Silver: Industrial Demand Holds The Key To The Short Squeeze

Fundamentals

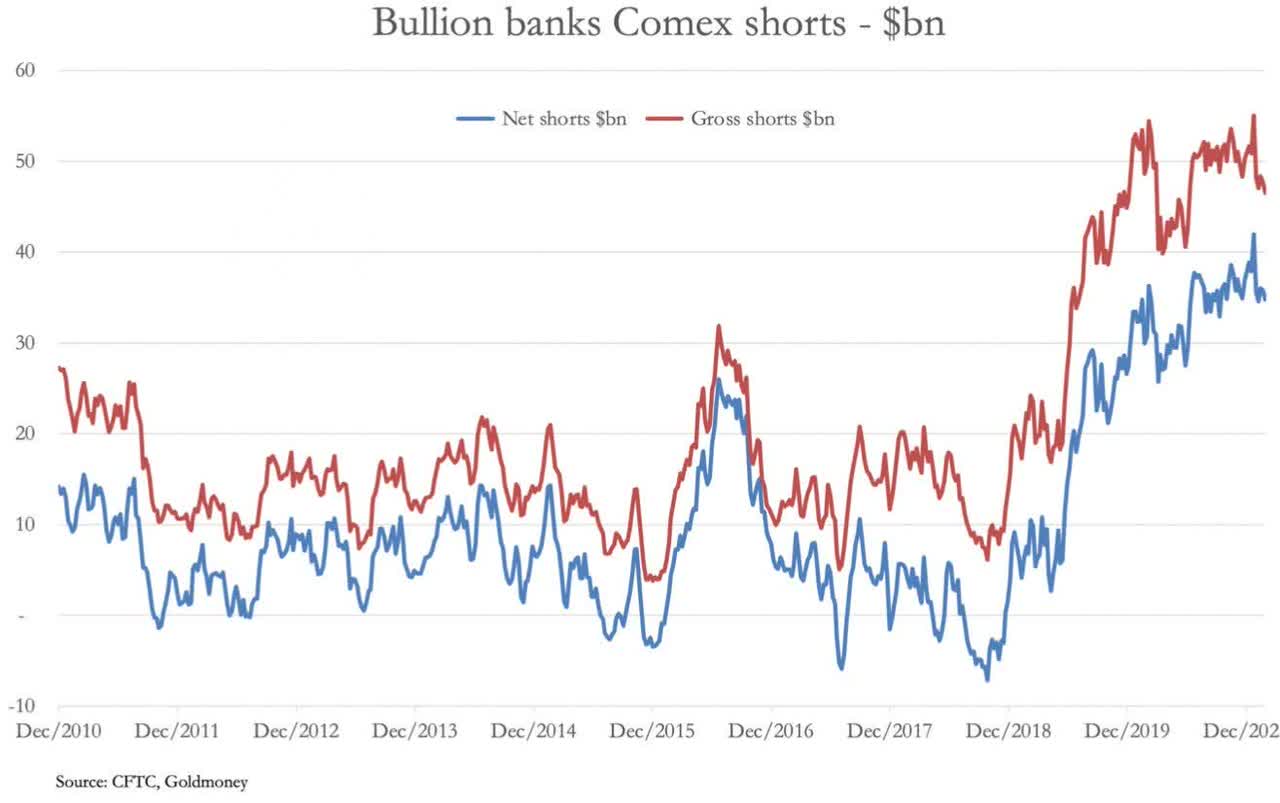

Central banks and hedge funds still have massive short positions in the Comex Exchange, which exceed $38 billion. They have not decreased their shorts. The market will go against these short positions.

(Click on image to enlarge)

There is a shortage of supply of gold and silver, especially for large deliveries. The 1,000-ounce silver bars, which are used for industrial uses, seem to be getting in short supply. The catalyst for this market exploding to the upside is not Reddit or Wall Street Bets, it is that industrial demand might panic and begin to buy everything in sight on the fear that we are running out of metal supplies. The pandemic has destroyed the supply chain as we knew it. Commodity prices are exploding, including grains, crude oil, and metals. They form the roots of inflation, which as we begin to normalize the economy, the velocity of that demand is going to trigger price inflation for consumers. This is similar to the 1970s when we came off the gold standard for the US dollar, which began its devaluation. Inflation ran into double digits through into the 1980s and gold was at over $800oz and the Dow was at 1,000. The stock market is now at 30,000 plus and the gold market has been the victim of this paper manipulation. Gold competes against the integrity of the US dollar as the world reserve Petrodollar. Gold has been artificially depressed in price by central banks and hedge funds using the paper market to short gold futures. Debt is now more than 100% of GDP in many countries, which also makes gold and silver that much more desirable.

