Profit From The Electric Car Revolution With Suppliers

The most over-traded stock in early 2020 was Tesla (TSLA), which shot up 125% in the first six weeks of the year, fell 62% during the pandemic shutdown, then climbed 468% by the end of September. While Tesla has more substance than “tulips” or “Beanie Babies,” the continuation of its meteoric rise can be reasonably questioned. Even if Tesla represents the future of electric vehicles, much of that future has already been accounted for in its current stock price. What has not been accounted for is this: the tremendous investment opportunities that exist in the overlooked companies that are set to supply the electric car revolution for years to come.

There is an absolute treasure-trove of companies that supply Tesla and other major electric car manufacturers that investors have failed to appreciate. In this piece, we will survey some opportunities in this space.

As the Coronavirus Health Crisis continues to plague the world economy, many of these businesses have shown extremely strong momentum and outpaced the S&P 500 index by a factor of 10:

List of Key Businesses

|

Ticker |

Name |

Price |

PE |

Gain/Loss YTD % |

|

Contemporary Amperex Technology |

209.20 CNY |

104.62 |

+195.51% |

|

|

Panasonic Corporation |

6.8 |

12.49 |

-12.67% |

|

|

BYD Limited |

116.24 |

203.93 |

+241.4% |

|

|

051910.KS |

LG Chem LTd. |

654,000 |

112.29 |

+208.2% |

|

Albemarle Corporation |

86.72 |

21.05 |

+19.43% |

|

|

Aptiv PLC |

94.05 |

14.32 |

-2.3% |

|

|

Sociedad Quimica y Minera de Chile |

31.53 |

37.18 |

+17.1% |

|

|

BorgWarner |

39.86 |

18.50 |

-9.67% |

|

|

Magna International |

46.58 |

- |

-16.1% |

|

|

TE Connectivity Ltd. |

98.06 |

- |

-1.6% |

|

|

Amphenol Corporation |

109.30 |

30.47 |

-0.64% |

|

|

Infineon Technologies AG |

25.94 |

81.82 |

+25.32% |

|

|

Autoliv Inc. |

76.63 |

47.50 |

-10.64% |

|

|

AGC Inc. |

3070 JPY |

28.95 |

-20.26% |

|

|

BRE.MI |

Brembo SPA |

8.75 |

22.22 |

-21.67% |

|

Avg Gain: |

+37.75% |

|||

|

S&P 500: |

+3.65% |

Source: David Huston

The Trend in Electric Car Demand

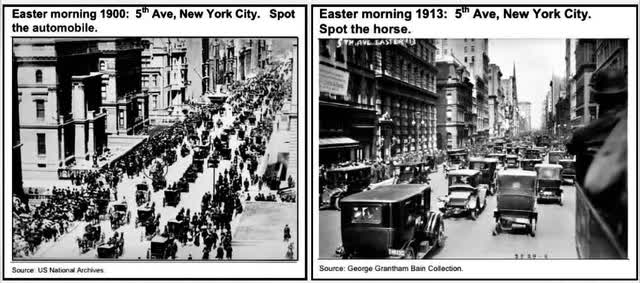

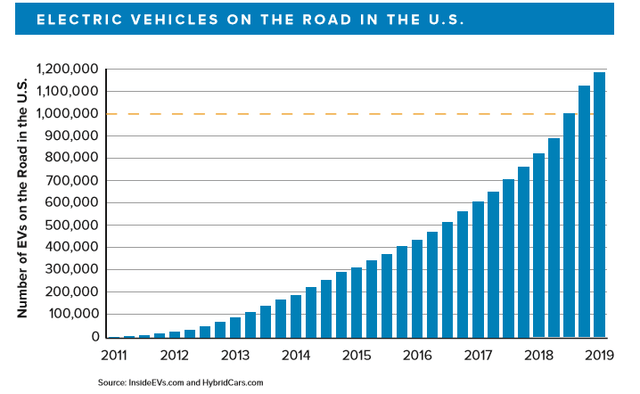

Electric car demand looks set to soar. After 40 years of struggle, and painstaking amounts of effort and research, it is nearly certain that electric cars will be populating our roads in the years and decades ahead. The rate of change is likely to go parabolic, like the replacement of horses with cars did at the start of the last century; in little more than a decade, cars went from being a rarity, to being ubiquitous on the streets of New York City. Look at what happened within 13 years:

