Silver Blindness

Snow blindness. First, all you see is snow, and then you can't see anything else. Your corneas get fried by overexposure to UV light. Looking at the top bar of a popular investing site as I type this, all I see is silver: Silver is about to rip people's faces off. It's just a question of when. The big bluff in silver. If all you see is silver, what are you being blind to? There's a benefit to being agnostic about precious metals, as I'll illustrate below.

Agnostic Security Selection

If you're in the business of selling precious metals, you're probably always going to be bullish on them. If you're a follower of Ludwig von Mises, or another hard money advocate, you're probably always going to be bullish on gold and silver as well. Our system starts out agnostic about precious metals and every other asset class, including stocks. Its universe includes every stock, ETF, and ETN with options traded on it in the U.S. Every trading day, it analyzes each of them based on their past total returns and options market sentiment. Sometimes it's bullish on precious metals names, as it was with SLV last Thursday (Silver: This Is Awkward). Sometimes it's not. At the end of last year, it was bullish on silver, with SLV its #1 name. But a hedged portfolio we presented here at the time didn't include SLV. Let's look at why, and what's happened since.

Our Top Names On New Year's Eve

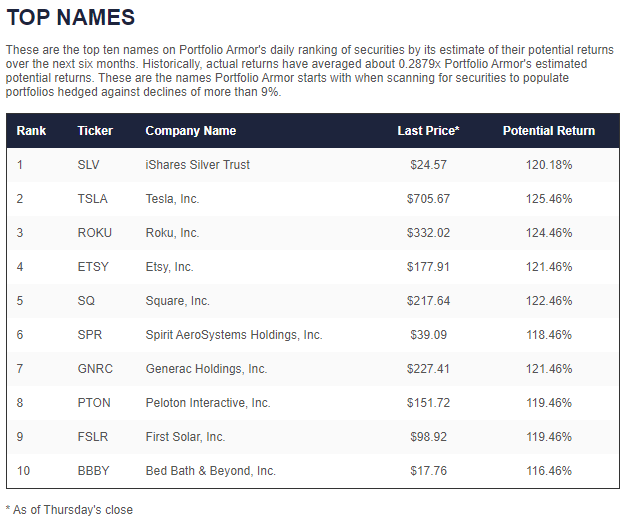

After analyzing every security each trading day, our system ranks them by their potential returns over the next six months, net of hedging costs. These were our top ten names on 12/31/2020.

Screen capture via Portfolio Armor on 12/31/2020.

As you can see, SLV was our top-ranked name there. Our potential return estimates there are all in the triple digits; as the screen capture notes, actual returns as of that date had averaged about 0.29x our potential return estimates. Potential returns are bullish estimates we use as a guide to where to try to cap upside when hedging.

Performance Of Those Top Names So Far

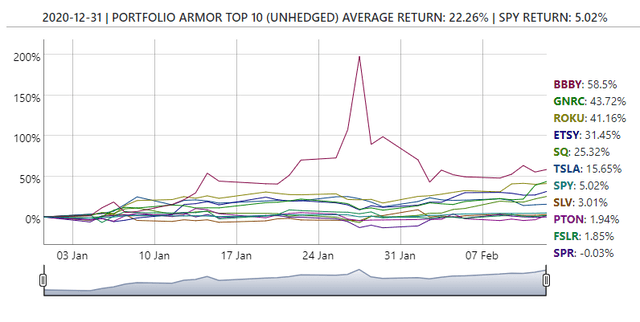

Here's how those top names have performed versus SPY since.

The big spike in that chart is Bed Bath & Beyond (BBBY), which became part of the Meme Stock Uprising in January.

Meme via the Portfolio Armor art department.

The Hedged Portfolio We Presented Then

Our New Year's post is archived on some sites now, but you can find another version of it here: New Year, State Of Fear. In it, we wrote about using the hedged portfolio method to navigate a state of fear and uncertainty.

Investing In A State Of Fear

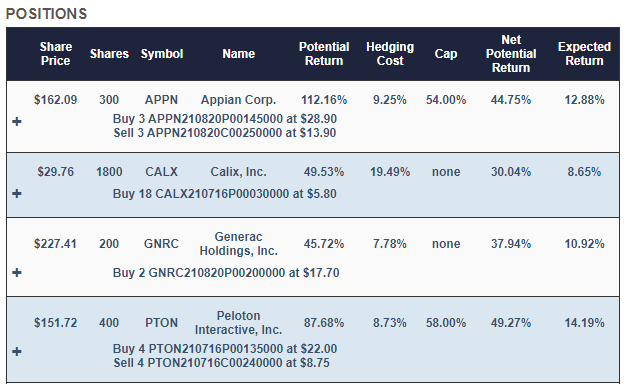

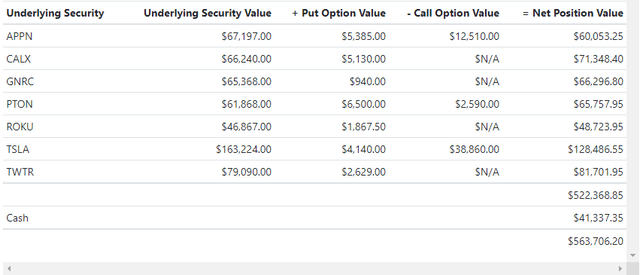

Our approach to investing in a state of fear is to buy likely winners and hedge away the fear. Here's an example, followed by an explanation. Let's say that you have $500,000 in cash you want to put to work in 2021, but you aren't willing to risk a drawdown of more than 20%. If you indicated that in our hedged portfolio construction tool on New Year's Eve, this is the portfolio it would have presented to you.

