Q1 2019/20 Corn Demand/Stocks

Market Analysis

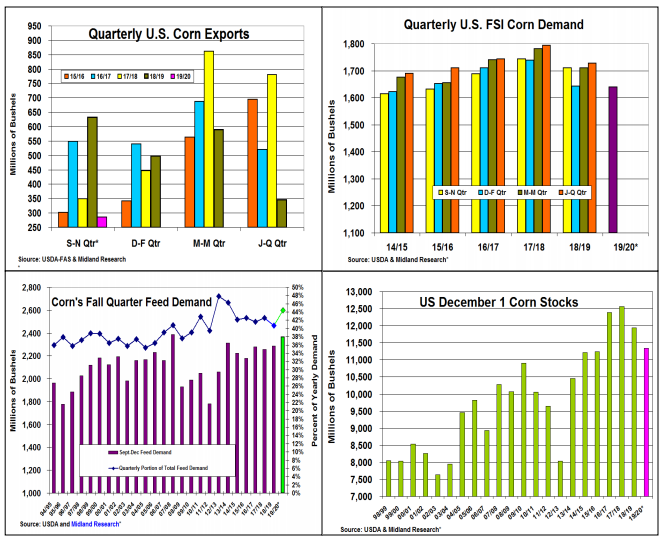

Disappointing export shipments and sluggish biofuel demand the first 6-8 weeks of the quarter as the US ethanol plants worked off excessive inventory were corn’s 2 big fall stories. During 2019’s US growing season concerns, world buyers turned to Brazil’s 23% larger corn crop (101 mmt) to cover a large portion of their needs making S. America a strong competitor. These weather concerns also prompted US livestock producers to up their feed coverage, too.

This year’s 1st quarter US sales & shipments took a hit with only 600 million (48%) on the books & just 285 million bu. (-55%) being shipped. Brazil’s 19 mmt larger crop was the primary reason as they pushed sales heavily. However, recent reports that a major meat producer bought Argentine corn to meet its Chinese meat sales suggests change. 2019’s late N. Brazilian bean plantings also projects a higher portion of Mato Grasso’s 2nd crop (safrina) corn being pushed into MT’s dry season. This suggests less Brazilian export competition in the 2nd half of this year.

Last fall’s sluggish industrial & ethanol corn demand reduced this usage by 70 million bu. to 1.64 billion. However, this domestic demand seems to be on upswing. A recent weekly EIA ethanol report revealed the highest US pace since June 2019 with only 6 higher levels since the 2017/18 crop year. October’s USDA ethanol corn usage also suggests 2019’s poorer quality crop may hurt this year’s conversion rate & up corn’s FSI bushels going forward.

African Swine Fever boosting China’s worldwide meat imports & inexpensive US feed grain prices (except during the summer months) helped keep 2019 cattle feedlot numbers higher & pork and poultry slaughter at record levels. This situation & 2019’s erratic US weather likely prompted feed buyers to step up their fall coverage resulting in 2.365 billion bu. fall feed level (+3.4%). Combining a smaller 2019 crop & a 4.3 billion quarterly demand, corn’s Dec 1 stocks could be down by 600 million bu. to 11.344 billion bu.

What’s Ahead:

With continuing positive signs about the Phase I US/China trade deal being concluded (China’s Vice- Premier arriving in DC this coming weekend), grain prices will likely be well supported. Corn isn’t likely in China’s direct buying plans, but sorghum, DDGs and ethanol could be. Advance sales to 75- 80% if Mar corn’s hits $4.00 level and begin Dec 2010 sales at 10% in the $4.08-$4.12 range.