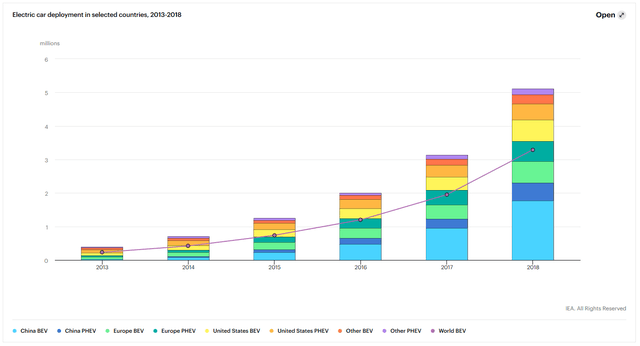

To further support that thesis, just look at this beautiful graph showing electric car deployment worldwide:

Source: IEA.org

China is leading the way, clearly, but Europe and the US are set to catch up. Electric cars are coming, and they are going to be building out infrastructure, supplier and parts manufacturing, sales, aftercare, and auto garages for the next 10-20 years.

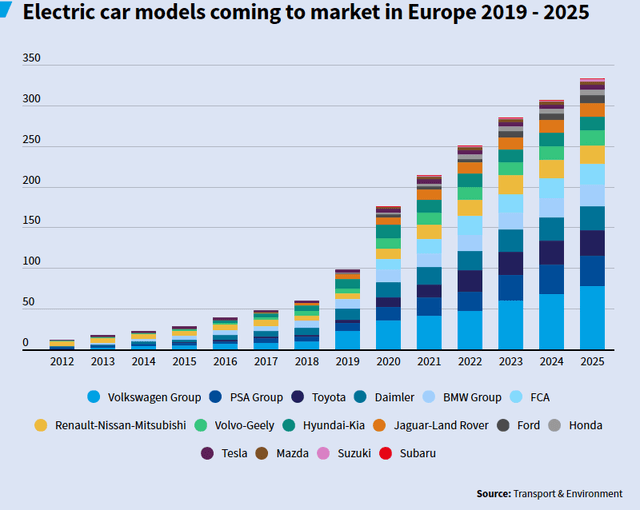

The number of electric car models coming to market in 2020-2025 is going to triple against 2019 levels, and should make Tesla very worried as this thesis takes hold with competitors:

The “buy Tesla” trade is extremely, eye-wateringly over-bought. Tesla traded for an astounding 241x earnings in February 2020. While profitable FTSE 100 businesses trade for 10-15x earnings. Tesla has a mediocre operating margin of 4.2%, it trades for 17.6x the assets that it owns (again, astronomical valuation), and it still carries a lot of debt. Oh, and it just printed off a bunch more shares and diluted shareholder value.

The auto manufacturers themselves are not amazing trades, because a lot of them have to shoulder the significant costs of “re-tooling” and changing their factories over to electric car production, all while continuing to crank out petrol and diesel vehicles. So where does that leave us?

The beneficiaries of all of this will be the suppliers. In investing, this is called the picks and shovels trade which we explore below.

