Rare Opportunities In Rare Metals

Investors constantly search for the “next big thing”, the next innovation that will disrupt entire industries and make early investors a lot of money. Now that “next big thing” is electric cars and alternative energy. The question is what is the best way to take advantage of the coming boom in these fields. The answer is rare metals like lithium and cobalt.

These rare metals are essential in the development of lithium ion batteries that power electric cars like Tesla. With the launch of the Model 3, potentially the world’s first popular mass market electric car, demand for these batteries is set to go through the roof. Tesla is not the only player in the electric car field either. All the major auto companies have electric cars in the works, and other companies like Foxconn and Panasonic are busy building enormous battery factories to satisfy the worlds ever increasing demand for battery products. With increased demand for lithium and cobalt comes incredible opportunity. Lithium was one of 2016’s best performing assets and 2017 is shaping up to be cobalt’s year which is why I want to focus on the latter in this post.

Few people have heard of Cobalt but it is one of the world’s most important metals. It is primarily used in super alloys which are crucial to make gas turbines, jet engines, permanent magnets, and turbine blades. Cobalt’s necessity to produce these things have led governments to declare it a “strategic” metals. However, the primary driver of the increased demand for cobalt comes from its use in batteries. Cobalt’s unique chemical structure makes it possible for batteries to hold their charge longer, which is why it is such a critical component. For example, the lithium ion battery that powers a Tesla Model S, uses 22.5 kg of cobalt, and just think, Tesla alone is about to start producing hundreds of thousands of cars all using similar batteries. Meaning Tesla and other companies are about to start soaking up cobalt by the ton (demand is set to triple by 2025), and this can cause a problem, or an even greater opportunity.

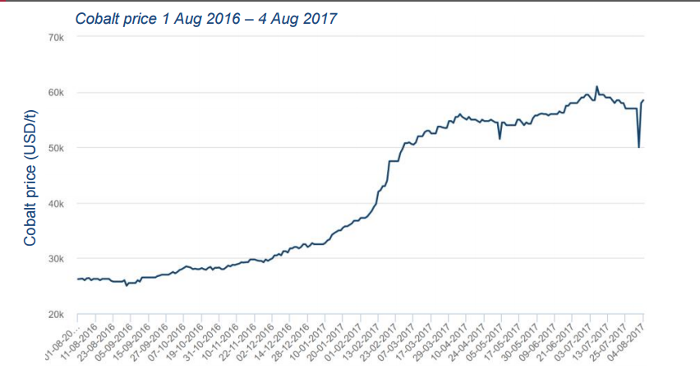

Cobalt Prices over the last year in USD per ton

As demand increases there has been worries that a supply crunch in cobalt is inevitable, this has led to surging prices (as shown in the chart above). Prices have surged from $10 a pound to over $25 in a little over a year, including a 14% increase in August alone. Unfortunately, taking advantage of these surging prices and investing in cobalt is tricky. For starters, almost 98% of cobalt is mined a byproduct of other industrial metals like copper and nickel, this means there are very few pure cobalt deposits out there. Another problem is that 65% of this “strategic” metal is mined in the Democratic Republic of Congo (DRC). You might know the DRC as one of the world’s poorest and unstable countries, or you might know it as one of the most corrupt but either way the fact that most the world’s cobalt comes from the country poses obvious supply chain problems. Even so there are a few options for those who want to get in on the cobalt boom.

Cobalt Futures

Cobalt futures are traded on the London Metals Exchange under the symbol CO. The futures are quoted in U.S dollars per ton and contracts range over a span of 15 months. These futures are up over 130% over the last year. Unfortunately, there is very little liquidity in this investment option, almost 40% of all contracts are owned by one buyer. These futures provide the most direct way to invest in cobalt, but for investors worried about the low volatility, another investment option could be cobalt miners.

Katanga Mining (TSE: KAT):

Katanga Mining is a Switzerland based holding company that trades on the Toronto stock exchange. It has a market cap of about $1.45 billion (Canadian), and the stock is up over 250% year to date. The company produces copper and cobalt at its mines in the Katanga province of the Democratic Republic of Congo, and is set to produce as much as 30,000 tons of cobalt and 300,000 tons of copper a year. This makes Katanga Mining one of the largest cobalt producers in the world with about 25% of the current market. The company also has the benefit of being owned by Glencore, which owns 86.33% of Katanga Mining. Glencore is one of the world’s biggest commodities players with a market cap of almost $65 billion. It likes to advertise itself as the largest producer of cobalt, but in fact most of Glencore’s exposure to cobalt comes from its stake in Katanga Mining.

