Pre-November Crop Report - Smaller US Crops Are Anticipated For Both Corn And Soybeans

Market Analysis

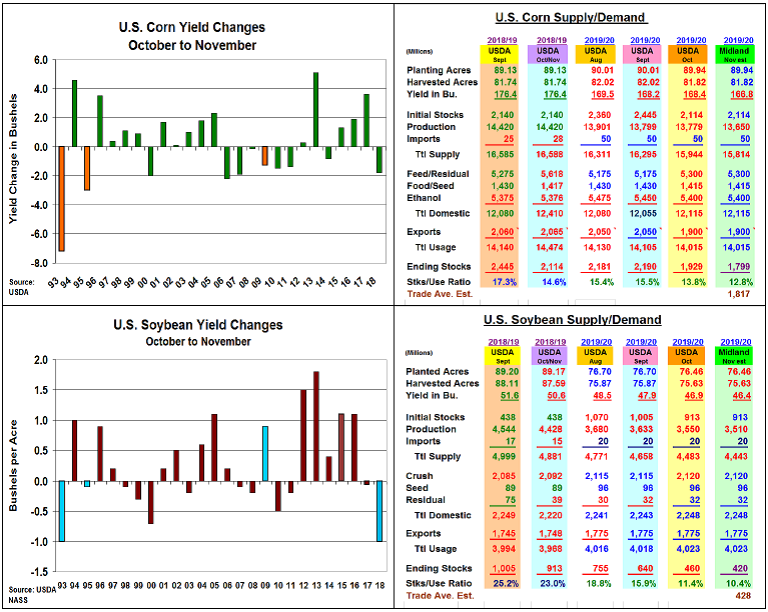

The trade is expecting smaller US corn & soybean out-puts on the upcoming November 9 report. A wire service survey is projecting 136 million smaller US corn output at 13.643 bill bu & a 40 million lower US bean crop at 3.51 bill bu. Both of these levels are very similar to our expectations. An abnormally heavy northern US snowstorm caused the USDA to resurvey its spring wheat, durum, barley and oats data for November. This prompted many in the trade to adjust their 2019 November harvested are-as. However, the USDA doesn’t normally change its acre-age levels until the final January report is issued.

2019’s US growing season has been a battle from start to finish. Last spring’s late plantings because of excessive moisture has led to a slow harvest period. October’s heavy rains have kept 2019 near 2009’s pace, the 2nd slowest ever (1992 is the slowest). Currently, corn is 2% behind 2009 at 52% & 23% behind the 5-yr average pace for Nov 3. April & May planting yields have been erratic with some near last year while other 15-20% lower. Despite corn’s Nov yield being higher than Oct in 4 of the last 6 years, Nov’s estimate really is an Oct update. We anticipate a 1.6 bu. drop to 166.8 bu. with a lower yield in Jan. Recent sluggish US exports because of heavy Brazilian activity have some expecting 50-100 million cut in exports. Normally, the USDA doesn’t adjust corn demand this month. This puts US stocks at 1.799 billion bu.

Last spring’s wet weather also impacted soybeans with late seedings. Soggy fields have slowed the harvest to 75%; the slowest pace since 1985. Despite 5 of the past 7 years of higher Nov US yields than Oct 2019 is still likely to drop 0.5 bu. to 46.4 bu. Mostly June plantings left so Jan yield likely lower. With no demand changes, US stocks could decline 40 million to 420 million bu.

If weather cuts 90 million northern acres/yield, wheat’s crop may drop 32 million with US stocks at 1.011 bill bu.

(Click on image to enlarge)

What’s Ahead

November’s US crop sizes remain important. Despite the fund/investor community eyeing the Phase 1 progress of a potential US/China trade agreement before making any moves, this month’s crop chang-es will impact available supplies. Our 2019/20 sales are 45% for corn & 50% for beans. Be prepared to advance sales 20% if Dec corn moves to $4.20-$4.30 & Jan beans advance to $9.75-$9.95 levels.