Record High Debt And Record Low Yields Are A Boon For Gold

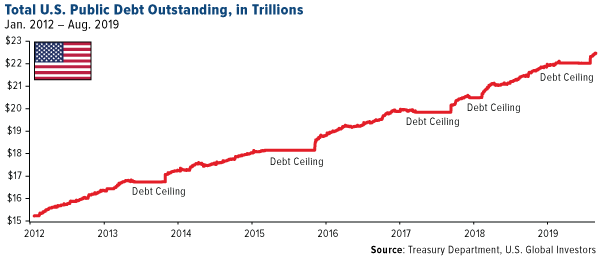

For the 2020 fiscal year, the federal budget deficit is expected to hit a massive $1 trillion—the first time in U.S. history that it will have expanded so rapidly in a time of peace and prosperity.

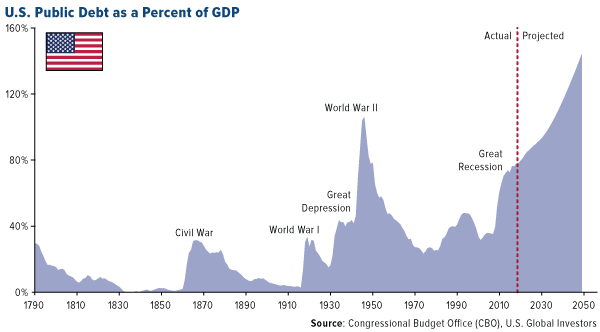

The most recent estimate by the Congressional Budget Office (CBO) puts total federal debt at a whopping 144 percent of gross domestic product (GDP) by 2049. This level of debt is not only unprecedented but also unsustainable. It puts everyone’s financial security at risk.

And if you’ve been keeping up with the Democratic presidential debates, things could get even worse. Medicare-for-all, the Green New Deal, reparations—these programs, while admirable and potentially beneficial, would add trillions more to the already-ballooning national debt.

Remember, it’s the policies that we should be paying attention to, not partisan politics.

Years ago, it might have taken $1 trillion to move the U.S. economy by 2 percent of GDP. What is that number today? It might take $10 trillion or more.

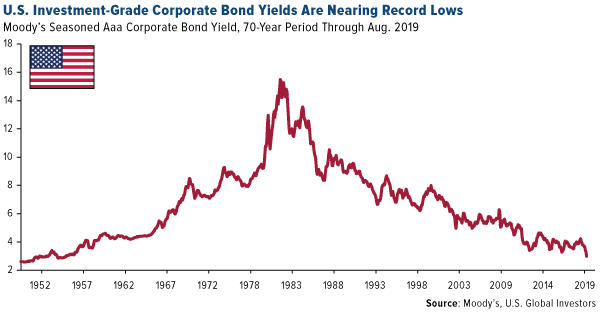

Low, Low Corporate Bond Yields Encourage Record Borrowing

Speaking of debt, you may have heard that a record number of companies last week sought financing in the bond market. It’s no coincidence they rushed to the trough all at once. Average yields for investment-grade corporate debt are near an all-time low right now, making borrowing very inexpensive and attractive. Apple, Deere, Walt Disney and Coca-Cola were among the record 49 companies that issued as much as $54 billion through this past Wednesday. Apple alone sold $7 billion, its first bond deal since 2017.

Historic Currency Debasement Calls for a Shot of Gold

Yields are at historic and near-historic lows, and they could be heading even lower sooner rather than later. The question you must ask yourself is how you will be positioned going forward.

In a recent blog post, Rick Rieder, chief investment officer at BlackRock, writes that we could be at what he calls the “monetary policy endgame.” In recent years, central banks have deployed nearly everything in their arsenal, including zero and negative interest rates and quantitative easing (QE). The last stage could very well be extreme currency debasement. For that to happen, rates would need to be taken deeper and deeper into negative territory as economies compete for the weakest currency.

“How should one position for such an endgame?” Rieder asks. The solution, he says, “is to hold an asset that maintains its real value—an asset that cannot be printed.”

Such assets include dividend-paying stocks and “commodity currencies,” including gold, which is limited in supply and expensive to extract.

And the worst assets? According to Rieder, these would include “a sovereign bond with a negative yield, closely followed by paper money at zero yield, both with a theoretically infinite supply.”

Again, that’s the power of scarcity, as I discussed last week.

I believe such scarcity, when coupled with the slow debasement of currencies, is enough to push the price of gold up to as high as $10,000 an ounce. As I told Daniela Cambone last week in Kitco News’ New York studio, we aren’t going to see $10,000 gold in the next 12 months. But with yields in freefall, and radical currency debasement estimated to happen by the world’s central banks, where else will investors be able to turn? Real assets have a limited supply and intrinsic value.

Disclaimer: All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be ...

more

You really think #gold will hit $10,000 an ounce? When do you think that would be?