Investing in Electric Car Suppliers

Famed investor Peter Lynch put it best: “with small companies, you’re better off to wait until they turn a profit before you invest.” Look for established, well-capitalized businesses that can profit from the coming electric car revolution. To do so, we are going to break down these suppliers into discernible categories:

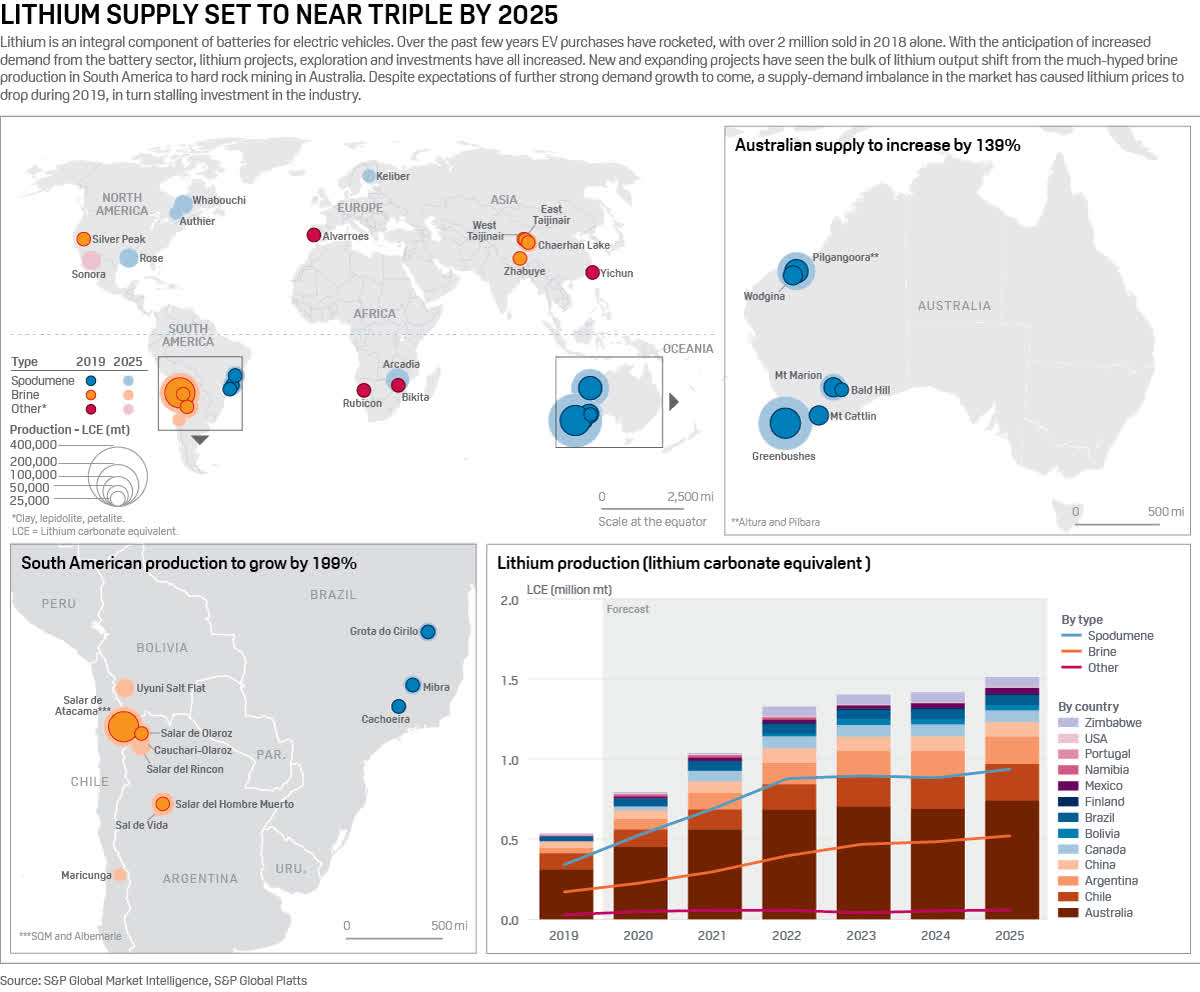

Lithium Miners & Producers

There are two lithium mining companies with good fundamentals that have started to outperform the S&P 500 index. At the same time, we need to point out that lithium supply is due to triple by 2025. If the upcoming electric car revolution does not kick into full gear, that might put pressure on mining companies who are relying on explosive growth.