Bitcoin is great, and I congratulate those who have done well with it. However, it has a long way to go before it is a currency. It is not for the masses. Investors are looking for an alternative to the US dollar and they are flooding into Bitcoin. At the Equity Management Academy, we believe far more in the long-term value of gold and silver, which have been assets for thousands of years. Bitcoin should probably be a small percentage of your assets, but I don’t think it will change the trust most people have in gold and silver. Any time we have had a monetary collapse or gone to a fiat currency, it has been disastrous and we have gone back to gold. The big question is whether gold will have a role in the future monetary system? Will we go to a gold-backed currency again? It will be interesting to see what happens. Unless the paper currency is backed by some kind of natural resource or precious metal like gold, then the same thing is going to happen over and over again. Governments print more and more money supply and the fiat currency is worth less and less until it is virtually worthless. The IMF is talking about the SDRs potentially as a virtual currency, but they are already doing that to exchange funds between central banks. Are central banks going to introduce a virtual currency? We are at the very beginning of a new monetary system, which still needs to be sorted out. The key is going to be who has the most gold. China, Russia, and Iran have been purchasing record levels of gold. No one knows how much gold China has. These corrections that we get in gold and silver, are contrary to the fundamentals and the overall sentiment of the market, which is extremely bullish long term. Buy the corrections and hold for the long term. It is a critical way to protect your portfolio from the devaluation of the US dollar.

The longer the economy stays shut, the worse the damage. The longer the US government takes to supply critical stimulus, the more harm to the economy. We are going to see some major recalibration of the US and global economy. A lot of jobs need to be created. In 2008, the problem was that all of the quantitative easing went into the central banks to pump up their balance sheets, instead of into small businesses and Main Street to create new jobs. The central banks were supposed to loan back to Main Street, which never happened. Big companies borrowed at 0% interest and bought back their own stocks and made fortunes while main street suffered.

The gold market has a long way to go to adjust to its mean in relation to stocks, crude oil, and debt. If you had a chance to buy this correction in gold, congratulations. Gold is trading the opposite of the sentiment. If you follow the herd, you are going to get slaughtered. That is why we use our Variable Changing Price Momentum Indicator (VC PMI) to trade the market.

Gold and Silver

Gold and silver are volatile today. Silver made $28.07 high overnight, and it reverted to $27.15. We saw a move of about a dollar. Silver is in the limelight because of this short squeeze that Reddit and Wall Street Bets highlighted a few weeks ago. Everyone seems to be anticipating the short squeeze to take place. The market, however, never does the move when you want it or it’s convenient for you.

The fundamentals for gold and silver are extremely bullish. There is a shortage of physical silver and gold supply. One of the mints is running out of supplies.

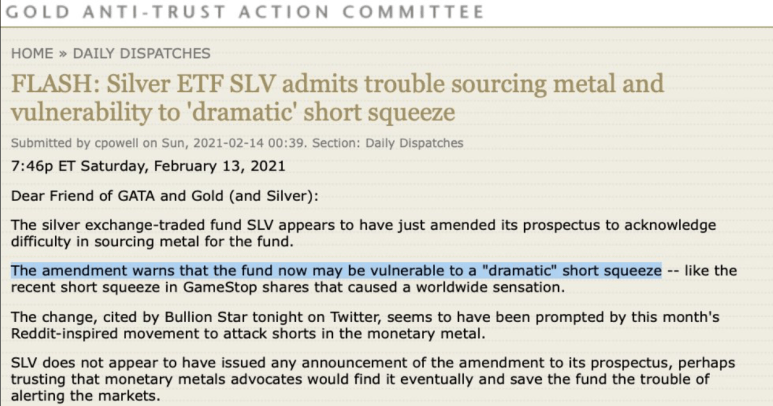

(Click on image to enlarge)

Over the weekend, on the 13th, the SLV, silver ETF, admitted trouble sourcing metals and was vulnerable to a short squeeze. SLV just amended its prospectus in stating that it was having difficulty sourcing metal for the fund. This seems to be triggered by the Reddit movement to attack shorts in various markets, including silver. Regardless of the fundamentals, the market will do what it needs to do technically.

