Pre-October US Crop/S&D Ideas

Market Analysis

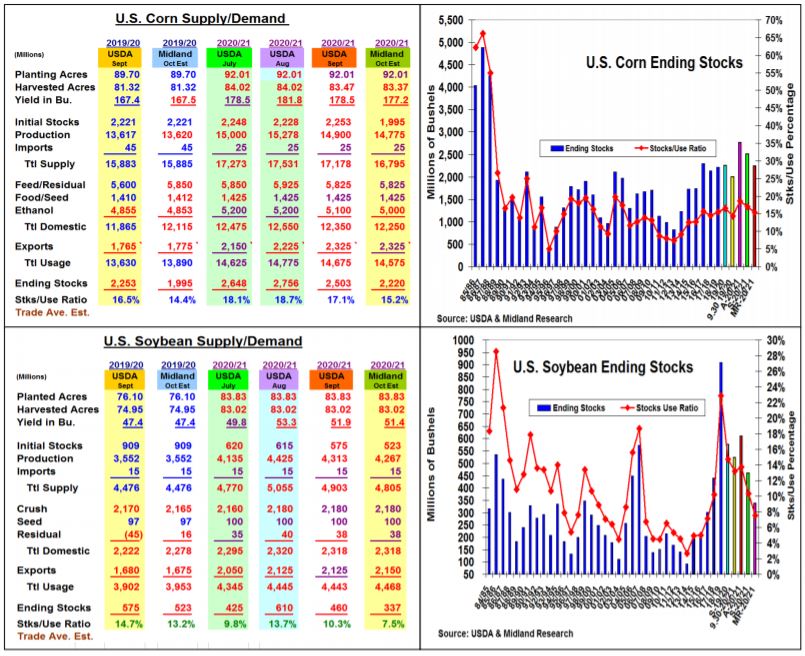

For the second year in a row, the USDA’s final corn (CORN) and soybean (SOYB) stocks were dramatically lower than expected. These smaller beginning stocks along with the USDA’s update on the size of the 2020 US harvest will be the next step in totaling the coming year’s corn and soybean available supplies on October 9. Overall, these lower stocks have likely changed both corn and soybeans 2020/21 total supplies from excessive to adequate at best.

Last week’s 258 million bu. drop in corn’s projected ending/beginning stocks relates to about a 3 bu yield reduction in corn’s 2020/21 yield level without changing October’s yield forecast on Friday. As previously noted, September s lower stocks will primarily be factored into this grain’s feed & residual level (5.85 billion) since last year’s crop size was increased by only 2.7 million bu. 2020’s US harvested acres could slip another 100,000 acres after last month’s 550,000 drop in Iowa’s Derecho damage. Late season dryness could slip the US yield by 1.5 bu to 177.2 resulting in a 14.775 billion bu. crop. However, this year’s late September harvest pace of just 15% could limit farmer & enumerator yield changes for October. Combining a smaller total supply by 383 million bu. and a slightly lower demand outlook (ethanol off 100 million) could tighten corn’s 20/21 ending stock to 2.22 billion bu. on Friday.

Soybeans’ 52 million smaller old-crop stocks to 523 million bu. relates to 0.64 lower yield without any other 20/21 changes this month. With smaller final crush & exports (5 million each) and September’s reduced stocks, the USDA didn’t change the US crop size this year. Late season dryness suggests a lower US bean yield, but 2020’s modest late September harvest progress (20%) may limit producer & enumerator changes this month. With no harvested area change & 0.5 bu lower yield, October’s bean crop could be 4.267 billion bu. With bean export sales at a record pace & 66% of USDA outlook, this demand forecast could be upped by 25-50 million bu this month. This could drop new crop’s bean stocks to 337 million, lowest in 4 years.

What’s Ahead:

China’s sharp increase in Phrase 1 US corn & soybean purchases along with reduced late season Midwest rainfall have dramatically changed these 2 US balance sheets. South American & Black Sea dryness are adding concerns, but lower US yields will be needed to sustain prices as the US harvest gears up.

Looking to add 10-15% sales at $3.90-$3.94 and $10.60-$10.75 new crop prices to current 30-33% levels.