Natural Gas: No Heating This Summer

The natural gas market rallied throughout the week, but the increase was met with resistance, as the low temperatures across the US and Europe made the first signs of spring that came up. Nonetheless, there was an increased demand this winter, as it was unusually cold this year. Combined with the decreasing gas supply, the prices, therefore, increased rapidly. For example, the production at the Waha-hub, which is a pumping hub in the Permian Basin, located within the Mid-Continental oil field, became so expensive that the price rose to $206 per million British thermal units on 16th February. This was the highest since 1995.

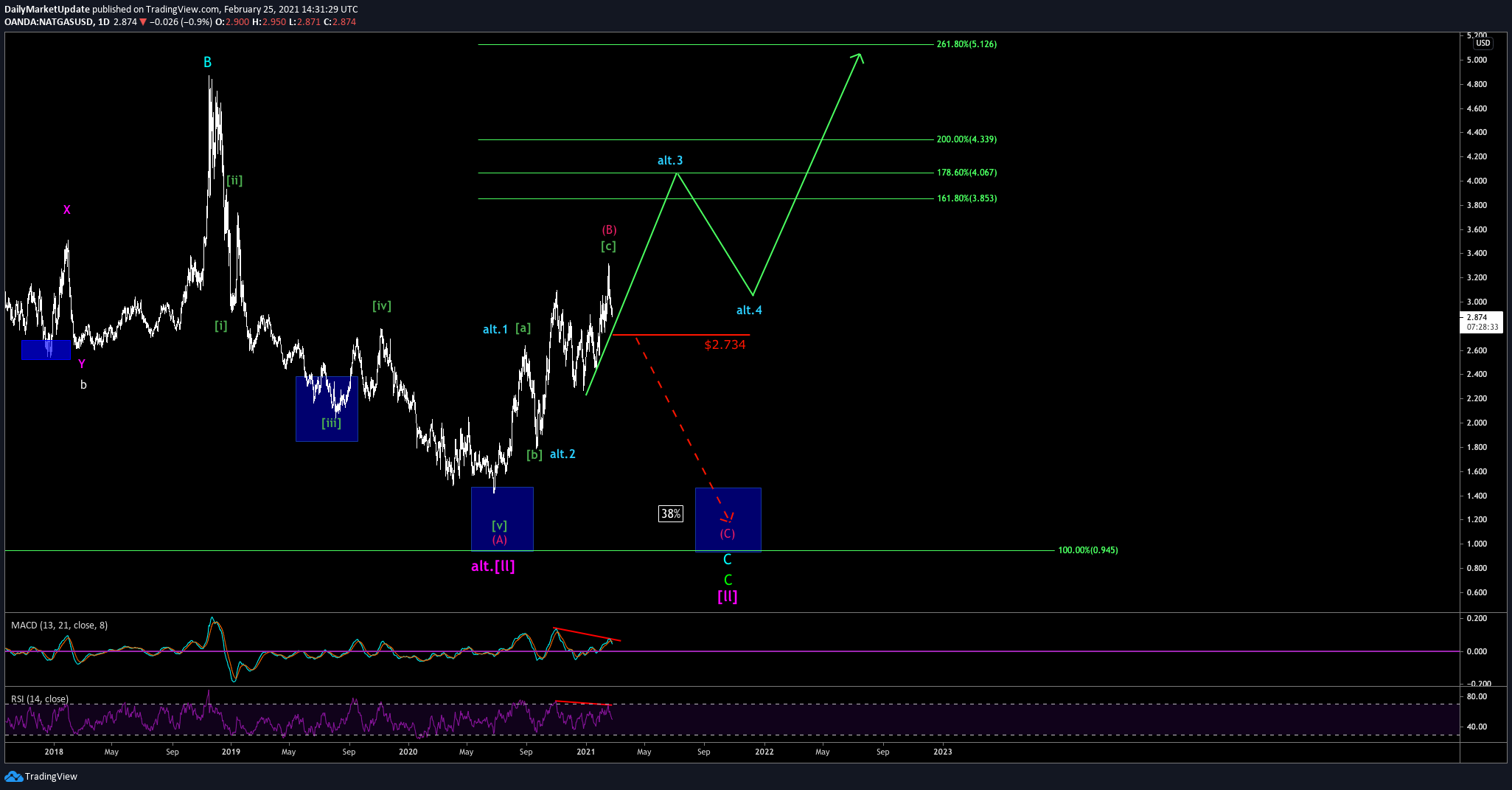

In the end, the prices dropped, and this week the market started with a minus. The most critical support line remains at $2.734. Below that level, we expect the prices to decline to $2.30 and even $2.00. From a technical perspective, as long as we don't breach that support line at $2.734, we need to expect higher prices. From a fundamental standpoint, we should bear in mind that spring is approaching, which means that the demand for heating, hence, natural gas should decline.

Natural Gas 1Day chart

(Click on image to enlarge)

To summarize, the price for natural gas is ready to tackle $3.40 if we argue from a purely technical perspective. However, the market has not fully convinced us, and fundamentally, the market will not be able to get rid of the oversupply in contrast to the longer-term sinking demand. Accordingly, the alternative scenario that aims at $2.00, with its 38% probability, remains a considerable possibility.