Navigating The Collapsing Oil Market

To the list of previously inconceivable events, add Texas oil drillers asking for their regulator to impose production curbs. Pioneer Natural Resources (PXD) and Parsley Energy (PE) filed a request with the Texas Railroad Commission (RRC) to hold a hearing on the state’s oil and gas production. It’s over 40 years since they last considered such a move.

The U.S. energy industry has been hit with a 1-2-3 punch – coronavirus demand destruction; collapse of OPEC+ limits on output; Saudi Arabia’s launching a price war while increasing exports.

Senator Ted Cruz (R-TX) described a call between nine U.S. senators and the Saudi ambassador complaining about “economic warfare”. The Saudis blame Russia. “The Saudis are hoping to drive out of business American producers, and in particular shale producers, largely in the Permian Basin in Texas and in North Dakota,” Cruz told CNBC. “That behavior is wrong, and I think it is taking advantage of a country that is a friend.”

The petition to the RRC from PXD and PE included recent presentations from two energy consulting firms that paint a dire picture.

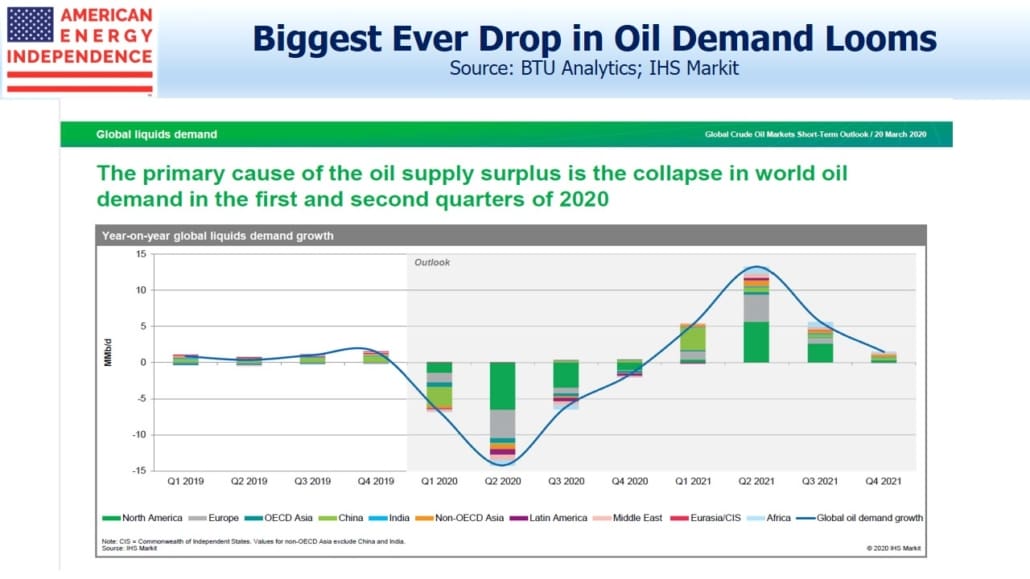

IHS Markit is forecasting a drop in global demand for crude oil of 14.2 Million Barrels per Day (MMB/D), and a 7.2 MMB/D drop for the year. This is far more than the drop during the 2008 financial crisis. The combination of collapsing demand and rising supply is filling up available global storage capacity, which is estimated at 1.3-1.6 billion barrels, assuming the excess oil can be moved there. The 1H20 forecast crude surplus of 1.8 billion barrels will use this all up.

