Platinum: More Selling Pressure Favored To Follow Breakdown

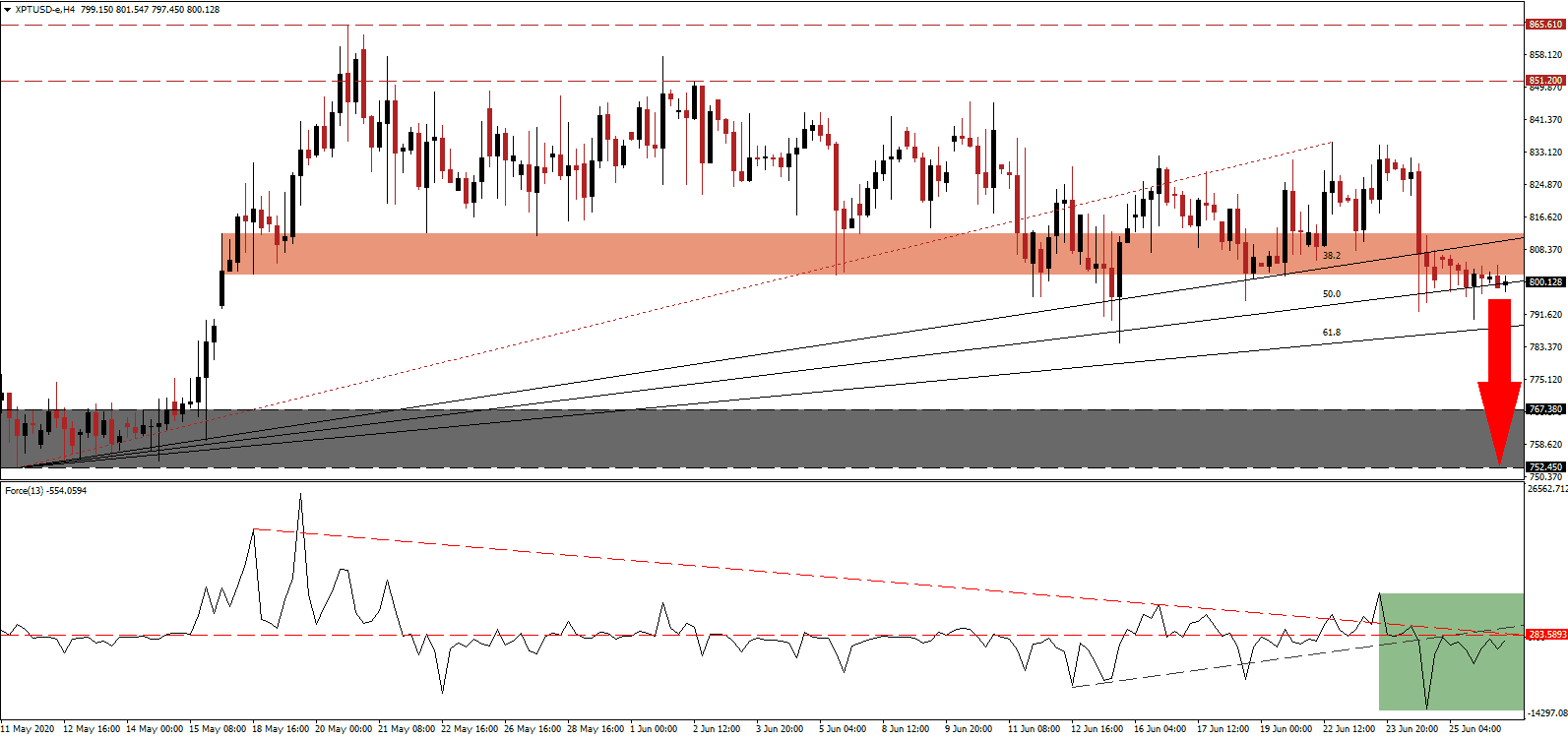

Platinum extends its correction as the global economic outlook remains grim and is continuously revised to the downside. South Africa supplies approximately 70% of the world’s platinum, but the nationwide lockdown halted production. It resulted in three significant miners, Anglo American Platinum, Sibanye Stillwater, and Impala Platinum, to declared force majeure on existing contracts. It allows miners to avoid certain conditions of the legally binding agreements due to unavoidable circumstances and highlights the supply chain disruptions caused by the Covid-19 pandemic. More selling pressure is favored following the breakdown in the XPT/USD below its short-term resistance zone.

The Force Index, a next-generation technical indicator, dropped to a new multi-week low before reversing. It now faces rejection by its horizontal resistance level, as marked by the green rectangle. After the Force Index corrected below its ascending support level, bearish pressures expanded, while the descending resistance level exerts additional downside momentum. Bears are in control of the XPT/USD, following the move below the 0 center-line.

With global demand low, the nationwide lockdowns in South Africa and the US are providing a temporary floor under the price of the XPT/USD. It prevents the market from being flooded with unwanted supply. The longer demand remains depressed, the less of a positive impact on price action the lack of supply will have. Adding to concerns is the resumption of mining with diminished demand. Platinum completed a breakdown below its short-term resistance zone located between 801.830 and 812.368, as identified by the red rectangle. The loss of 800.000 psychological support level is expanding breakdown pressures.

One positive development to monitor is the deterioration of the US Dollar. Platinum is priced in US Dollars and often enjoys an inverted relationship. While a collapse in the currency is unlikely to spark a rally in this metal, it will limit the downside potential of the correction. Price action is presently challenging its ascending 50.0 Fibonacci Retracement Fan Support Level. A breakdown is favored to spark a new wave of selling, pushing the XPT/USD into its support zone located between 752.450 and 767.380, as marked by the grey rectangle.

XPT/USD Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 800.000

- Take Profit @ 752.500

- Stop Loss @ 815.000

- Downside Potential: 4,750 pips

- Upside Risk: 1,500 pips

- Risk/Reward Ratio: 3.17

In the event the Force Index reclaims its ascending support level, serving as resistance, platinum may push higher. The uncertain demand and gradually increasing supply are adding more bearish pressures than US Dollar weakness is providing bullish momentum. Therefore, the upside potential in the XPT/USD remains limited to its intra-day high of 835.590, the end-point of its redrawn Fibonacci Retracement Fan sequence.

XPT/USD Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 822.500

- Take Profit @ 835.000

- Stop Loss @ 815.000

- Upside Potential: 1,250 pips

- Downside Risk: 750 pips

- Risk/Reward Ratio: 1.67

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals and ...

more

Disagree. Look - all indices red and platinum is up.