Saudi Production Cut By 50%: New Income Investments For The Coming Oil Price Spike

I originally wrote this article, and published it two weeks ago. Little did I expect the attack on the Saudi oil infrastructure and the effect on oil prices. Here it is again with additional comments.

For the last three months, crude oil has been stuck in a $50 to $60 per barrel trading range. The WTI benchmark price has lulled traders into thinking that this trend will continue. I have contact with many investors, and I find that many have the viewpoints and beliefs that trends will continue indefinitely. It’s hard for many to envision a change in the trend.

The drone attack over the weekend in Saudi Arabia has taken 5 million bpd of production off the table. At least for a short period of time. On Monday the price of crude oil traded up over $5 per barrel or 10%.

When you look at this price WTI crude oil price chart, from the start of 2018, you can see two price run-ups to $75 and $65 per barrel. With the price trending around $55, oil traders are thinking more about the next recession rather than continued economic growth.

I think that $65 to $75 oil will be the next range, once the investing world gets over the belief a recession is right around the corner. Royalty trusts are one investment type that will do very well when oil prices move higher.

Final thought. Most of the financial news is focused on how fast the Saudis can get production back online. I don’t see anyone asking how many more drones are out there pointed at the world’s crude oil chokepoint. The weekend attack may not be the last.

Royalty trusts produce income derived from the production and sales of commodities, typically oil and natural gas. This type of investment will produce both a nice income and capital gains as the price of crude oil moves higher.

An energy royalty trust earns all or most of the profits from oil and gas production out of acreage designated to the trust. These are not companies, and there are no management teams. A trustee collects the trust’s shares of earned royalties or profits and passes them on to investors.

When you invest in a trust, you purchase units, not shares. Most royalty trusts pay monthly distributions which vary from payment to payment.

The amount you earn from a royalty trust can go up with rising energy prices and if the operator of the trust properties increases the amounts produced. Some of these trusts have existed since the 1970s and have paid distributions for decades.

Newer recovery techniques developed over the past decade allow operators to “restart” production in older wells, boosting trust income. Keep in mind, as a trust unit owner, you are not investing in the oil company operating the wells. You are receiving a portion of the profits from the oil and/or gas produced by the wells.

The obvious downside to these trusts is that if energy commodity prices fall, so will the distributions and the trust unit prices. These commodities are priced based on global supply and demand forces — especially crude oil, with natural gas moving towards a global system.

The International Energy Agency forecasts that the current oil demand of 98 million barrels per day will grow by an average of 1.2 million barrels per day per year for the next five years. Energy royalty trust prices, as well as distributions, move in parallel with the cost of crude.

I view these trusts as a way to get direct exposure to energy commodity prices and to own assets with values not driven by stock market sentiment. The May-June price drop in crude oil has put these trusts on sale. Here are three trusts to consider.

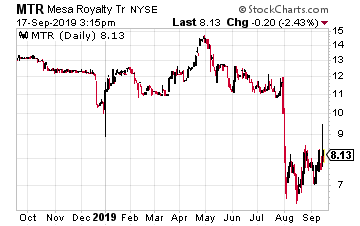

Mesa Royalty Trust (MTR), incorporated on November 1, 1979, owns property interests in the Hugoton Area (Kansas) and the San Juan Basin (Northwestern New Mexico and Southwestern Colorado).

The Trust does not engage in any operations.

An average of the last three distributions gives MTR a 7.7% yield on the current $7.8 unit price.

Remember that for all royalty trusts, monthly distributions will vary, sometimes dramatically.

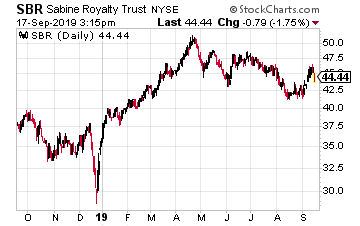

Sabine Royalty Trust (NYSE: SBR) was established as of December 31, 1982. The trust holds royalty and mineral interests in producing and proved undeveloped oil and gas properties in Florida, Louisiana, Mississippi, New Mexico, Oklahoma, and Texas.

The total distributions paid from 2014 through 2017 show how the payments mirror the change in the price of crude oil.

Note that oil reached its recent peak in 2014 and low in early 2016. Here are the total distributions per unit for the four year period:

2017: $2.368370

2016: $1.93403

2015: $3.10520

2014: $4.09779.

Recent distributions give SBR a current yield of 7.2%.

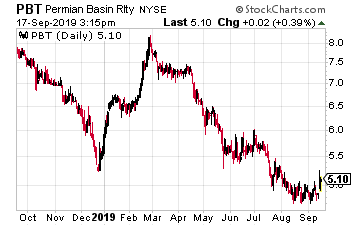

Permian Basin Royalty Trust (PBT) incorporated in 1980. The trust owns royalty interests in 33 Texas counties with most of the production coming from the Waddell Ranch properties located in Crane County, which is in the heart of the Permian oil play.

Six major fields on the Waddell Ranch properties account for more than 80% of the total production.

The Waddell Ranch properties are mature, producing properties, and all the major oil fields are currently being waterflooded to facilitating enhanced recovery.

Based on recent distributions, the PBT current yield is 10.2%

Disclosure: None.