Sentiment May Be Bullish, But Weakening Fundamentals Mark The Turn

The divergence between the stock market and the underlying economy has gotten ridiculous. While most of the productive economic indicators are falling, the stock market keeps rallying after each correction. The market does not pay attention to fundamentals anymore and is largely driven by popular opinion, aka sentiment.

The schizophrenic stock market is primarily driven by two major supporting factors: resumption of Fed monetary easing and the completion of a trade deal between China and the US.

The problem now is that neither is likely to happen in the short run. I do think the Fed will eventually be forced to resume QE-type policies in an attempt to stave off a deflationary recession. But I don’t think China is going to agree to what the US considers a fair trade deal anytime in the near future.

Trade Wars Have Casualties Too

The latest on the trade front has China reneging on verbal agreements on trade by changing key provisions during review of the written documents. The result of this action by China caused Trump to implement billions more of tariffs on Chinese goods.

China has responded by increasing tariffs on US goods into China. The reality is that China has historically had higher tariff rates on US goods, but the additional trade pressure will slow down the ability of US companies to do business in China.

The trade war has only escalated after recent talks. There is a business and a cultural reason for China’s actions. China does not respond well to the blustery dialogue Trump is famous for using in his US real estate dealings. They are a culture that requires mutual respect, and not excessive use of threats when completing negotiations. Trump’s approach has backfired in these negotiations. However, the current administration is not fully to blame for China’s about-face in negotiations, which is much too simplistic of an explanation.

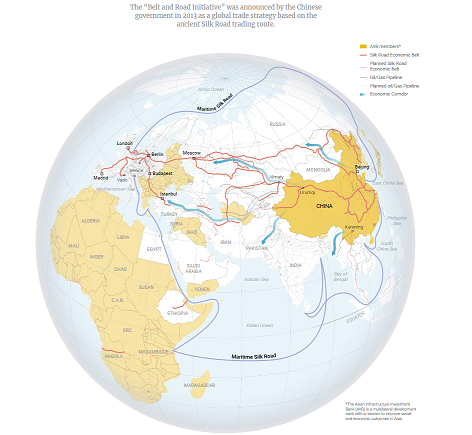

China needs US dollars from trade to finance their industrial sector. China is at the same time trying to advance their economy beyond industrial production and into services and technology to compete in the global markets. The plan is to build their middle class and increase the average wages of their people. At the same time, China is in the process of aligning with Russia, the Middle East, and Europe in their Belt & Road trade initiative.

(Click on image to enlarge)

Image Source: South China Morning Post

The initiative will expand current naval and land trade routes and expand markets for Chinese goods. The increased trade will reduce the amount of dependence China has on the US for buying it’s products. China knows the western economies are weakening, and wants to establish new trade relationships and find new sources of income.

In addition, China is heavily buying gold which strengthens their currency relative to the US dollar. The Chinese are featuring the Yuan in more and more non-dollar energy and goods contracts. As China strategically moves away from US as their primary trading partner, their leaders have less incentive to strike a complex, binding trade deal with the US. As a result of China’s economic positioning, the US now needs a strong trade deal going forward more than China does.

Federal Reserve Policy Expectations

As far as the Federal Reserve’s monetary policy, the market should not expect a strong move in either direction right now. The US economy is very fragile at the moment. When the Fed implemented rate hikes and tightening procedures last year, the stock market crashed hard in the fourth quarter. This is an indication that market sentiment is linked at the hip with Fed policy. This is the Fed’s fault, of course, as previous QE programs designed to solve last recession’s liquidity crisis have gone too far.

Now the market lives off of the Fed like a drug addict off of their dealer. As any recovering addict will tell you, coming down off the drugs can be very painful. And if not properly managed, steep drug addictions can actually shock the system while being life threatening.

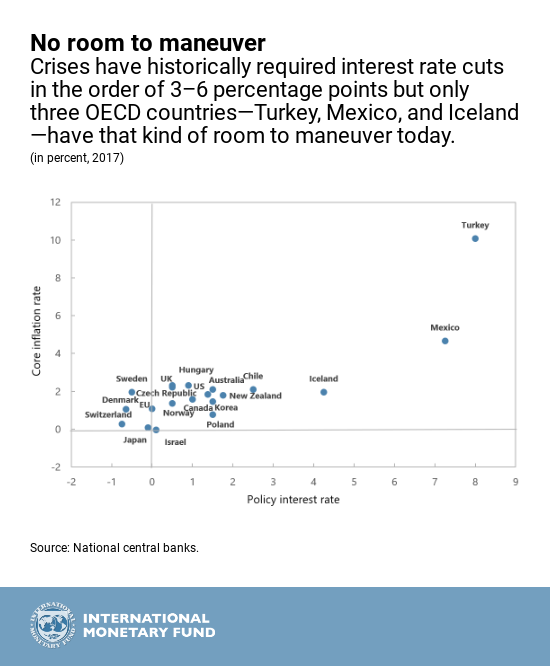

The Federal Reserve doesn’t want to ease heavily now because they are trying to build room for rate cuts in a future recession. Typically 3-6% full percentage points of interest rate room are needed to quell recessionary pressures. Not many countries in the world are positioned with high enough interest rates to accommodate this type of policy.

(Click on image to enlarge)

Image Source: IMF

And given the extraordinary amount of debt floating around in the world system, 3-6% of interest rate cuts may not be nearly enough if the debt bubble pops and we slide towards a deflationary depression. The Fed needs more interest rate room, but they were not able to create it this time without stoking a legitimate recession.

Negative Interest Rates (NIRP) and the IMF Template

NIRP policies are likely to become a fixture in the American banking system to allow for more policy maneuvering by the central bank. But first, the war on cash must continue to force them majority of users into digital forms of money. Per the IMF, cash forms a zero bound on interest rates which prevents monetary authorities from fully implementing their long desired NIRP plans.

When cash is available, however, cutting rates significantly into negative territory becomes impossible. Cash has the same purchasing power as bank deposits, but at zero nominal interest. Moreover, it can be obtained in unlimited quantities in exchange for bank money. Therefore, instead of paying negative interest, one can simply hold cash at zero interest. Cash is a free option on zero interest, and acts as an interest rate floor.

Whether or not the IMF recommendations for a NIRP system are successful likely depends on how bad the next recession is. If the recession is deep and wide across the American economy, business leaders and Keynesian economists will strongly promote both reduction in cash reserves and implementation of bank digital currencies. This system has already been outlined by the IMF.

If another crisis happens, few countries would have that kind of room for monetary policy to respond. To get around this problem, a recent IMF staff study shows how central banks can set up a system that would make deeply negative interest rates a feasible option.

Summary

The current environment does not leave a lot of wiggle room for policy planners. Should the general economy follow the direction the data seems to suggest, we are in for the end of the current bull market. Stock prices will soon follow the economy down, forcing the hand of the Fed to adjust their monetary plans to favor more easing. But, the Fed has little space under the current monetary system to implement the same plans they have used time and again in the past.

The trade deal with China looks dead, at least to the extent that Americans hope that it strongly favors them. Some type of deal will get done, but I doubt the Chinese sign an expansive agreement that locks them into trade policies not aligned with their growth objectives. That likely means US service and manufacturing sectors will experience a rapid decline during the next recession.

The stock market will not tell you any of this, of course. That is because the market is not a leading indicator of economic health. Rather, it is a measure of economic bull and bear markets that have long since been in the making.

Attention to economic indicators is the best way to avoid future stock market shocks. Gold and silver are excellent positioning tools to stabilize financial portfolios when hot economies cool off and transition into recessions, be they big or small.