Pre-October USDA Crop Report - Final 2018/19 Corn & Bean Stocks Have Change Market Dynamics

Market Analysis

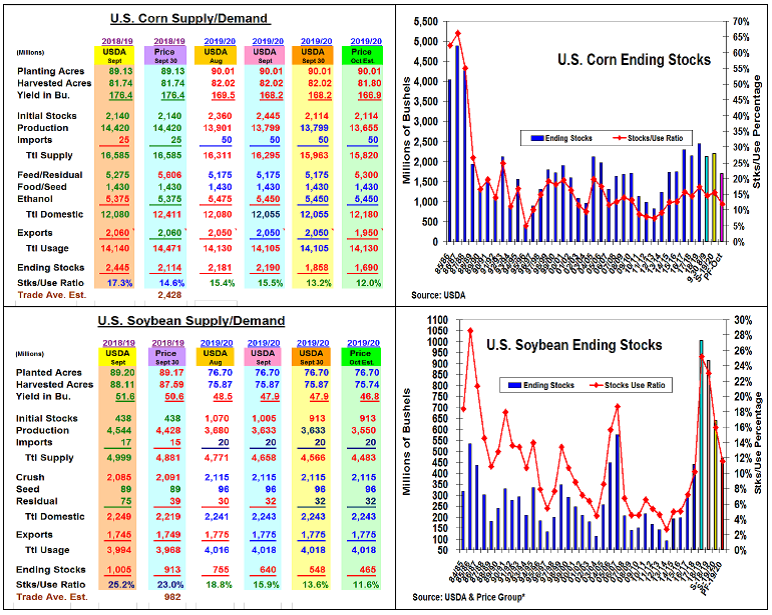

Going into the final data update on this year’s old-crop corn and soybeans stocks, talk circulated about an over-estimate of last year’s bean crop because of high residual levels on previous quarterly updates. However, corn’s ending stocks was quite an eye-opener, too. Instead of a minor change, Monday’s final corn supplies were 314 million bu. below the trade’s expectations. Soybean’s 2018/19 final stocks were 69 million bu. below the trade’s average estimate and 92 million lower than September’s projection. These two stock levels have dynamically changed both crops beginning 2019/20 total supply lev-els from excessive to adequate at best.

In corn, this week’s big drop in ending and beginning corn stocks relates to about 4 bu yield reduction in corn’s 2019/20 yield level without changing October’s yield fore-cast on next week’s crop report. As previously noted, Monday’s stock level will primarily be factored into this grain’s feed & residual level since no change in 2018/19 crop size is available. 2019’s record late plantings and erratic weather could slip corn’s harvested acres by 215,000 acres when FSA’s data is normally incorporated this month. This week’s 11% US harvest pace may keep October’s yield change to 1.3 bu. drop (166.9) as farmers and enumerators have limited harvested data to judge.

In soybeans, this week’s smaller old-crop stocks and sharply lower 2019 plantings pulled new crop stocks to 548 million bu, a 45% drop from September’s old-crop level. US soybean harvested area could shrink by 126,000 when the USDA utilizes its FSA’s data this month. Similar to corn, a modest 1.1 bu. lower yield producing an 83 million smaller crop seems the likely output this month. With the USDA probably keeping its demand levels unchanged with the US/China talks resuming next week, 2019/20’s stocks could drop to 465 million, a 54% yearly decline vs. September’s old-crop stocks.

(Click on image to enlarge)

What’s Ahead

The past month’s 150-600% of normal rainfall from the Great Lakes to the N. Plains while heat & drought (5 to10%) from Indianapolis to the US Gulf suggests corn & beans remain vulnerable to lower yields. Some late-maturing crops could be impacted by freezing temperatures through mid-month. Hold corn & bean sales at 45% & 50%. Look at $4.10-25 Dec & $9.40-50 Nov as next sale levels if Oct’s weather stays bad.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of its ...

more