Monthly Markets Outlook: April Special

March has been a fairly volatile month for most asset classes, and inflation fears have been the main market driver. Equity markets managed to bounce back from a sell-off and some indices even reached a new record high - such as the Germany 30. Oil saw a heavy sell-off amid crowded positioning, and a strong Dollar has been driving the price of precious metals lower.

The start to the new trading month is likely to be subdued as many major markets will be closed on April 2nd and 5th due to public holidays. However, the rollercoaster ride is far from over yet, and in this article, we will be looking at the major themes that traders will focus on over the next four weeks.

Inflation spooking markets

Central banks around the globe have tried to calm markets down and reassure them that inflation is not something to be concerned about right now. While the Fed´s comments did help to stabilize markets, concerns about rising inflation are far from gone. The U.S. economy remains on a steady recovery path, and economic data in April is likely to signal that it is picking up momentum – starting from an NFP figure on Friday that is set to beat expectations. The recent stimulus package has been another major boost for the world´s biggest economy, and investors are keen to hear more about President Biden´s economic plan. Rising growth expectations could push yields higher, and markets would start to doubt even more that the Fed will keep rates low until 2023. Investors hate uncertainty, and an early rate hike could do serious damage to the stock market rally.

Europe's slow vaccination campaign

European equity markets have been performing relatively well considering the sharp increase in new COVID-19 cases and the prospect of prolonged lockdowns. Investors have already accepted that the current restrictions could be extended for quite some time and potentially even into the summer. The EU´s vaccination campaign had a sluggish start and frustration is starting to mount. However, market participants are optimistic that vaccinations will pick up soon, and with the general progress that has been made in the fight against COVID-19, investors are starting to see a light at the end of the tunnel, even if it is not a very bright one at the moment. However, in April markets could start to increasingly focus on the EU recovery fund, which is still facing various hurdles.

Strong Dollar

Rising U.S. yields are making the Greenback increasingly attractive. Should the economic data continue to hint at a strong economic rebound and President Biden´s economic plan strengthens the trust in the recovery, there is further room to the upside. The Euro could suffer the most in the short-term, at least until the vaccination campaign picks up some momentum. Low-yielding currencies such as the Japanese Yen and Swiss Franc are bound to remain under pressure as well. Meanwhile, Gold has lost its shine. A sharp increase in inflation would make the precious metal attractive again, but the chances for that are rather slim in the near future.

What are the charts hinting at?