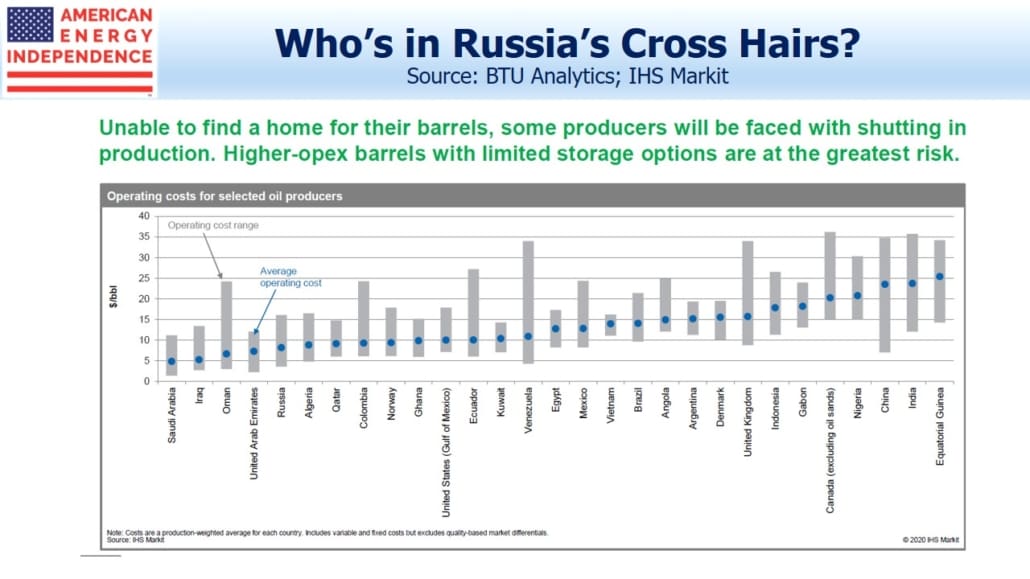

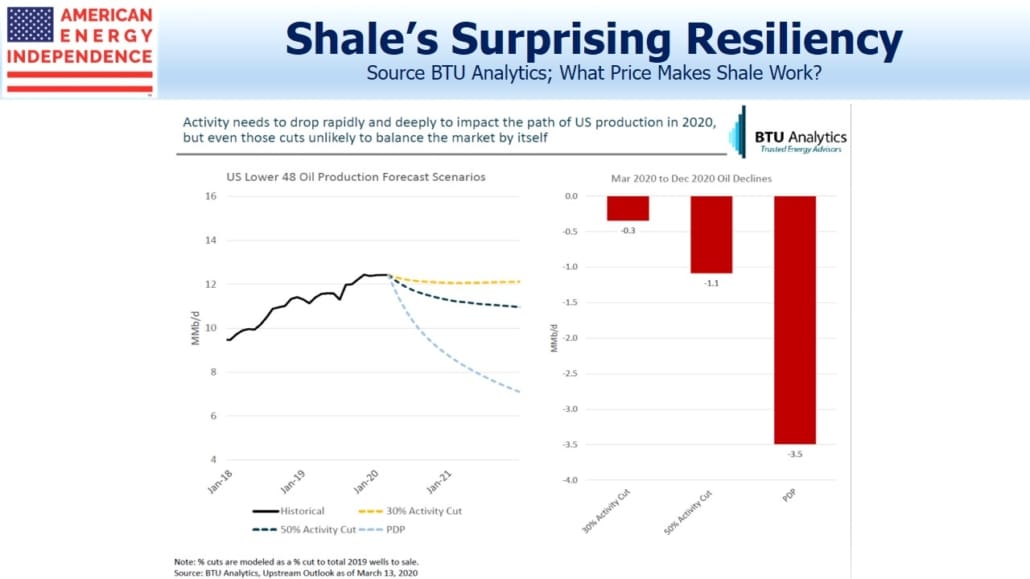

Producers around the globe are already shutting in production, which can cause permanent damage to a reservoir depending on its structure. Shale oil production is easily curtailed through sharp decline rates by simply reducing the number of new wells drilled and completed. Once producing, a shale well’s operating costs are very low. Lifting costs (meaning the cost to produce after the well has been drilled) are just $3-5 per barrel. So this type of production is unlikely to be shut-in. New wells drilled will drop sharply, causing U.S. shale output to fall mostly through curtailed drilling of new wells and the normal fast decline rates for existing wells. The breakdown of OPEC+ has made many other producing regions in the world unprofitable. Even Russia may need to start shutting-in production as spot prices drop below $15 a barrel.

The decision to drill new US shale wells to offset production declines will face a different analysis. Producers will look towards the forward curve which is currently $11 higher one year out than spot prices, to lock in hedges for wells they expect to exceed their breakeven return threshold. This slide from BTU Analytics shows that a drop in drilling activity of around 50% (which they estimate would occur with WTI prices in the mid $30s) would stabilize US production around 11 MMB/D.

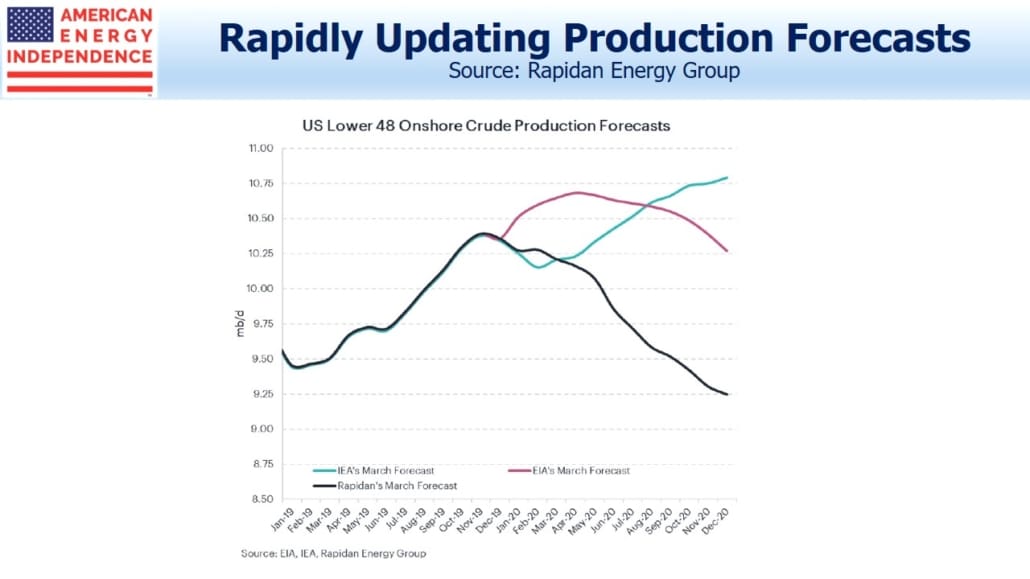

Rapidan Energy Group’s forecast is for U.S. oil production to fall by 1.25 MMB/D. The two other forecasts on the chart, from the U.S. Energy Information Administration (EIA) and the International Energy Agency (IEA), were produced only a couple of weeks earlier, showing how rapidly situations are changing. Rapidan is forecasting an even bigger drop in 2Q20 global demand, of 16.4 MMB/D, but with a faster recovery so their 7.1 MMB/D full year demand drop is close to BTU Analytics.

Current prices are ruinous for all producers. President Trump recently said he’d be discussing oil prices with Russia. He told NPR, “We don’t want to have a dead industry that’s wiped out. It’s bad for them, bad for everybody. This is a fight between Saudi Arabia and Russia having to do with how many barrels to let out. And they both went crazy; they both went crazy.”

The U.S. has limited leverage over Russia. We could curb imports of foreign oil, although that would cause problems for domestic refineries which generally aren’t equipped to handle the light grades produced by shale drillers. The U.S. military’s ongoing defense of Saudi oil infrastructure is gaining attention and seems absurd when that country’s policies are so damaging to our domestic energy sector. A single presidential tweet on the topic wouldn’t hurt.

The information provided is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Graphs and ...

more