Oil Update - Wednesday, July 7

“Davidson” submits:

- US Crude Prod unchanged at 11.1mil BBL/Day, US Net Crude Imports fall 0.8mil BBL/Day, US Crude Inv falls 7.6mil BBL

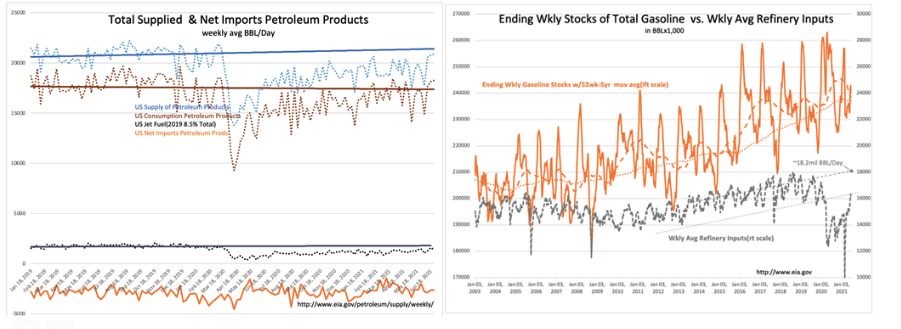

- US Gasoline Inv rise ~1mil BBL, US Exports Refined Prod unchanged, US Refinery Inputs unchanged, Jet Fuel consumption unchanged

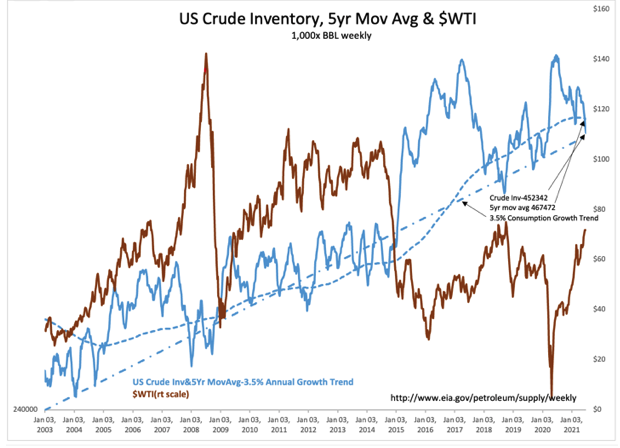

US Crude Inv continues to be drawn lower and is now 3mil BBL away from falling below the 3.5% Growth Trend Line representing low inventories since 2003. The trend’s value this week is 449,005Mil BBL meaning that current inventories are less than 1% above this 18yr trend line. The fact that US Consumption of Refined Products has normalized without normalization of Jet Fuel with TSA passenger traffic rising sharply is a strong indication we are headed to a fossil fuel deficit as economic activity expands.

The history of $WTI prices has a historical pattern of rising when US Crude Inv have been this low. The price rise has typically continued till inventories regained a ~10% above this trend line, or ~50mil BBL higher than today. In my experience and reading of headlines over the period, rising prices build over time and have not resulted in higher production as if one could turn on a spigot. Producers require a period of rising prices to commit capital to exploration and the exploration process requires a period of trial and error even with the advanced technology developed in recent years. There can be a delay of several years for production rising to quell investor fears of insufficient supply, Much is dependent on investor perceptions of economic demand, alternative supplies and the timing required for something deemed out-of-balance to come back into balance. That the futures market, 10x larger than the $WTI cash market, reflects market psychology more than it does actual Supply/Demand. It should not surprise anyone that once fears accelerate that we are decently behind the Supply/Demand curve, the futures markets have the potential to drive $WTI to historical levels.

At the moment, prices in the mid-$70s have not stimulated additional crude production as crude inv continue to fall into historic low levels. At the moment many continue to believe oil for fueling transport is being phased out by vehicles operating on batteries when this technology remains at best nascent despite the media focus on Tesla. Essentially 100% of modern global transport of goods and people is powered by fossil fuels. There are no viable alternatives currently nor on the immediate horizon.

The lack of investment in fossil fuel infrastructure has hidden from public view existing major technology advances. Mostly unrecognized by investors has been the positive impact these advances have had on E&P cash flows as companies dealt with uncertain economic ebb and flow and ESG themes reducing capital available. One industry insider told me privately they saw the current environment as a “Perfect storm!” for the coming industry profitability.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more