Oil, DUC’s, Retail Sales And Inflation

It’s really odd seeing the media coverage and then looking at the data. The media tells us oil companies are not drilling, the data tell us something very different. They tell us Putin is responsible for inflation but the facts there also tell us something very different.

Always follow the data and not the commentary from the media.

“Davidson” submits:

My outlook is opposite to consensus opinion. Typically the facts do not support the consensus view in most instances if one looks closely enough. In the history of investing, if the consensus is correct, then there are no investment opportunities. This has never been the situation.

Baker Hughes Rig Count:

The Baker Hughes Rig Count reports 4 new rigs, 2 oil/2 gas rigs. The lack of correlation with any factor other than maintaining production near current levels is all one can interpret. There is a report of a surge in Permian Basin permits where it is generally accepted that drilling is most efficient vs production. The Permian Basin also reports the largest reduction of DUCS(Drilled Uncompleted wells) since June 2020.

Drilling activity remains on pace since Jun 2020 as evidence continues to build that supply is falling well behind global demand.

Real Retail Sales report today:

Real Retail Sales are holding at high levels. Real Personal Income, after the recent spike, has normalized to the trend from 2009. Note that Trucking Tonnage is picking up as a signal that supply chain issues may be easing.

These are good signs for economic expansion while fear of recession remains rampant. Recent corrections in transport and consumer discretionary issues represent opportunities.

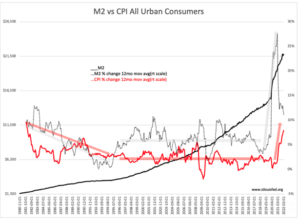

M2 vs Inflation:

The commentary connecting M2 to inflation is in every other headline of late. The history from 1990 reveals a correlation but not one that is perfect. The issue is who is creating the M2 vs who is spending it and what is behind the spending. This is not unique to the US as the concept is the same regardless of country. The two entities that create M2 are lending institutions and governments. The recipients of this lending are businesses and government. On the business side, borrowed funds are used to bring innovation to society in the form of products/services which are faster-better-cheaper replacing older options. This is lending to advance society’s standard of living. If successful, businesses generate enough profits to pay the debt off in full and in the process turn debt to equity adding a greater value to the economy than valued borrowed. The addition of value that is greater than the M2 created by borrowing is deflationary. On the government side, funds are used for implementing regulations, social support programs. Government also spends based has political agenda of politicians in the majority at the time. While regulating “fairness” in society has value, many government actions are criticized as not adding value. It is when government spending rises but does not add societal value that M2 expansion proves inflationary. Businesses are deflationary, governments are inflationary.

The chart begins in 1990 due to a new M2 definition. The inflation down tend actually began in the early 1980s after Fed Chair Volcker clipped inflation with a period of high rates and Pres Reagan made drastic cuts to government regulation. Inflation and M2 remained in relatively steady controlled trends till 2020-2022 with diminishing efforts by government to sponsor socially engineered spending. There was even a period called “The Sequestration” when government discretionary spending fell ~2% annually in Real terms resulting in the lowest sustained inflation in 50yr+.

The current rise in M2 2020-2022 from government issuance of debt is guaranteed to be inflationary for several years at best. Those who speak of “peak inflation is behind us” have little sense of history. Investors should have equities that respond well during inflationary periods i.e., energy and energy-related, infrastructure-related, transport, and suppliers of other vital goods and services where inflation adjustments are passed through.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more