Oil Price Effect On Industrials

“Davidson” submits:

Market psychology sets market prices. It is based on investor perceptions of the moment. It has a ‘will-of-the-wisp’ quality. It is always at work in one direction or another with investors chasing themes believed to produce portfolio gains.

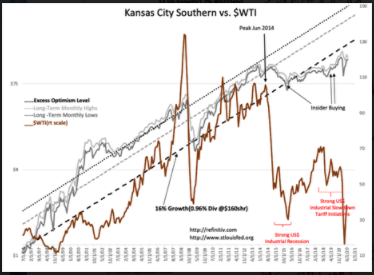

Oil prices (WTI) vs. companies exposed to industrial sectors in the US provide a good example of the impact of market psychology. With the emergence of computer-driven algorithms in the past 20yrs, more capital has been shifted with correlated price trends than ever before. The need for execution speed and quarter-over-quarter performance measurement, even day-vs-day performance in some instances, has meant less capital is subject to fundamental valuation analysis as investing on price trends rises. Some of this is clearly evident in the relationships of industrial companies with WTI. Linde (LIN) and Kansas City Southern (KSU) are good examples.

Linde (LIN) and Kansas City Southern (KSU) have posted superior equity performances for more than 20yrs and in turn, investors have responded with superior share total price/dividend returns of 15%+ vs. the SP500’s ~6%. Over the years, investors have used shifts in oil prices to judge cash flow shifts in companies within related sectors and anticipate future business spending. Oil prices in turn, through the futures market, have been used by portfolio managers to hedge against perceived inflationary pressures, geopolitical events, currency swings and anticipated shifts in general economic activity. The futures market for oi is roughly 10x larger than the actual amount of oil produced/consumed. In the early 2000s, oil prices which had relatively little correlation to the prices of LIN and KSU have gradually developed a stronger relationship. Since 2014, lower WTI is correlated to lower valuations for LIN and KSU even as these companies report record Revenue and Gross-Operating-Net Income Margins. Sudden declines in oil prices resulted in short term negative impacts on industries LIN and KSU serve but adjustments were made and their respective financials recovered. While financials have not only recovered but posted new records for these companies, oil prices have not recovered and neither have investor perceptions.

Market psychology always has a level irrationality. It comes from the differences in perception of Momentum Investors(price trend followers) and Value Investors(fundamental metrics investors). Momentum Investors believe in the French-Fama ‘Efficient Market Theory’ which states that market prices are established by public and non-public information and fairly and nearly instantaneously reveals underlying economic trends. Said differently, Momentum Investors believe that markets are the smartest indicator available and predict future economics better than any other indicator. Value Investors can point to thousands of examples in which there is little correlation between economic/business fundamentals and market prices as a counter-argument. It is an age-old argument that occurs every market cycle. Markets are a composite of investor perceptions spanning a wide range from those of the Momentum camp to the Value camp. Each is firmly convinced of its own approach.

In my experience, every market price has elements of Momentum and Value investing. The recommendation is to recognize the influences of each approach and to buy portfolio positions using Value investing but sell using Momentum investing to take advantage of each. One needs to be patient in the process. To be out of favor to the degree issues such as LIN and KSU are today, has taken several years of deterioration of market psychology. To come back in favor will likewise take several years of financial outperformance to convince investors that future returns are assured enough to build optimistic perceptions.

(Click on image to enlarge)

(Click on image to enlarge)

LIN and KSU remain suggested portfolio additions. Business is good and looks to continue in the context of falling regulation, lower domestic taxation and initiatives to reduce global tariffs. Good gains have been achieved thus far but better returns appear yet ahead as market psychology turns more optimistic and these companies shift back to trend valuations.

Buy on Value, Sell on Momentum.

Buy where skilled corporate insiders who are the best informed Value Investors are most actively buying.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests ...

more