SDRs May Be Subtly Becoming The New World Order Digital Currency

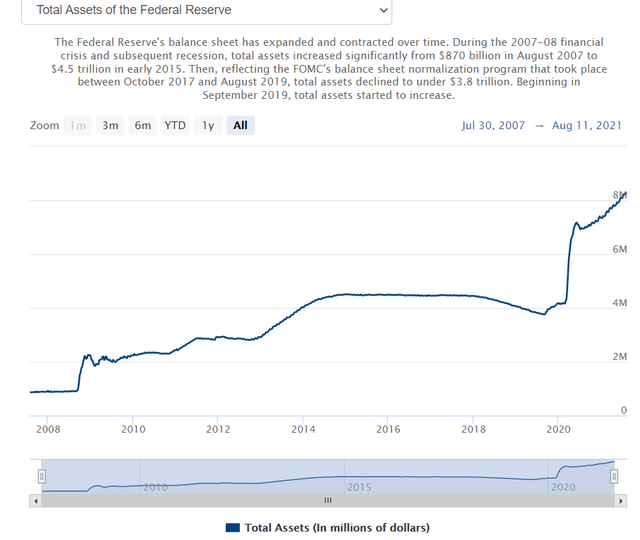

During the 2021 pandemic, the IMF is allocating $650 billion to meet what they said was a long-term global need for reserve assets. It is unclear why this was needed since governments were already printing huge amounts of money. The G7 government debt is 140% of GDP and major central bank balance sheets as a percentage of GDP is at 78% - the highest levels ever. We appear to be in a crisis. The Fed is issuing even more special drawing rights (SDRs), which further increases the money supply. The Fed says that the increase in SDR is not expected to increase any global inflationary pressure. Quantitative easing was also not supposed to lead to any inflationary pressure, yet prices continue to rise and have since 2008. We feel that the potential for inflation is now highly likely and even hyperinflation is a possibility.

SDRs may be becoming a new world currency, under the control of central banks. See an article on IMF proposing a new world currency to replace the US dollar and other national currencies.

In 2007, the major central bank balance sheets were $4.9 trillion and today they have topped $30 trillion. Has it helped the economy? No. US federal debt has topped $28 trillion. All US sector debt is more than $84 trillion and apparently, it is not enough. The Fed and other central banks want even more debt, more reserve assets, and more printing of money.

Every country that has tried to reduce their balance sheet or reduce the printing of money has had to backtrack as the stock market and Wall Street have had a tantrum. Wall Street appears to be more in control of the financial world than the Fed or governments.

The global economy is based on massive debt, and governments and central banks continue to prop it up by printing yet more money.

Courtesy: ecb.europa.eu

Investors are turning to real money: According to WGC gold and silver, demand for gold and silver is increasing. Demand is increasing again this year as investors worry about the Fed’s policies and the declining value of fiat currencies, like the US dollar.

With talk of a new global currency, digital currencies and fiat currencies are at war. We are beginning to see a reset of the monetary system. Gold and silver are also in a war against fiat currencies over what is real money.