What this hinges on is tangible numbers coming out of electric car manufacturers that suggest there is robust demand for their cars. Provided that the electric car manufacturers continue to see robust growth, you would expect this to translate into increased demand for electric cars.

The growth trend since 2011 in US electric car is very encouraging and should continue, even post Covid-19:

The same can be said of big markets like the UK (up 220% in December), the EU (up 53.5% year on year), and only slightly less encouraging is China (up 7% after they removed a key incentive).

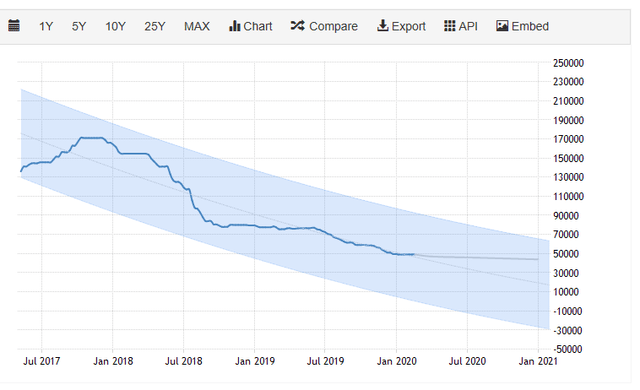

The negative is that demand is not set to pick up anytime soon to compensate for the glut of supply we have today. The reason being that counter-intuitively, despite the massive uptake in lithium requirements for cars, there is still too much supply out there. Prices are forecast to be relatively flat until January 2021, so no need to rush into buying lithium companies from a demand perspective:

Source: tradingeconomics.com

There are two solid plays for lithium production:

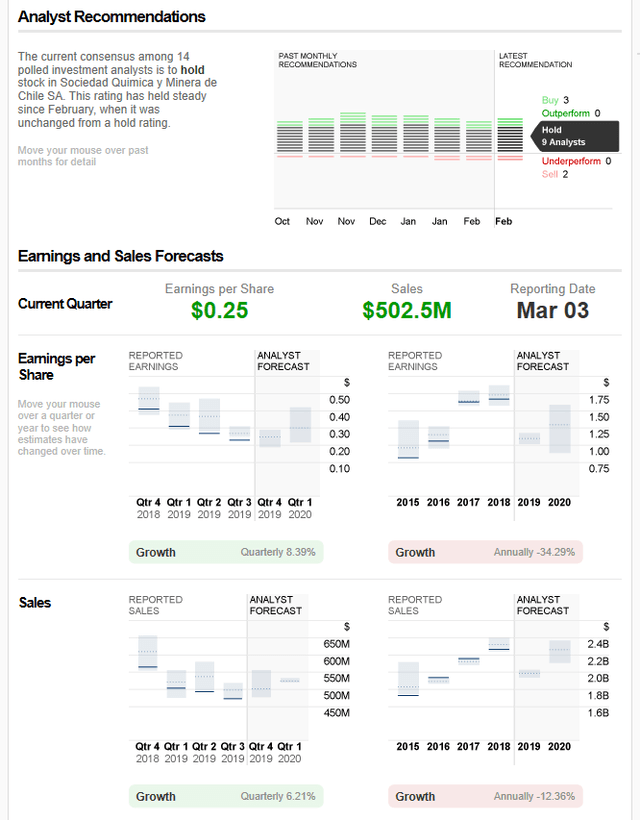

- Sociedad Quimica y Minera de Chile SA (NYSE: SQM)

SQM stands for Sociedad Quimica y Minera de Chile SA, a Chilean lithium chemicals, fertilizer and iodine production company based in South America. The company derives 43% of its profit from lithium carbonate and electrochemical materials for batteries; it has a respectable industrial chemicals division and it provides iodine to the market in large quantities.

