Pre-Feb US/World S&D Report - China’s Health Emergency Prompting Trade Deal Concerns

Market Analysis

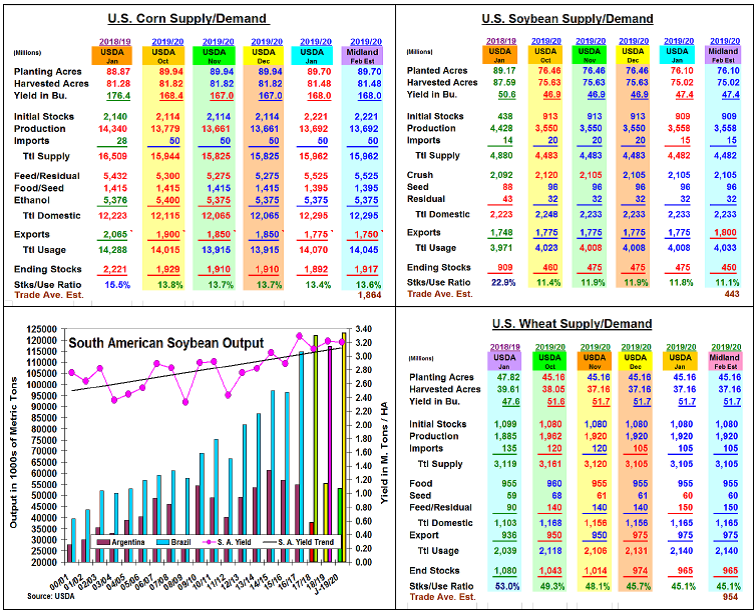

The upcoming World Output & US/World Supply/Demand reports will be updated on February 11. Traditionally, the USDA doesn't make many changes in their US and World balance sheets after finalizing the US crop numbers last month. In the past, the USDA's World Board has taken a wait and see approach in its US demand & S. Hemisphere crops projections. However, last month’s US/China trade deal has many expecting some demand signs of how the Chinese might reach their $40 Billion ag commitment.

Things to consider: (1) the trade deal levels are for calendar - not crop year periods (2) Feb 15 is the effective date for the trade deal (3) China’s coronavirus health event has rightfully switched Beijing’s attention from trade and (4) S America’s first crop prospects are looking good. Because of these factors & no recent Chinese purchase, we expect the USDA to be conservative on their 2019/20 demand re-visions. The USDA’s Feb 20 & 21 Ag Outlook Forum is the likely event when they reveal their economic impact of the trade deal on the US 2020/21 Supply/Demand sheets.

Despite ideas of 2 mmt of Chinese corn buys in 2020, the current sluggish US export pace has us concerned. Given the current 50% sales pace (3rd slowest in the past 15 years.) vs. the USDA export forecast on Jan. 30 sug-gests they could leave corn’s overseas demand at 1.775 billion bu. or reduce it by 25 million this month. No change in either ethanol or feed usage is likely. Overall, corn’s US ending stocks could rise by 25 million bu. to 1.917 billion.

After a delayed start, Brazil’s improved weather & early harvest reports suggest 1-2 mmt jump in the USDA’s 123 mmt soybean crop. However, this year’s 190 million jump over 2019’s shipments by Jan 30 suggests a possible 25 million bu. increase in exports to 1.8 billion bu. This could mean a drop in US 2019/20 bean stocks to 450 million bu.

With limited impact from the recent US/China trade deal and US wheat exports continuing on their seasonal path, no change in the US Supply/Demand levels are expected this month.

(Click on image to enlarge)

What’s Ahead

Talk of Chinese grain deal details being revealed on the USDA Feb 11 update are circulating. However, we are cautious their purchases maybe late 2020 & during 2021 suggesting the USDA’s update may come at Ag Outlook Forum on Feb 20 & 21. Coronavirus remains a cloud. Utilize March rallies to price 10% of your corn & beans at $3.88-90 & $9.25 and 15% of your new crop output at $4.00-05 & $9.40.