Silver Is Moving Up

Silver is moving up. But when? We have been hearing that silver is "soon to explode" for over a year now. Obviously, no one has a crystal ball. And hence, no one really knows. Everybody involved in the silver market is asking: when? Patience is stretched and a lot of doubt has been creeping in as many investors have begun questioning whether the whole silver idea is correct.

Psychology is the most crucial aspect of trading. One needs to reevaluate at least once a week for the larger time frame plays of one’s thesis, and most of all, the probability of success for one’s game plan. Only then does one stay ahead of the game and remains ready to push the button if and when action is required.

So, what are the facts?

Monthly Chart - Silver in US Dollars: Probabilities

Silver in US dollars, monthly chart as of Dec. 10, 2021.

In 2020, silver broke a multiyear sideways range and moved strongly up. It has now consolidated for over a year in a sideways range again. This is a bullish setup.

As much as emotions might be weary, a general rule is that the longer a congestion is from a time perspective, the more significant the subsequent breakout from that range will be. Statistical probabilities are also clearly pointing to the upside rather than returning into the prior range.

Not to forget, buying near the lows of such a range guarantees the lowest entry risk and highest risk/reward-ratio play to be taken for the long side, even if emotions might tell you otherwise.

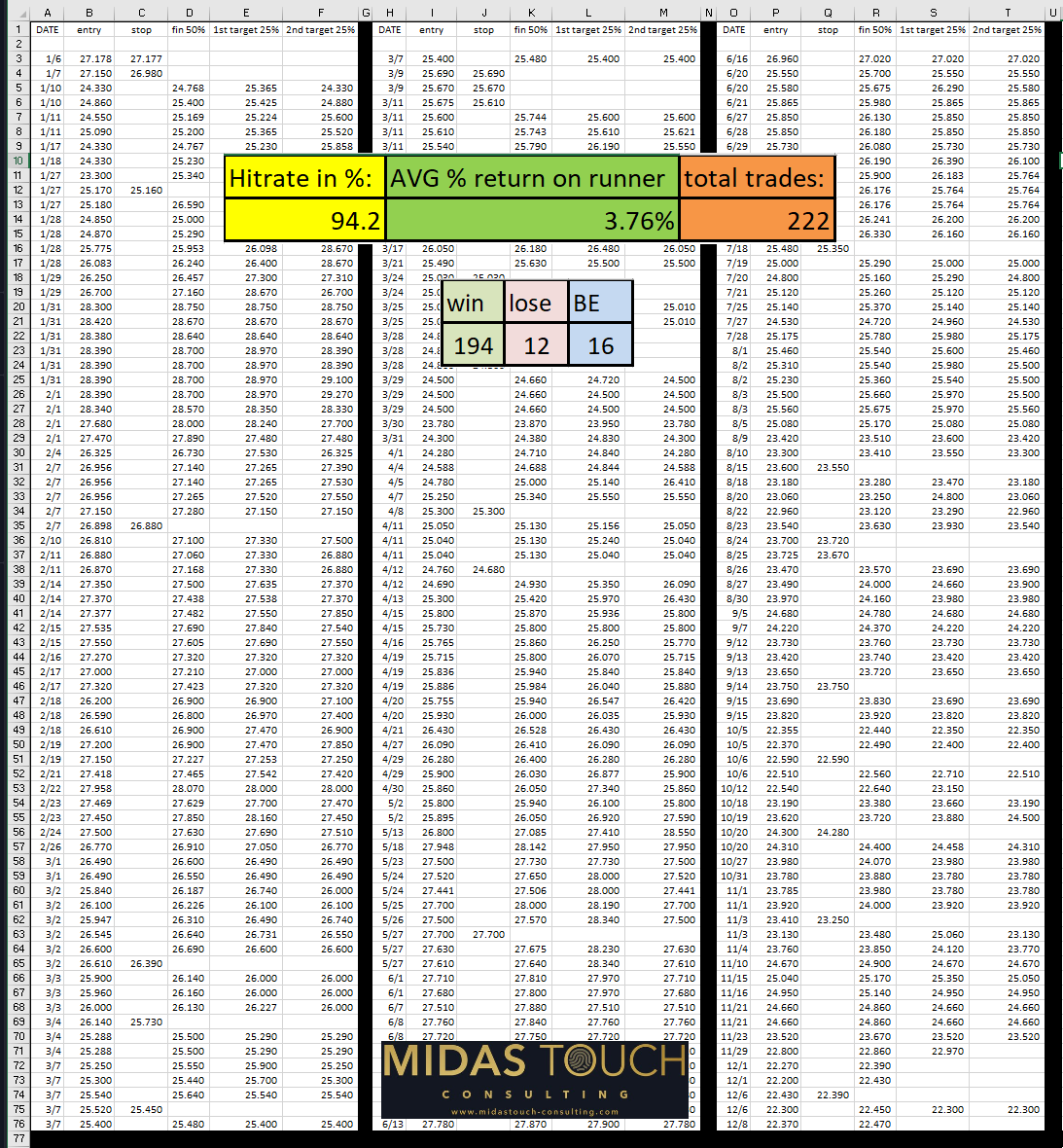

2021 Silver Trade Performance

Another fact is that one does not need to know when and if a breakout is happening to extract money from the markets consistently.

The above chart is this year’s silver trades that we posted in real-time. The systematic approach illustrated focuses on low-risk entry points with a risk reduction method through our quad exit strategy. Sideways markets may provide an income-producing aspect of one’s trading, and a possible breakout of a range would give a significant bonus.

An approach like this keeps emotions in check since one’s labor gets rewarded and allows for significantly higher rewards once ranges do break.

Quarterly Chart - Silver in US Dollars: Silver is Moving Up

Silver in US dollars, quarterly chart as of Dec. 10, 2021.

In short, while waiting is strenuous and one might feel doubtful, silver is an even likelier success story now than it has been six months ago, or even a year ago.