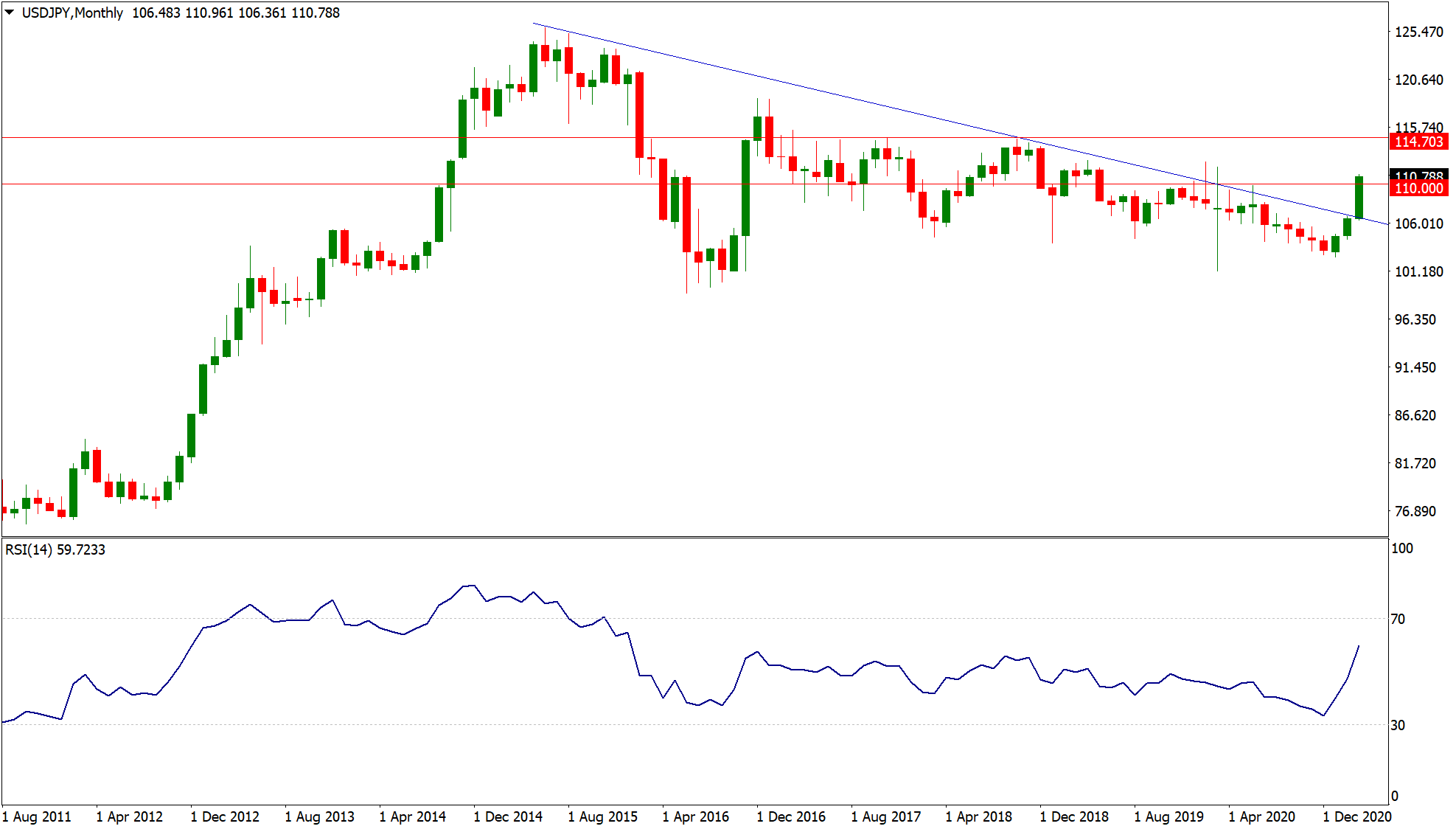

Greenback outperforming

With the breakout above the psychologically important resistance level at 110.00 - USD/JPY has cleared another major hurdle. A continuation of the rally towards 115 seems likely, although with the RSI signaling that USD/JPY is overbought in the short-term, there could be a pullback towards 109.50 first before the currency pair resumes its rally.

(Click on image to enlarge)

