Oil Update - Wednesday, July 10

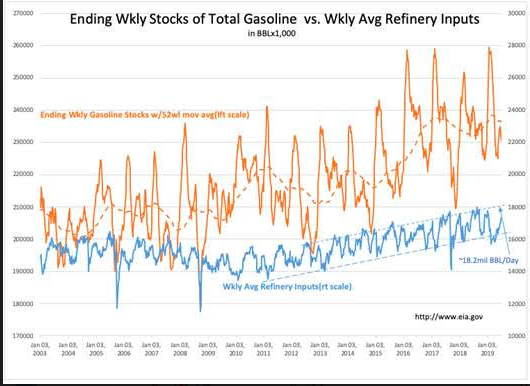

The numbers below do not take into account Exxon restarting Baytown very soon that will take another 600,000bbl/day off the market.

“Davidson” submits:

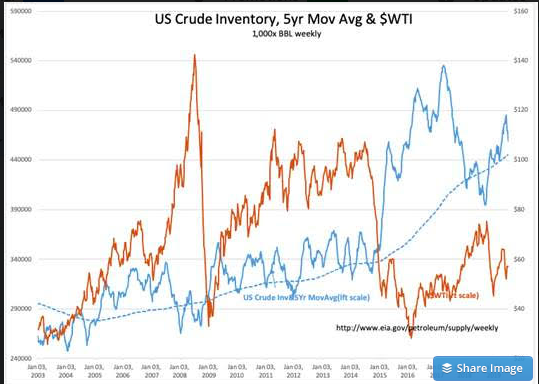

US Crude Inv falls 9.5mil BBL & Gasoline Inv fall 1.5mil BBL With this report, US Crude Inv sits ~13mil BBL above its 5yr mov avg. In the next few weeks, we could easily see US Crude Inv fall well below its 5yr mov avg.

These declines reflect summer travel demand which rises seasonally. Refining inputs continue to remain ~800,000 BBL/Day below peak trend line usually seen at this time. The deficit in refining occurred with outages due to mid-west flooding earlier this spring, spring maintenance, a large fire in a NJ refinery (likely a permanent reduction) and notably Exxon’s Baytown unit of ~600,000 BBL/Day upgrade that later had a fire and only recently announced coming back on line later this week.

The US Oil Situation has many parts which can have issues and is why US Crude Inventories tend to be between 20-25days of refining demand. The primary feature of oil pricing seen since 2009 has been the correlation of US Inventory with its 5yr mov avg. Even though global demand/production has risen a fairly steady 1.75% annually, we have witnessed significant price swings whenever current US Crude Inventories rose above or fell below its 5yr mov avg. This occurs because traders swing from believing markets are seeing an ‘oil glut’ to ‘oil shortage’ as their primary measure is this correlation.

At this point, it appears oil traders remain sensitive to this relationship. It is expected that once Exxon’s Baytown unit comes back on line, we should see a significant fall in US Crude Inv below its 5yr mov avg as gasoline inventories are rebuilt back to seasonal levels. We should expect that traders will respond with significantly higher oil prices the next couple of months.

Recent equity investor pessimism has been correlated with the belief that higher US Crude Inv reflected slowing economic activity. Investors have mistaken rising crude inventories as an economic indicator when this was in fact due to an unusual period of refinery outages. It is likely that falling US Crude Inv will be met with higher oil prices and improved equity investor psychology regarding global economic activity.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more