Peak Inflation Watch — Oil Edition

Image Source: Unsplash

There are many factors that drive consumer price inflation. Yet at the headline level, the oil factor is often the first among equals. By that standard, the recent pullback in the price of crude hints at the possibility that we’ve seen the summit for inflationary pressure at the headline level.

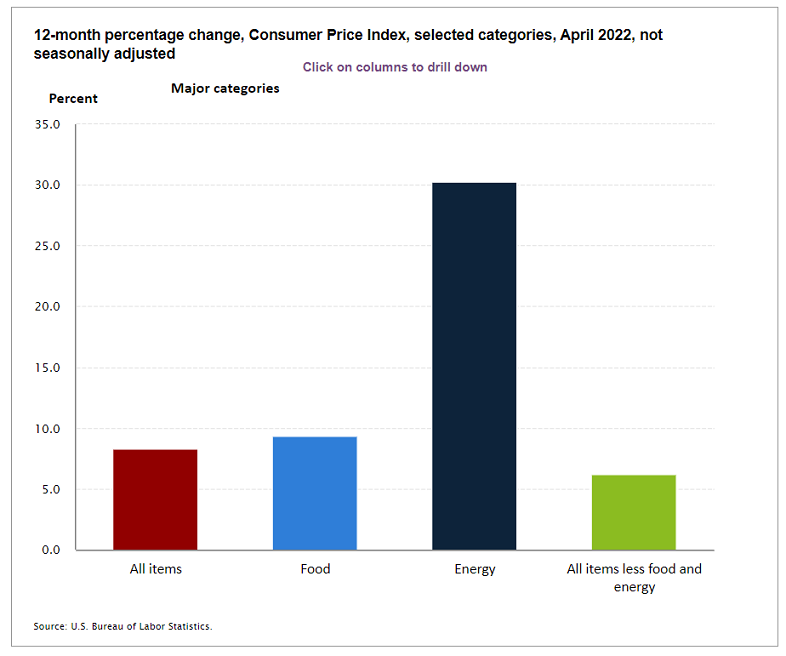

The influence of energy prices is always a significant input for consumer inflation, and that’s certainly been true recently. In the current April report on CPI, the US Bureau of Labor Statistics advises that energy was an outsized influence.

Although there’s a strong case for modeling inflation’s trend on a core basis (stripping out food and energy prices) to identify the trend, it’s still useful to monitor how headline pricing (inclusive of food and energy) ebbs and flows. On that basis, here’s a quick look at estimating headline CPI via oil.

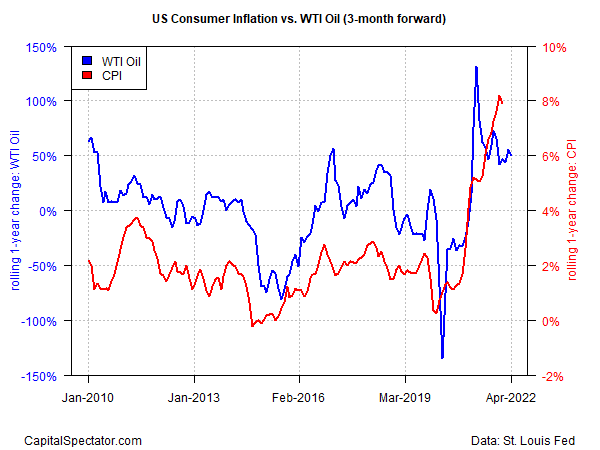

To strip out some of the noise let’s review how the spot price for West Texas Intermediate (WTI), the US oil benchmark, evolved in year-over-year terms vs. the annual pace of the Consumer Price Index (CPI) at the headline level.

On the assumption that oil prices provide a near-term forecast of CPI, the chart below compares crude on a three-month-forward basis vs. inflation. The main takeaway: the spike in oil has eased in recent months, which implies that headline CPI will decline in the months ahead.

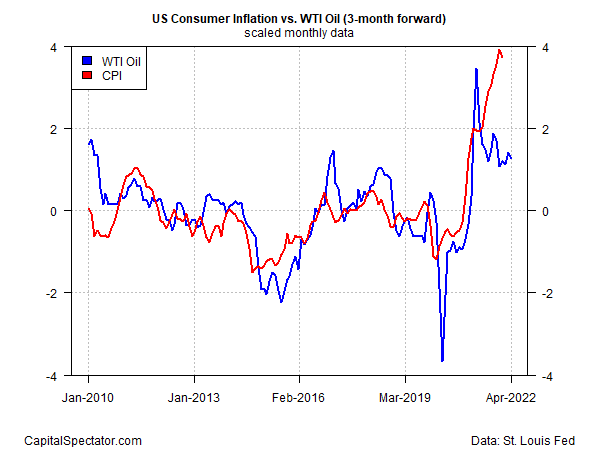

For a clearer view of the relationship, the next chart compares CPI and oil on a scaled basis so that the data is presented on a directly comparable level.

Despite the close relationship, there’s no guarantee that inflation will soften in the near-term. Even if it does, inflation still looks set to remain high relative to the pre-surge period before the pandemic.

It’s also possible that energy markets will spike again because of the Ukraine war or some other factor that affects global oil supplies. But for the moment, the energy market appears to be foreshadowing a moderately lower rate of headline inflation in the near-term.

Disclosures: None.