Katanga Mining has large proven copper and cobalt reserves at it mines in the DRC however there are significant risks involved with doing business in the DRC and investing in Katanga. For starters, the region is known to be incredibly unstable both politically and economically. The country’s large debt load and constant warfare has left the country’s infrastructure and power grids virtually nonexistent. Also, it is known that many mines in the region employ child labor, something that violates international labor laws and the moral standards most companies, including Katanga Mining. The company’s heavy exposure to a few core industrial metals also poses long term issues, the company was forced to shut down production at times because of low copper prices. That coupled with several recent accounting problems could turn potential investors off to Katanga Mining. There are other options for investors who do not feel comfortable with investing in the DRC, due to the increased demand for cobalt, prospectors have been looking for new deposits some of which have been found within existing copper and nickel mines in Canada, Australia, Russia and even the United States.

Ecobalt Solutions Inc. (TSE: ECS):

Is a Canadian mineral exploration and mine development company traded on the Toronto stock exchange. The company has a market cap of about $175 million (Canadian) and has seen its stock rally 125% over the last year. The company’s primary investment is the Idaho Cobalt Project (ICP), which is located on 4,080 acres within the American mineral rich state of Idaho. The project is slated to produce about 1,500 tons of cobalt a year over the lifespan of 12 years. The primary advantage of Ecobalt Solutions and its Idaho mine is that it will avoid the obvious supply chain risks associated with mining cobalt in the DRC. By having its main mine in the United States Ecobalt Solutions has the advantage of America’s modern infrastructure and political stability. Something larger mining companies in the DRC do not have. Ecobalt is also a pure play cobalt company. The company does not have exposure to other industrial metals like copper meaning investors have a rare opportunity to bet on cobalt and only cobalt.

Unfortunately, junior mining companies like Ecobalt Solutions have their own unique set of problems. For starters, they are extremely risky and their stocks are prone to periods of large swings. The company also does not have any revenue now since its Idaho mine is still not operational, even though the company is making progress it could still take months if not years for the mine to start yielding actual cobalt. The company has invested over $110 million in the project to date, meaning any delay in the development of the mine could have severe financial consequences. However, with Ecobalt Solutions Idaho mine is currently being only late stage environmentally friendly primary cobalt deposit in the United States and with cobalt prices surging, the company does seem to be in good shape for the future.

Umicore (BSE: UMI):

Umicore is a Belgian based global materials and technology company, that trades on the Belgian and London stock exchanges (in London under the ticker ONSI). The company has a market cap of about 7.12 billion euro, and its stock has rallied about 18.5% over the last year. Unlike the other companies I have mentioned Umicore is not a cobalt miner at all, the company’s activities revolve around automotive catalysis, energy and surface technologies and recycling. The company is involved in the cobalt space in a different way, it deals with cobalt recycling and refining. Umicore uses the cobalt it collects from recycled products and uses it to make super alloys. As the amount of lithium batteries increases so too will the demand for recycling of these same batteries. The company also produces materials and technologies that are found in 1 out of every 5 lithium batteries.

Umicore is striving to become a world leader in clean mobility materials and recycling. As the production of lithium ion batteries increases profits at companies like Umicore that provide materials, technology and recycling solutions will also increase. Already the boom in lithium batteries is having a positive effect on this companies bottom line, revenues are up 13% year over year. This company could be a good option for investors hoping to take advantage of a niche field that will be created by a boom in electric cars and rare metals.

Regardless of whether you invest in cobalt through futures, miners or refiners, the opportunity is there. Right now, there are 2 million electric cars on the road worldwide, estimates say this will increase to over 140 million by 2040. Britain and France have already decided to ban petrol cars entirely by 2030, demand is only going up and investors hoping to take advantage of the coming boom should get on board.

Disclaimer: This material has been distributed for informational purposes only and is the opinion of the author, it should not be considered as investment advice.