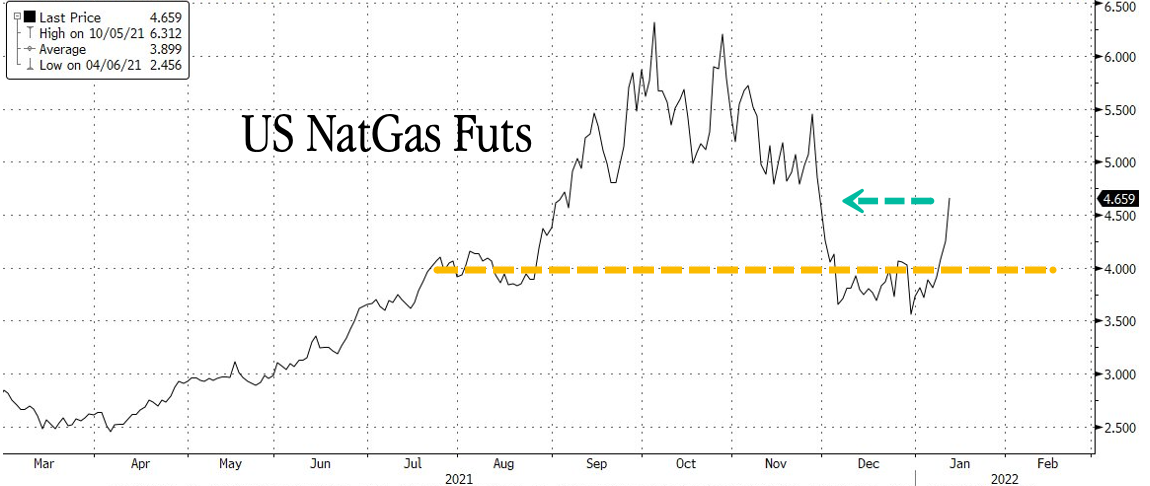

"No One Wants To Be Short" - US NatGas Futures Erupt As Cold Sweeps East Coast

U.S. natural gas futures jumped to levels not seen since early December amid a cold blast across the eastern U.S. and new threats of a winter storm over the weekend.

Futures for February delivery soared 9.5% to $4.66 per million British thermal units, the highest price since Dec. 1.

(Click on image to enlarge)

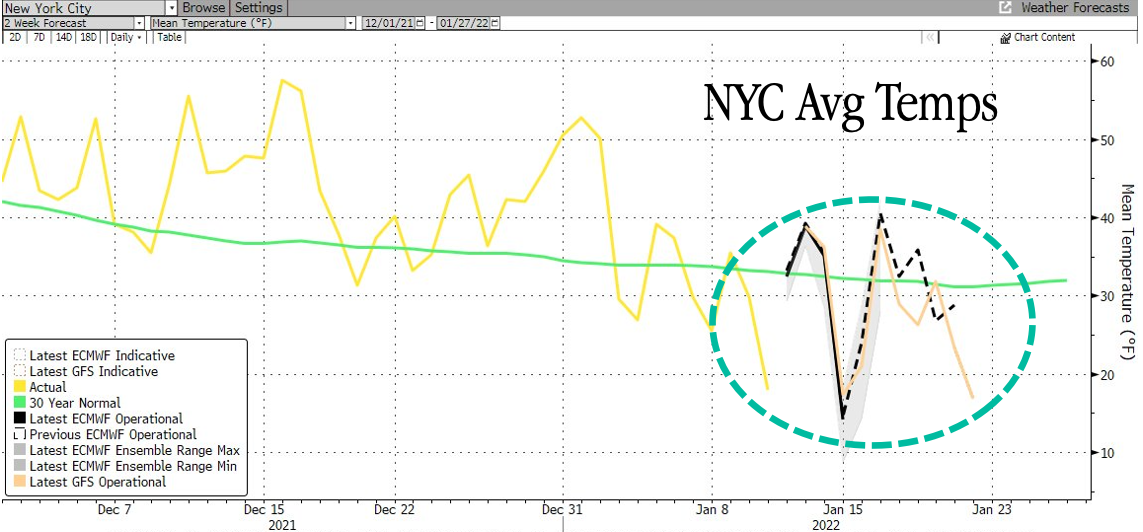

In a weather forecast Tuesday, we noted that some of the coldest air in years is pouring into parts of the U.S. Major metro areas across the East Coast are seeing frigid temperatures, which are boosting heating demand.

Average temperatures in NYC are expected to be well below the 30-year average through the end of the month.

