inflation rate.

Not counting soybeans means that you are not counting a commodity that drives the food industry, while not counting crude oil is ridiculous, given oil’s role in the economy. On top of inflation, we have massive unemployment. These are not normal conditions. This environment is heading toward a massive reversion in precious metals to new all-time highs.

Gold

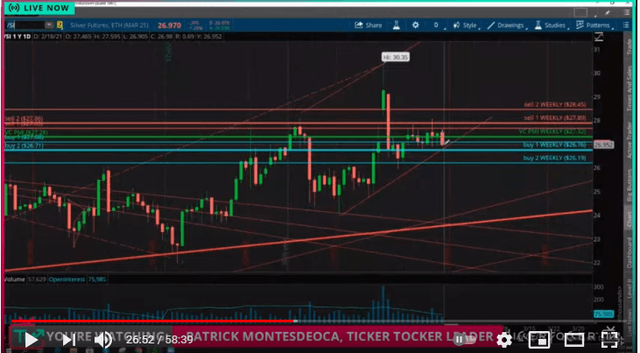

Image Courtesy of Ticker Tocker

In gold, we have been trading above the average monthly price. The daily and the annual average price are at about $1779. That is right into the VC PMI Buy 1 monthly of $1781 and the daily average of $1779. This area of $1779-$1780 is a critical area, which represents what the VC PMI calls a harmonic relationship between different cyclical trends (daily, weekly, monthly, and annual).

Recently, the market came down in a 50% Fibonacci retracement. The low tested the 2020 lows. The market is at a critical pivot point related to the Fibonacci retracement, which is heading into the Buy trigger point of $1763. We have been in a liquidating market since the market high was made at $2089 in August 2020.

Gold and silver prices are being shorted on the paper market in huge amounts, which keeps their price down. The market is testing the November lows of $1767.20. We appear to be within a few dollars of the bottom in silver and gold. A close above $1781 in gold, would activate a buy trigger. Being in the $1760 range serves as the daily buy signal. If gold goes above $1780, it would bring in the daily, weekly, and monthly signals.

Given the massive short position in the silver market, the Reddit crowd appears to be testing the new lows and getting on the long side of silver against the short sellers on Wall Street. It's just a matter of time before we see the tremendous strength of these new buyers. For silver, a close above $27.08 will activate a day buy trigger. For conservative traders, you can use $27.08 as a protective stop, while aggressive traders can use a maximum dollar stop based on the amount you can afford to lose. The third option is to get out at the end of the day.

Silver

Silver is showing us that all of the sentiment that drove the price down has reached a point where buyers are likely to come into the market. The daily Buy 2 level is at $26.71 and the weekly is at $22.76, which provides a harmonic relationship between the different time cycles. In this area, do not sell.

Look for a washout to $26.71, where a reversion is likely to occur or a close above $27.08. There's a 90% to 95% probability that buyers will come into the market at these levels. You can day trade based on these levels or add to your long-term position.

Gold also is in an area with a high probability of a reversion back up. Do not go short. The probabilities are that the market is going to revert, not continue down. It may continue down, but it's far from likely.

Expect the volatility in gold and silver to continue as the tug-o'-war between the short sellers and the unexpected demand continues. The demand is from the Reddit crowd, but because of them, the whole world is focused on metals, so others are also coming into the market. The increasing demand for silver is really putting the short positions are risk. The London exchange has hardly any physical availability.

If the paper market gets even more out of whack with what is in the physical market, they may stop selling cash. Majestic Silver (AG) did that last year. It did not matter what the paper price was, because that was not the real price. We are running out of supplies. The only place to go was the futures market. The short side of the market is afraid of such a thing happening. We are looking at any time for gold and silver to hit the VC PMI buy triggers.

Disclosure: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned ...

more