Silver Chartbook – Target Accuracy Versus Support And Resistance Stops

Silver is trading sideways. Time to evaluate stops and targets. When the mind is overwhelmed due to data overload or too many variables in a probable outcome, it likes to simplify. In its extreme, it resorts to intuitive responses like fight-flight. What is overwhelm? In most cases, it is an emotional response to an unsolved problem. For trading, this means a data stream evaluation that accumulates to too many questions and results in a desire for simplicity. In the case of exits, most beginning and intermediate traders resort to a support and resistance stop. But that is a very simple way to get taken out of the market. Target accuracy versus support and resistance stops.

It is foolish to find a rigid module like a line in the sand (a single price level) in a game with a high degree of variables. Variables that are in constant flux in a dynamic model. Driven by collective psychology, even irrational at times. It would be best if you had real likelihoods based on movement in price, volume, and time (at a minimum).

If you learn how to drive a car, the dynamics aren’t just pushing the various pedals at the appropriate time. After years of experience, you find the deciding value of surviving this game to be all surrounding factors. For example, slowing down when you see children playing near the street or in heavy rain on the freeway. You create more distance between the car in front of you if its driver is swerving and you suspect a drunk driver. You can feel if something is wrong, but it isn’t an intuitive response due to feeling overwhelmed. It is a subconscious filled with many rules that you have over time hip pocketed that in their sum alarm you to slow down or even stop.

