Silver Forecast: Markets Likely To Pull Back To Look For Buyers

While we have seen a nice resurgence in industrial companies in the stock market, the reality is that the industrial situation around the world is going to be very tenuous at best. It is because of this that I believe silver continues to lag in underperform the gold market, so having said that I think that the silver market may go down to the $15 level to find buyers.

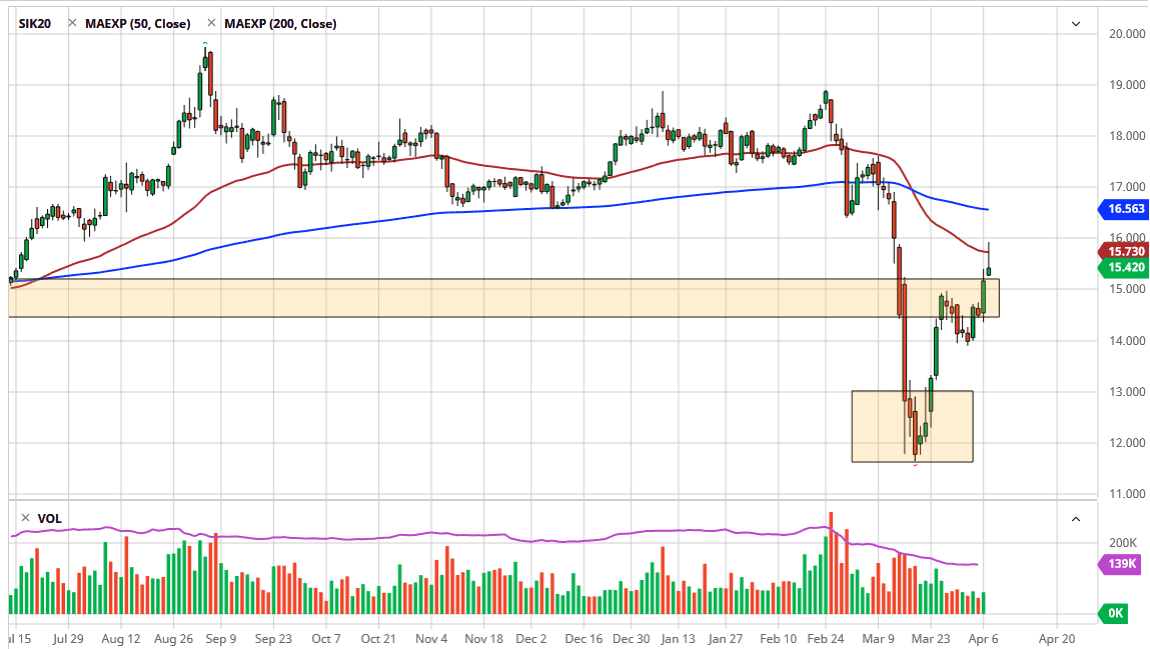

Silver markets have rallied significantly during the trading session on Tuesday but gave back those gains rather drastically. The market initially tried to break above the $16 level but failed. It also struggled with the idea of the 50 day EMA and therefore if you doubt forming a bit of a shooting star. The shooting star, of course, is a very negative candlestick, so I think that we could very well see the silver market roll over a bit here.

Over markets are highly sensitive to not only the aspect of the precious metals of the metal but also the idea that it is an industrial metal. While we have seen a nice resurgence in industrial companies in the stock market, the reality is that the industrial situation around the world is going to be very tenuous at best. It is because of this that I believe silver continues to lag in underperform the gold market, so having said that I think that the silver market may go down to the $15 level to find buyers. That’s an area that should be important due to the fact that it is a large, round, psychologically significant figure and an area that probably causes a lot of interest in this market.

The alternate scenario is that we break above the top of the shooting star which is a very bullish sign. I don’t necessarily think that will happen right away, but it is always a possibility. I believe that the market is probably going to need to pull back a bit in order to find some value hunters and buyers looking to get involved to the upside that may have missed the initial move. The $14 level looks to be massive support right now and I am essentially thinking of this as my “floor” in this market. If we were to break down below there, then I think the $13 level could be supportive as well, but I also recognize that a move below the $14 level could shake a lot of the confidence in the silver market.

Based upon the bullish flag that we have broken out of that happened during the Monday session, we should, in theory at least, go looking towards the $17.50 level or so. That’s obviously a longer-term move, as there is a serious lack of industrial demand for silver and other raw materials that are so sensitive to industry.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more