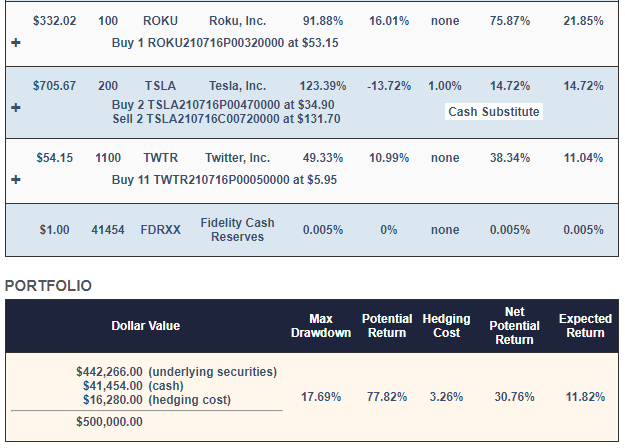

With this, your maximum drawdown over the next six months - that is, if every underlying security went to zero - would be a decline of 17.69%. Your best case scenario would be a gain of about 31%, and your expected return (a more likely scenario) would be a gain of about 12%.

Why These Names?

Appian (APPN), Calix (CALX), Generac (GNRC), Peloton (PTON), Roku (ROKU), and Twitter (TWTR) were selected because they were among our top names - the ones that had the highest potential returns, net of hedging costs, when hedging against a >20% decline. SLV was our top name overall then, but our overall ranking is based on hedging against >9% declines, so this portfolio ended up without silver or any other precious metals exposure. Our system started with roughly equal dollar amounts of each, and then rounded them down to round lots, to reduce hedging costs. It swept up most of the leftover cash from the rounding-down process into a tightly hedged Tesla (TSLA) position, to further reduce hedging cost.

Why These Hedges?

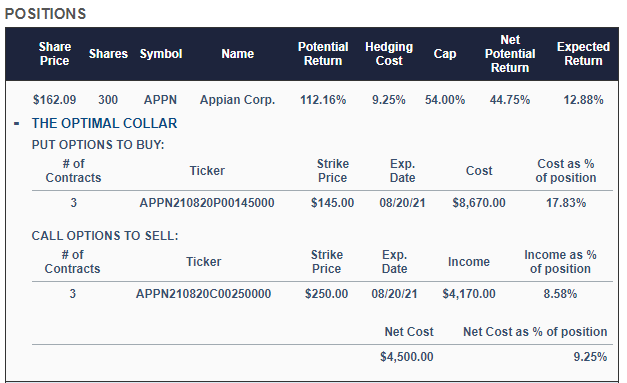

On our website, if you click the plus signs in the portflio above, the positions expand to give you a better look at the hedges. For example, this is what the APPN position looked like expanded.

As you can see, APPN was hedged with an optimal, or least expensive, collar. Some of the other positions are hedged with optimal puts. Our system estimates returns both ways to determine which type of hedge is best. We elaborated on that process in a recent post: When To Hedge With Puts Versus Collars.

How That Silver-Free Portfolio Has Done So far

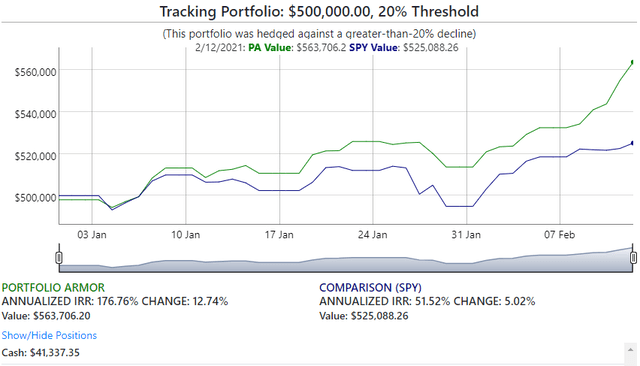

Here's the performance so far of that hedged portfolio as of Friday's close, net of hedging and trading costs.

As of Friday, that hedged portfolio was up 12.74% (slightly exceeding the expected return of 11.82% we estimated for it ahead of time) while SPY was up 5.02%.

That portfolio's performance was driven largely by Generac Holdings (GNRC) and Roku (ROKU). Had it included the silver ETF SLV instead of one of those names, it would have done worse.

What's the ROKU or GNRC of today that you're not seeing because of silver blindness?