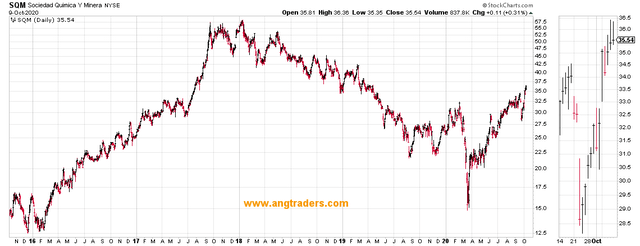

With revenues of $2bn the business has had a stable business model for many years. Unlike Chinese competitor Tianqi, debt is relatively under control and well covered by assets. What has really walloped the share price is the collapse in the price of their product, with lithium carbonate Li2CO3 falling more than 50%, which you can see in the decreasing EPS since Q4 2018:

There seems to be positive forecasts for sales growth and potential EPS and profitability growth in 2020. While you wait for that to happen, SQM pays a tidy 3.0% dividend and had plenty of cash to continue doing so, as it sits on a 26% pay-out ratio.

At $35.5 the business trades at a discount to fair market value. It has a PE of 41, which is expensive, given it does not have immediate term growth prospects for 2020. If lithium prices accelerate and SQM continues to deliver in the way that it has been, then it would not surprise us to see these shares trading in the region of $45-50 per share. Look to get in before growth accelerates in 2021-2022.

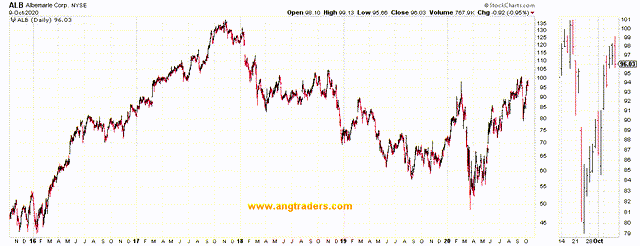

2. Albemarle (NYSE: ALB)

Albemarle is a coveted S&P 500 dividend aristocrat and it has increased its dividend at a 22% growth rate since 1994. It achieved this record on 3rd February 2020 and it is a fantastic achievement that demonstrates Albemarle is dedicated to shareholder returns. The company has low-cost and well-run operations with a reasonable moat.

There are three key reportable segments: Lithium, Bromine Specialties, and Catalysts. Here is an overview of net sales across the three segments:

- Lithium 2018 - $270.9 million

- Bromine Specialties 2018 - $232.6 million

- Catalysts 2018 - $251.1 million

The main growth driver now is Bromine, followed by a bit of sales growth in Catalysts.

Albemarle managed to post a 22% rise in revenue and 12% YOY increase in EBITDA in the third quarter of 2019. The forecasts for FY 2019 suggest a revised adjusted EPS figure of $6.00 to $6.20, which is still 10-14% better than the previous year.

At 23x earnings and 22x 2021 earnings, with due consideration to the fact that Albemarle has paid an increasing dividend for over 20 years, you will be investing in a stable and highly cash generative business with a good future ahead of it. We look to add on weakness towards the end of 2020.

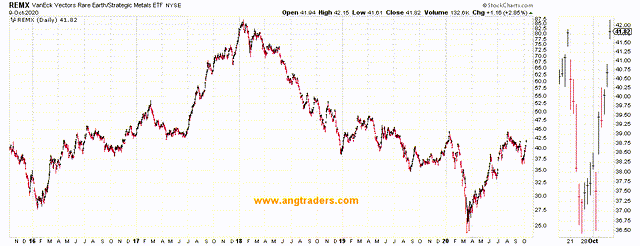

3) VanEck Vectors Rare Earth/Strategic Metals ETF (NYSEARCA: REMX)

In addition to individual lithium plays, investors can take a ‘broad-spectrum’ approach via the VanEck rare earth ETF (REMX) which holds multiple rare earth suppliers. REMX has recovered from the COVID-19 shutdown but remains close to the lows. Considering that demand for these elements can only increase, REMX is an economical way of investing in this sector.

REMX is weighted towards Chinese companies (43%), Australia (27%) and Canada (11%). Given that rare earth metals feature in electric car vehicles, batteries, mobile phones, iPads and computers this is a good way to invest in the “suppliers” of new technology.