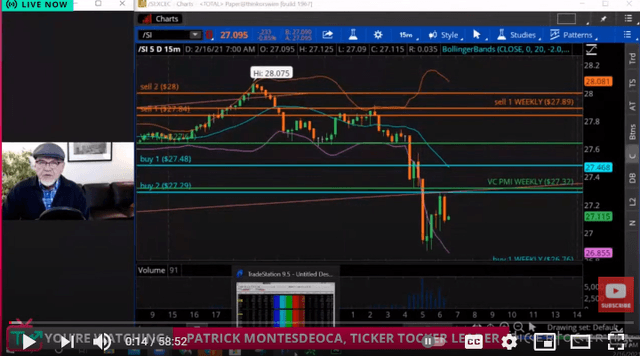

(Click on image to enlarge)

Silver came into the area where our Variable Changing Price Momentum Indicator (VC PMI) said to take profits around $28.07. We then reverted back to the mean, almost to the weekly Buy 1 level of $26.76. It broke the daily support levels of $27.48.

After the stop losses are taken out and the nervous Nellies get out of the market or are stopped out, we are looking for the market to close above $27.32, which activates the VC PMI Buy 2 level of $27.29. The mean is $27.64, which becomes the target if $27.29 is activated. There is a 95% chance that if $27.29 is activated, then the market will reach the mean of $27.64. If it closes above $27.32, then it is a daily confirmation of a buy trigger. This is not a guarantee, but it is highly likely because the price has reached an extreme level on the daily.

The fundamentals are saying that we are running out of supplies, yet the market ran up and then came down more than a dollar during one trading session. This represents a record level of volatility. Such moves are becoming common.

If we close above $27.32, it will activate a bullish weekly price momentum and a buy trigger. The targets above remain in place. The VC PMI identifies the entry point for you to make the highest probability trades. Now we have bearish sentiment which is making traders nervous wondering what has happened. They are getting stopped out and are very confused. That is why we use the VC PMI to tell us where the market is likely to go.

Silver activated a buy signal. It is leading the way; it is the canary in the gold mine. Gold will follow.

Gold

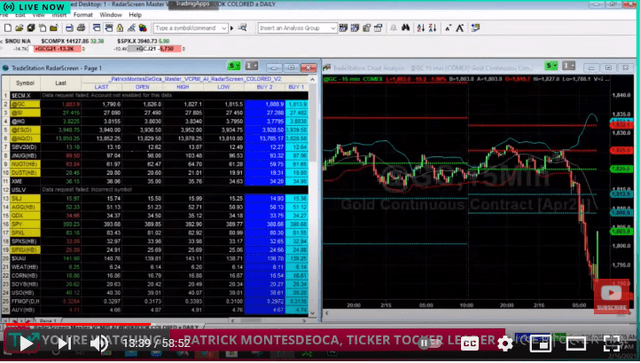

Courtesy: Ticker Tocker

Gold is doing the same thing. We are seeing a reversion. If it closes above $1801, it is going to activate a buy trigger. Now we have a fast market to the upside. A major reversion is unfolding. It is back up to $1807. It is a tremendous buying opportunity on this reversion. The VC PMI gave us the area where that reversion was going to occur.

If we go above $1810, which is the yearly average, then gold will take off. There is a harmonic convergence around that level, so if we go through $1810, we will see the market accelerate on the way up with the target of the monthly level of $1874. We are seeing major buying. Hold onto your longs and, if you held on to them, congratulations.

It looks like $1788 could be the bottom of the market for the spring rally. The VC PMI told us that the bottom was going to be around $1788, which the market then validated. We have an annual bullish price momentum according to the VC PMI and we are looking at $2164, the annual average, as the long-term target. The near-term target is $1874. If you have short positions, we recommended you cover them as we moved all the way down. This could be a major reversal to the upside. Relentless demand is coming into the cash market to counteract the massive short selling in the paper market. The weekly buy signal at $1801 and the weekly and annual buy signals have all been activated, which signals a major change in the trend momentum is unfolding.

Other Commodities

Copper also appears to be ready to roar up. Across the board, commodities are seeing major shifts in price. Inflation is entering the system. The key is whether the Fed will raise interest rates, which they probably can’t do given the record levels of debt. It appears likely that the Fed will let inflation run and cap long-term interest rates in an attempt to curb inflation.

The precious metals offer a tremendous buying opportunity during corrections. The long-term trend for precious metals, as well as almost every commodity, is extremely bullish. Supply chains are stressed, leading to shortages, and the massive printing of money is devaluing the dollar, which will lead to inflation and a rise in the price of all commodities. Buy corrections and hold for the long term. The gold and silver markets are oversold and undervalued on the daily, weekly, monthly and annual averages. Accumulate gold and silver.

Disclosure: I am/we are long SILJ.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold, and silver, check us out on more