OPEC+ Set To Start Easing Cuts

OPEC+ surprised the market at the end of last week. Expectations heading into the meeting were that the group would rollover cuts. But instead, the group has agreed to increase production by a little over 2MMbbls/d between May and July/

What did OPEC+ agree?

The recent pressure that we have seen on the market, along with growing Covid-19 cases in some regions led many to believe that OPEC+ would rollover current cuts when they met at the end of last week. However, de facto leader, Saudi Arabia, continues to surprise the market, and the group agreed that they would start to ease production cuts from 1 May.

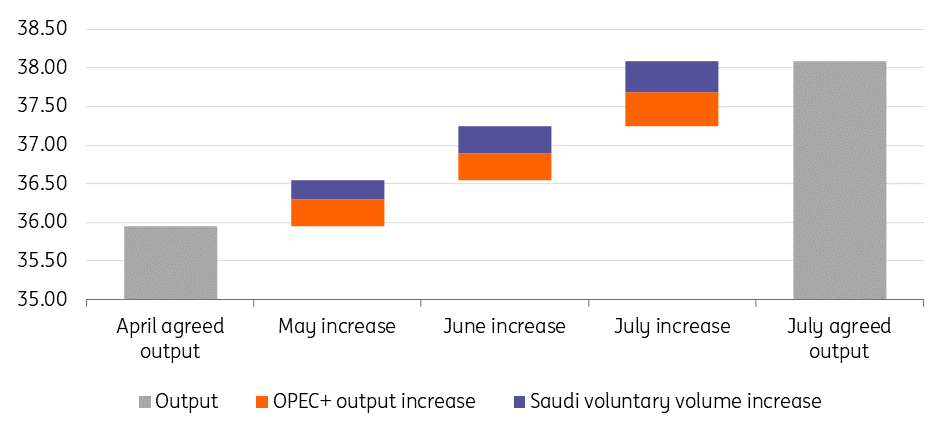

OPEC+ will ease cuts between May and July by 1.14MMbbls/d, with production increasing gradually by 350Mbbls/d in both May and June, and then a further 440Mbbls/d in July. Back in December 2020, the group agreed that any easing would be limited to 500Mbbls/d per month, so the latest move leaves the increases within this limit.

However, in addition to OPEC+ gradually increasing output, Saudi Arabia will also start to bring back the 1MMbbls/d of production that it has voluntarily cut since February. The Kingdom will bring 250Mbbls/d of this supply back in May, 350Mbbls/d in June and finally 400Mbbls/d in July.

There likely would have been some pressure within OPEC+ to start easing production cuts, with suggestions that some producers were not too happy that Russia had been allowed to ease cuts, whilst others have had to keep output unchanged since January. Had the group not agreed to ease, we might have started to see compliance slipping as producers became increasingly frustrated.

It would not only have been internal pressures pushing for an easing of production cuts. External pressures have also been growing. India has been fairly vocal about the group’s production cuts for the last several months, calling on the group to increase output. In addition, the US Secretary of Energy had a call with Saudi energy minister, Prince Abdulaziz bin Salman al-Saud ahead of the OPEC+ meeting, where she highlighted the “importance of international cooperation to ensure affordable and reliable sources of energy for consumers.”

OPEC+ agreed output increases between May and July 2021 (MMbbls/d)

(Click on image to enlarge)

OPEC, ING Research

How has the market reacted?

Surprisingly, despite the market broadly expecting a rollover of cuts, prices have held up well. In fact, following the announcement, ICE Brent traded higher. This suggests that there is an element within the market that may be taking this easing as a positive signal for demand. The action taken suggests that the group has confidence in the demand outlook for the remainder of the year, particularly as we continue to see a pickup in vaccination rates.

In addition, this easing is not set in stone. If for any reason, the market comes under pressure in the weeks ahead, the group could reverse their decision when they next meet on the 28 April.

What does this mean for the outlook?

Despite OPEC+ agreeing to gradually increase output, the market is still set to draw down inventories over the remainder of the year. Although this drawdown will not now happen as quickly as the market was anticipating ahead of the OPEC+ meeting. As a result of these drawdowns, and given that the group could reverse their decision at their next meeting if needed, we have decided to leave our price forecasts unchanged. We continue to believe that the market will remain well supported and see ICE Brent averaging US$70/bbl over the second half of this year.

The obvious risk to this view is if demand does not recover as expected over 2H21. We are forecasting demand over this period to be around 6MMbbls/d higher YoY, which would leave it averaging around 98MMbbls/d over the last 6 months of this year. This is still more than 2.5MMbbls/d below 2H19 demand levels.

The other risk for the market is further supply increases from Iran. Iranian shipments have been increasing in recent months despite US sanctions, and preliminary numbers from a Reuters survey suggest that Iranian supply increased by 210Mbbls/d MoM to average 2.3MMbbls/d in March. Furthermore, in recent days, there has been growing noise that the US and Iran could hold indirect talks, which has the potential of seeing the US return to the nuclear deal. If this were to happen, it also increases the possibility that we finally see US sanctions against Iran lifted, allowing for further growth in Iranian oil exports. However, in our balance sheet we are already allowing for further increases in Iranian supply and assuming 3MMbbls/d of supply by the time we get to 4Q21. Despite this increase our balance sheet continues to suggest a drawdown of inventories.

ING oil price forecast

ING Research

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more