Automotive Suppliers

This is currently a very troubled sector and therefore it is fertile hunting ground for great businesses that are trading at very attractive pricing points.

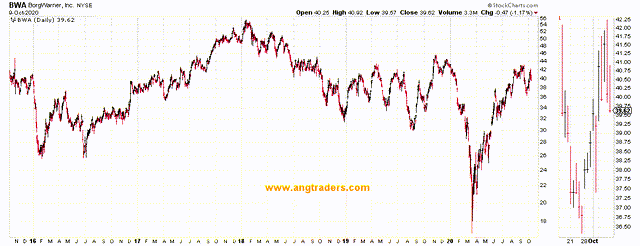

- BorgWarner and Delphi Technologies (NYSE: BWA)

Borgwarner is a global automotive parts manufacturer with a focus on powertrain products including manual and automatic transmissions. The acquisition of Delphi by Borgwarner allowed it to benefit from the expansion of electric car manufacturing.

The Engines segment was worth $6.2bn in sales for 2019. They aim to be over-weight in hybrid and electric vehicle engine production by 2023--the acquisition of Delphi adds weight to this expansion--while maintaining a balanced exposure across the industry.

In terms of performance BorgWarner had a rough time during the Covid-19 crisis when it dropped ~60%, but it has managed to recover the greater share of that:

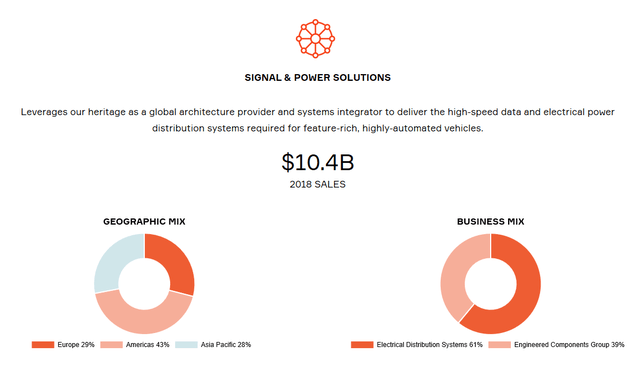

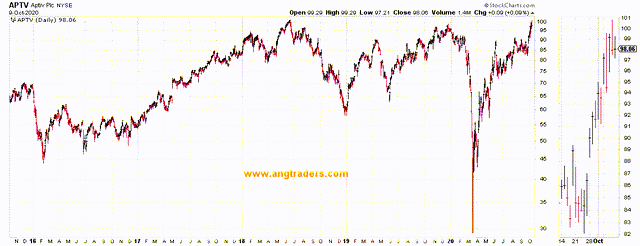

2. Aptiv PLC (NYSE: APTV)

It is fascinating how much attention Tesla gets for creating attractive-looking electric vehicles with dense battery packs--the stock market values the business at 241x earnings and it trades at 10x the enterprise value of GM-- whereas a brilliant business like Aptiv PLC, that designs and manufactures vehicle components, electrical systems and safety technology solutions for the world’s largest automotive companies goes largely unnoticed.

Aptiv operates through two segments: Signal and Power Solutions & Advanced Safety and User Experience.

Aptiv has $10.4 bn in sales through its signal & power solutions segment. Electrical distribution systems are essential for modern cars, as they control heat, lighting, braking and other essential sensors in modern vehicles (otherwise referred to as the ‘nervous system’ of a modern vehicle).

Aptiv is not only a mature and established business producing critical components for vehicles, but it also has a foot in the door for autonomous driving; through a partnership with Lyft, Aptiv has offered 100,000 rides in Las Vegas through the use of their autonomous BMW 5 series vehicles.

In short, Aptiv provides everything that the modern vehicle needs, which makes the move from gas and diesel vehicles over to hybrids and EV’s, a low-risk event for Aptiv.

