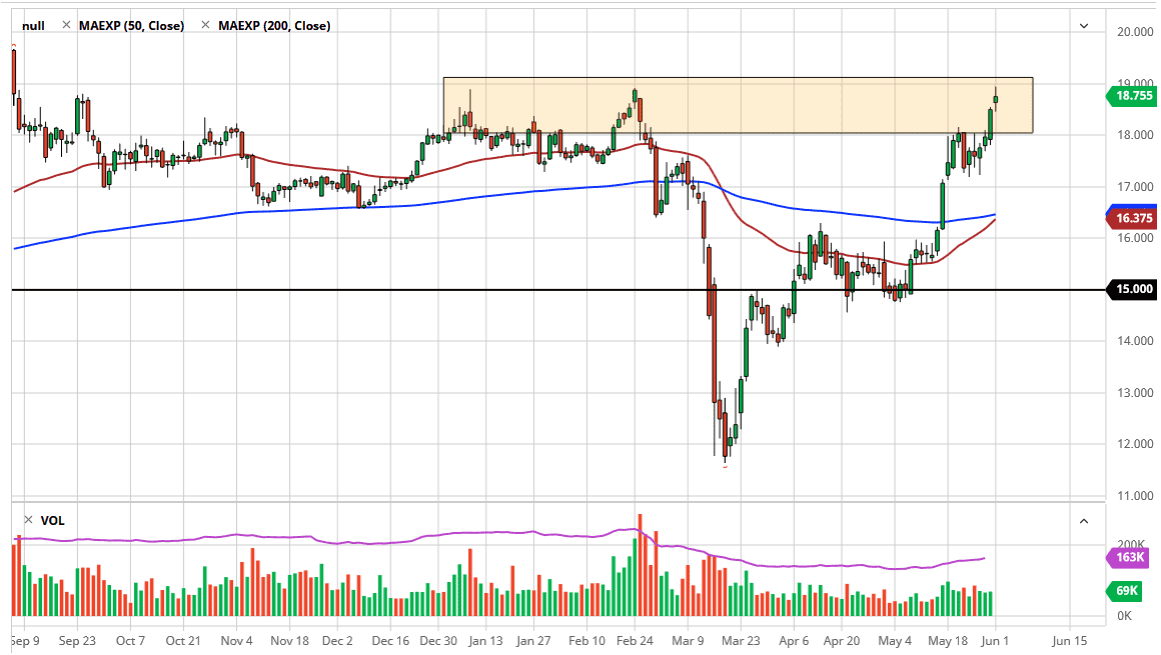

Silver Forecast: Markets Continue To Grind Towards Resistance

Silver markets have gapped slightly during the open on Monday, only to turn around and fall, and then rally again before giving up even more. Ultimately, this ended up forming a relatively neutral candlestick, so I do think that it is only a matter of time before we get a little heftier pullback. At this point, the $18 level makes quite a bit of sense for an initial target for sellers, as it was the previous resistance. Remember, the “market memory” will come into play, as it is likely to see a lot of people paying attention to that level on the chart.

If we do break down below the $18.00 level, then it is likely that the market could go down to the $17.25 level which had previously offer quite a bit of support. We are getting ready to have the “golden cross” form when the 50 day EMA starts to break above the 200 day EMA, and that of course is something that a lot of longer-term traders get excited about. The reality though is that it is likely the market is going to pull back somewhat significantly from the area we are in, due to the fact that the $19 level has offered so much resistance in the past. Furthermore, the “golden cross” and the “death cross” (the exact opposite) are quite often signals that are extremely late, and for the most part pointless.

If we can break down below the $17.20 level, then I anticipate that the market probably goes looking towards the blue 200 day EMA on the chart. At this point, I believe that the market is getting a bit of her stretched, so at the very least it would make quite a bit of sense that we pull back to find a bit of momentum if nothing else. If we were to break above the $19 level though, it is likely that we could then go looking towards the $20 level, which is a major psychological level that of course will attract a lot of attention. That being said, I think it is going to take some work in order to break out above there so I would not be looking for that anytime soon. Look for value, and then take advantage of it at lower levels is probably going to be the best way to trade the silver market.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more