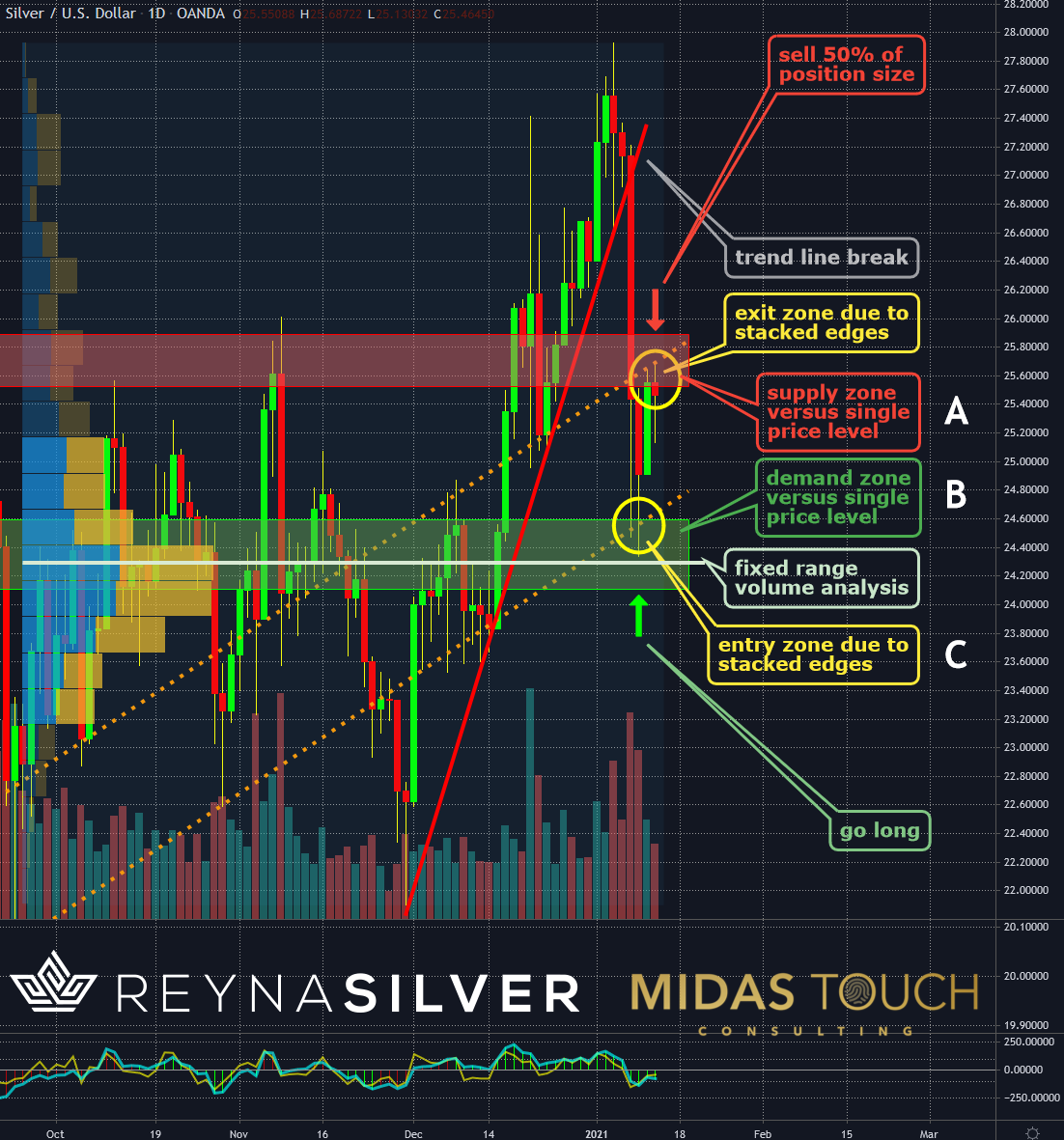

Silver, Daily Chart, Stacking Odds:

(Click on image to enlarge)

Silver in US Dollar, daily chart as of January 13th, 2021.

A traffic route needs readjustments in the event of a new force affecting traffic. Trading targets are affected by real-time factors, as well. Aspects like new data releases, momentum, volume, and price behavior as a whole. This, in alignment with the time component, weakens a static approach that tries to insist on a simple number of a support resistance price level. To get to a more accurate probability prediction, one needs first to widen a single target number to a target zone (A, B). A zone that is more in alignment with a distribution zone based on prior fractals.

Most importantly, look at the way of how prices move towards such zones. An action-reaction principle comes into play if prices moved fast towards a distribution zone (C). In turn, this increases the likelihood of a bounce. On the other side of the spectrum, a slow directional creep of prices much more easily can penetrate a support/resistance price zone.

Silver, Weekly Chart, Exit management:

(Click on image to enlarge)

Silver in US Dollar, weekly chart as of January 13th, 2021.

Proper exit management requires a similar complex strategy mixed of experience and a clearly defined approach of targets versus a flawed system of a support and resistance trailing stop.

In the weekly chart above, you can see an example of how targets and stop levels change throughout time. Directional support resistance lines update with each candle printing. Standard deviation bands, which work great for the Silver market, are moving along with price behavior. They also work as flexible target and stop levels.

Silver, Monthly Chart, Target accuracy versus support, and resistance stops:

(Click on image to enlarge)

Silver in US Dollar, monthly chart as of January 14th, 2021.

Right now, Silver is trading sideways. It is important to know when to get out with our established positions. We post those in real-time in our free Telegram channel.

Entries are exits, and exits are entries. In principle, your entry system can be applied for your partial profit-taking as well. It is futile to try to pick tops and bottoms; resorting to an inadequate support resistance approach isn’t a lucrative solution.

You want to stack odds in your favor. Also, a core element is a multi exit approach. It provides choices widening one’s possibility to catch larger moves (see our quad exit strategy). Certainly, counter signals at the same time frame are an excellent way to take some profits off the table.

When prices trade in regions that it has traded in before, you might consider tools like fractal analysis, linear regression channels (A), and fixed range volume analysis (B). These, amongst others, to identify high probability supply and demand distribution zones.

Should prices trade at all-time highs, the main focus needs to be on momentum analysis, counter signals on the same and higher time frames as the entry and signal time frame, and tools like Fibonacci extensions. Volume analysis is a precious component to determine where it is wise to lighten up the load. Novices predict price level. For instance, an analysis where one expects a high probability in time when price changes direction, is more valuable in opposition to a fixed price zone.

Target accuracy versus support and resistance stops

Exits are the holy grail of trading. In alignment with risk control, they determine the level of profitability. For most, it is here where the rubber meets the road. Above all, exits are the deciding factor if a system is consistent (winning) or an endless string of losers. Here, an advanced system approach that takes many analysis factors into account brings actual value to your trading results.

Targets are changing quite substantially through time. The market is in motion, and as such, forces in play need constant reevaluation to be genuinely accurate in their probabilities. Just like driving a car, you can’t just expect to reach your destination each time to work the same way. It would be best if you considered all factors. From the health of the driver to the mechanical condition of the car. From traffic and weather conditions to any unexpected influencing factors of each ride.

Disclaimer: All published information represents the opinion and analysis of Mr Florian Grummes & his partners, based on data available to him, at the time of writing. Mr. Grummes’s ...

more