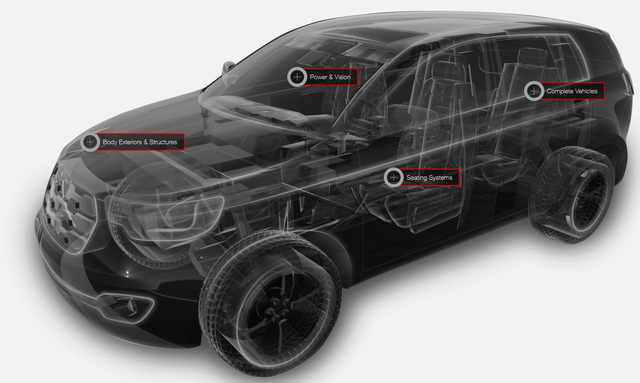

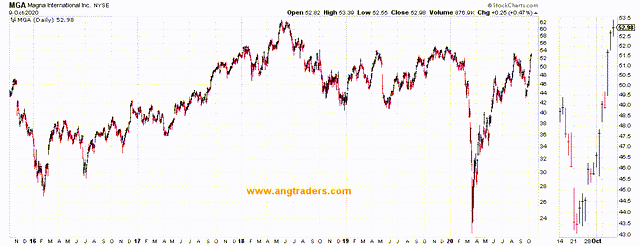

3. Magna International (NYSE: MGA)

Magna International is one of the largest companies in Canada and it is the largest automotive parts manufacturer in North America.

This is not your boring grandfather’s business either, producing rugs and plastic widgets. It recently partnered with Daimler to introduce the first augmented reality navigation system on the Mercedes A-class using forward facing cameras. They have produced thermoplastic lift gates for Jeep that reduce weight by 28%.

Admittedly the bulk of revenue comes from four standard part segments:

- Body Exteriors & Structures - $17.5 billion

- Power & Vision Systems - $12.3 billion

- Seating Systems - $5.5 billion

- Complete Vehicles - $6.0 billion

For the largest division – body exteriors and structures – Magna provides energy management solutions and high-quality steel for the body and chassis. The company also brings hot stamping forming processes to manufacturers – this allows vehicles to have more complex, rounded shapes and structures without sacrificing quality and safety.

Magna is a very well-run business that can move seamlessly into the future of electric vehicles. Despite enormous headwinds they have managed Covid-19 tightly and provide investors with a 3% dividend that is not funded by debt.

Battery Manufacturers

As obvious as investment in battery manufacturers seems, the fact that most companies which are involved in battery manufacturing have the bulk of their revenue and profit coming from other divisions, forces us to choose businesses carefully to invest in “pure play” battery manufacturing.

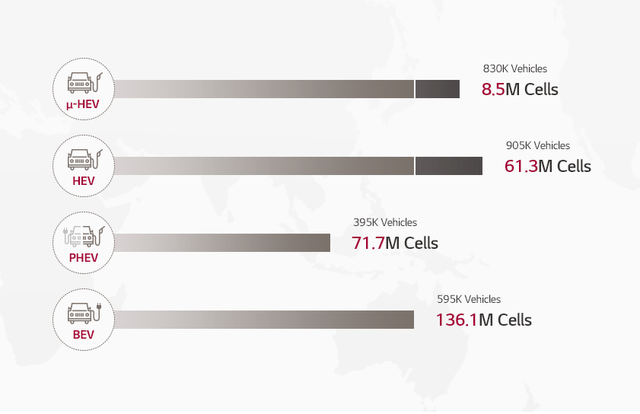

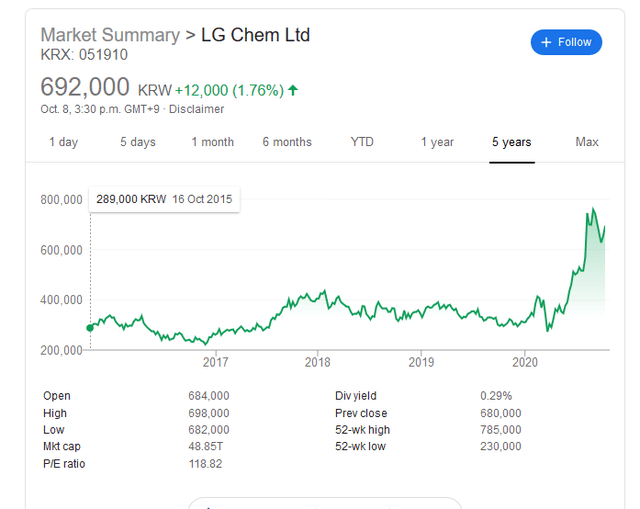

- LG Chem (KRE: 051910)