(Click on image to enlarge)

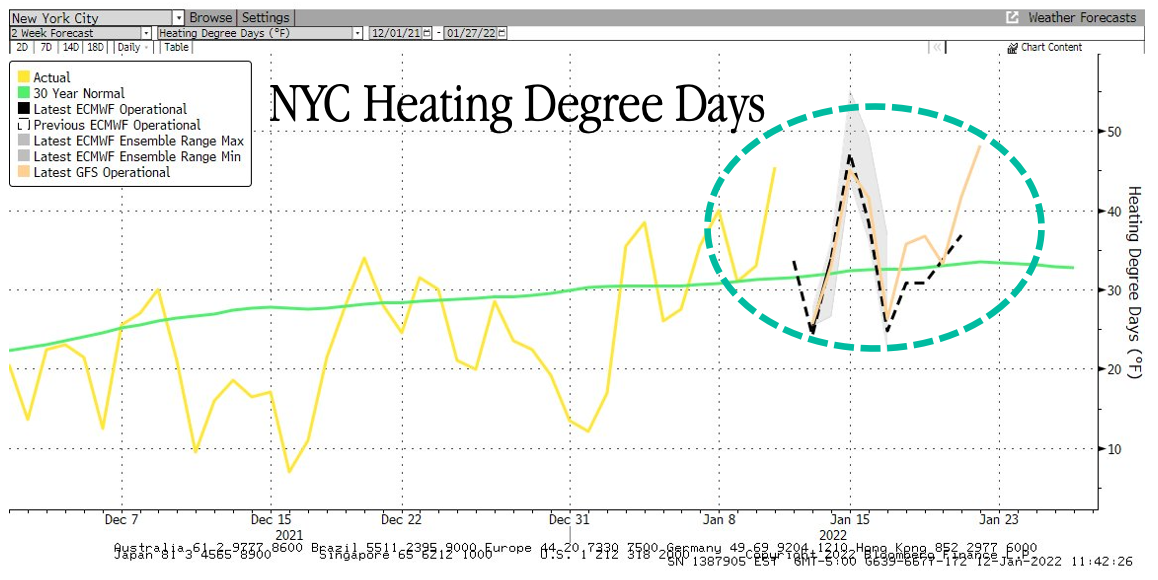

Heating degree days for NYC will be above normal through the second half of the month -- this means heating demand will soar.

(Click on image to enlarge)

Dennis Kissler, a senior vice president at Bok Financial Securities Inc., told Bloomberg that the move in gas prices is "about short-covering and how much colder weather can get into January through February."

"Add in the tight supplies in Europe that may bleed over to Asia, and no one wants to be short," Kissler said.

"Front-month futures reached the highest seasonal price since 2010. Traders holding bearish positions are buying to close out their bets as the price crossed both the 200- and 50- day moving averages, which are bullish technical signals. The risk premium is being added back to winter gas prices, with the front-month contract advancing at almost twice the pace of April futures," Bloomberg said.

We haven't been keen on more widespread/notable cold for the upcoming 5 - 10 day period (see latest blended forecast below), but the signals beyond that are more intriguing for stronger and more expansive cold potential (end of week 2 bias-corrected NAEFS shown). #Energy #NatGas pic.twitter.com/btDH9NqCKK

— BAMWX (@bamwxcom) January 12, 2022

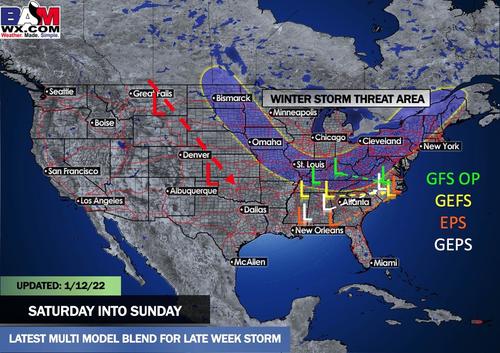

For the last several days, meteorologists at private weather forecasting firm BAMWX have been outlining the rising risks of another winter storm for the East Coast over the weekend. So far, models don't show the exact track, timing is still vague, rain/snow line is still not determined, and heaviest snowfall regions have yet to be identified.

On an international front, the spread between European gas and US gas is coming in after reaching a record high last month. The reason for the reversal is that US prices are soaring on freezing weather. Meanwhile, EU prices are slumping due to rising imports of LNG which is offsetting a slump in Russian pipeline supply.

(Click on image to enlarge)

For more than a month, we've been tracking the increasing possibilities of a significant cold weather pattern in January that would "spark a bullish reversal" in gas. It appears that day has arrived as speculative buyers are also helping to drive the rally in gas higher.

Disclaimer: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more