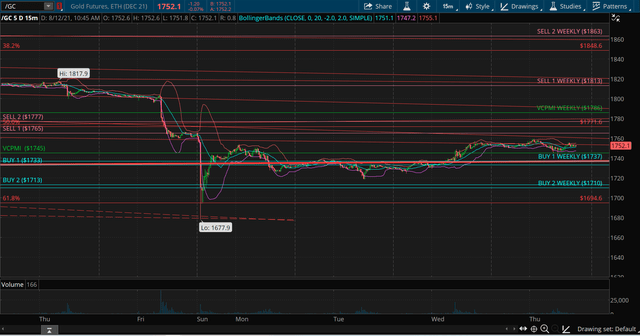

Courtesy: TD Ameritrade

This recent major attack on precious metals since Sunday night involved $4 billion in short contracts in the paper market, which collapsed the precious metals markets. The paper shorts were for gold that did not exist. The US dollar benefits as gold suffers. Gold made a low of $1678, matching the previous March low. Then buyers came into the market. This area was identified by our Variable Changing Price Momentum Indicator (VC PMI) algorithm weekly Buy 2 level, which recommended buying into the market. From there, the market reverted back up above the VC PMI daily average of $1745. Now we have a bullish price momentum with the daily VC PMI targets of $1764 (Sell 1) to $1794 (Sell 2) and the weekly average price target of $1786. It appears we have a bottom forming with daily, weekly, and monthly signals indicating a bottom. $1810 to $1813 are more targets, and if we get above $1810, then we are looking at the annual average price of $1810 and the monthly average price of $1813 which, if we reach those levels, would complete this correction.

We are looking at the creation of another fiat currency called the SDR, challenging the US dollar as the world’s reserve currency. Bitcoin is also competing as a potential decentralized global currency against the SDR centralized vision of a global currency. Gold and silver are a third alternative to the US dollar as a reserve currency. This appears to mark the transition of the US dollar into a basket of currencies including SDRs and Bitcoin as the world reserve currency as opposed to being the single world reserve currency. This change should be discussed more publicly, yet it is not. With so much change in the monetary system, we recommend protecting your assets by investing in gold, silver, and now Bitcoin as a digital asset.

Featuring: Bitcoin

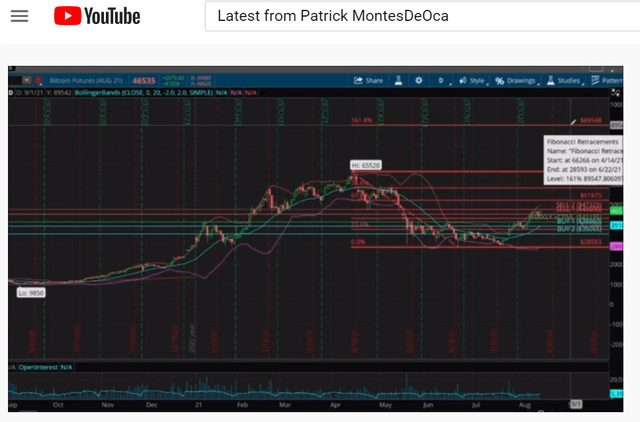

In our July 21 report, the Variable Changing Price Momentum Indicator (VC PMI) gave us a buy signal for Bitcoin at 31,752. We recommended, if long, to use the close below 31,752 as your conservative stop. You could also add to your position at 29,938 as your second stop if you were using multiples. The initial target was the average price of 33,853. Closing above 33,853 activated the Sell 1 level of 35,667 and the Sell 2 level of 37,768. Bitcoin is now at 46,590. The signal that was activated on the 11th was tested until about July 23, when it confirmed the buy trigger. It is now trading around the mean, with a 50/50 chance of going up or down. By closing above 47,325, it will become a support level or the next price fractal, which activates the target of 65,520.

Courtesy: ema2trade.com

The low last year of 9850 and the recent high of 65,520 shows a Fibonacci retracement. Since that high, Bitcoin reverted back down in a perfect Fibonacci retracement, which reached a low of 28,800 on June 22. The VC PMI said not to go short at that level; wait to see buyers come in, which they did, and wait for a buy signal at 35,265. The market closed at 37,735 and activated a buy trigger with the targets above activated. Now Bitcoin has taken out all of the Fibonacci trend line resistance levels and it is breaking out. The market may rally back up in a Fibonacci 61.8% retracement to 51,875 or even 58,204, which is the 78.6% retracement. Either level would maintain the integrity of the previous trend, which was accomplished last year. It appears to be a cup and handle formation, which is very bullish. If we get through the 78.6% retracement, we can rally up to 89,548 for Bitcoin this year.

The market appears to be anticipating where we are going with the US dollar and monetary policy. A great deal of money is looking for an alternative asset that is delinked from the banking system, such as Bitcoin and other digital assets. Corrections offer the chance to increase your holdings in these assets as an alternative to the US dollar, which, laden with debt, will continue to lose value.

Disclosure: I/we have a beneficial long position in the shares of BTC-USD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own ...

more