LG Chem is one of the 10 largest industrial chemical companies in the world and it is headquartered in Seoul, South Korea.

The flagship product is ABS (Acrylonitrile Butadiene Styrene), which is a plastic used to make car components, toys, home appliances, IT devices and thousands of other goods.

LG Chem is a leading supplier of electric vehicle (EV) batteries including the BEV, PHEV and HEV styles of battery. They are already working on their 3rd generation of batteries with ranges of 500km, and rapid charge times of 30 minutes.

LG Chem has a battery plant in Holland, Michigan, and has been producing EV batteries for the US market since 2013. It has been developing battery packs since 1999 and has a deep interest and experience in this area. That is why they produce enough cells to make over 200,000 electric vehicles per year in the US, supplying General Motors and Ford for their flagship models. The Chevy Volt and the Ford Focus Electric run on batteries supplied by LG Chem.

Source: google.com

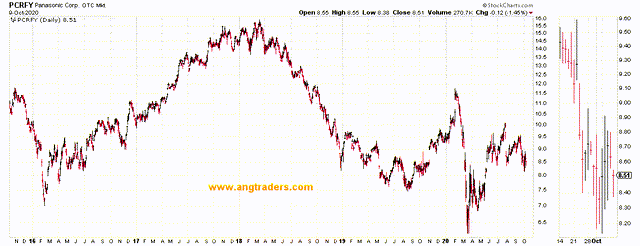

2. Panasonic Corporation (ORCMKTS: PCRFY)

Panasonic is an existing partner in supplying batteries for Toyota’s electric vehicles. Last year, the two firms formed a joint venture for the manufacture of EV batteries where Toyota owns 51% of the venture while Panasonic will own the remaining 49%.

The aim is to increase battery capacity by 50 times, compared to those used in current Toyota hybrid vehicles. Mazda, Subaru, and Daihatsu will source batteries from this joint venture. Honda already uses Panasonic batteries but will benefit from this new collaboration.

Panasonic and Toyota will also develop solid-state batteries, which will eventually replace the lithium-ion batteries used in electric cars today. By offering a higher range at a lower cost, these new battery types could drive Panasonic’s revenues higher.

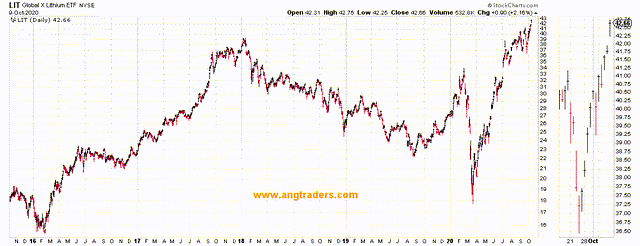

3. Global X Lithium & Battery Tech ETF (NYSEARCA: LIT)

The Global X Lithium & Battery Tech ETF (LIT) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Lithium Index. LIT is a way of investing in both lithium and battery production in a single holding.

For investors looking to get exposure to many of these companies, LIT could be a good ETF to consider. It does, however, have a nearly 10% stake in Tesla (hard to avoid) so have a look at the underlying holdings and ensure you are comfortable with the risks. The ETF has outperformed other indexes and is much higher than February 2020 levels.

Conclusions

There is tremendous momentum in companies that supply the electric car industry. Provided that electric vehicle growth matches or surpasses the expectations of investors and analysts, it looks like the next ten years may see this trend continue. The companies and green energy ETF’s that we have researched here are well worth considering as a part of a balanced portfolio for years to come.

Nice!