What should also not be underestimated is the fundamental situation of this wealth preservation play. The extensions of governments playing the inflation game to such length are likely adding fuel to the silver play.

Widespread problems that are the pillars to this insurance play have, if anything, increased. Consequently, they are also supporting a likelihood that silver prices go up. When? Well, that is hard to say since no one knows the future, but maybe this question gets proportionally too much attention since insurance isn’t just bought for the next storm to come but instead acquired to protect one’s wealth for the long-term.

The quarterly chart above shows how silvers inherent volatility can sustain, in times of market turmoil, extended phases of extreme standard deviation levels. Price moves far away from the mean (red line). We are trading near the mean as of now, and the very right green line is a projection of a possible price move up.

Quarterly Chart - S&P 500 in US Dollars

S&P 500 in US dollars, quarterly chart as of Dec. 10, 2021.

Still have some doubt left? Have a look at the S&P 500 chart above which represents the broad market. Does that look like a healthy chart? Baby boomers and general stock-market participants might be in for a rude awakening once they realize how little their fiat currency is still worth when they cash in those stock portfolio investments.

Just compare your total living cost from 2020 with 2021. All positions from food to health insurance, from car gas to electricity bills. Calculate the percentage difference from those two numbers and add this percentage to the average acquisition cost of your physical silver, and you have the real value of your silver already now.

Does this chart represent great times when we face supply chain disruptions? Or is it all smoke and mirrors, and once the music stops, there will be countless chairs missing for everyone to sit down in?

Silver is Moving Up

The essential principle in play is that markets are counter-intuitive, meaning your feelings might have switched from enthusiasm to uncertainty, even frustration, but facts are in direct opposition to one’s feelings.

This principle is the underlying reason why moves out of extended congestion zones can result in substantial moves. Bears step aside and bulls chase prices.

Disclaimer: All published information represents the opinion and analysis of Mr Florian Grummes & his partners, based on data available to him, at the time of writing. Mr. Grummes’s ...

more