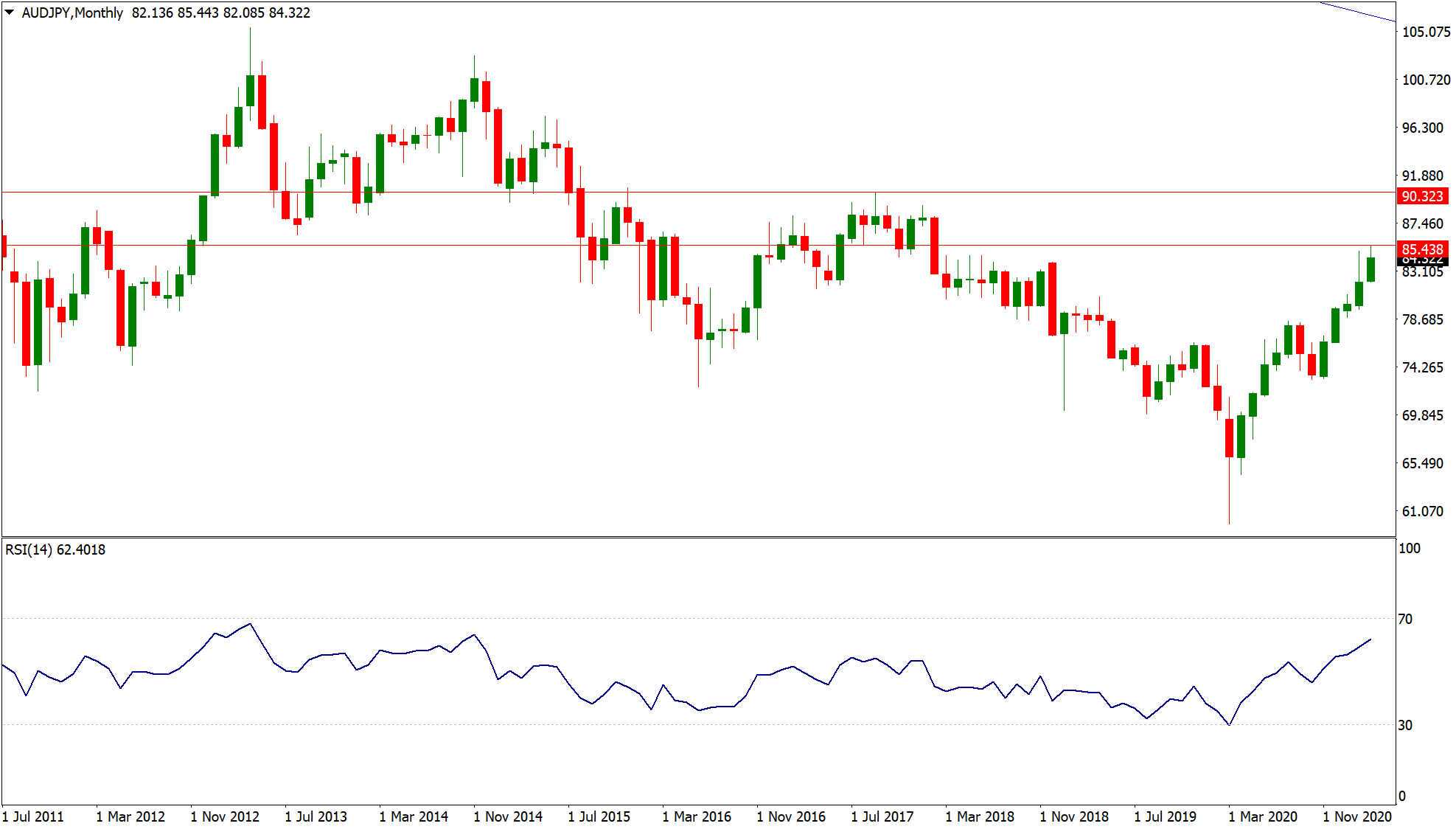

Aussie benefitting from healthy risk appetite

The Australian Dollar has been suffering from the broad USD strength in recent weeks, but risk appetite remains healthy overall, and that has been pushing AUD/JPY higher recently. Rising trendline support from the November 2020 low was kept intact, and the currency pair is likely to test the 85.50 figure within the coming days. A clear break above that level could trigger further momentum buying and pave the way for a rally towards the 90 level.

(Click on image to enlarge)

(Click on image to enlarge)

Gold - more pain ahead

Following a stellar 2020 performance, Gold has increasingly lost its shine and bulls are getting nervous. April could be another bad month as the Dollar continues to strengthen, and inflation fears are not at a level yet where investors would be rushing back to Gold as safe haven. $1676 remains a key level to defend for Gold bulls - as a breakout below that level would signal that the sell-off is far from over. The next significant support level would then lie at $1500.

(Click on image to enlarge)

Oil - further room to the upside following consolidation

Following a period of consolidation, volatility is likely to pick-up again in April. OPEC+ is not in a rush to hike its output, and the recovery for U.S. shale could take a while. This is likely to keep prices supported in the near term, and Oil could be marching back towards the $70 level over the coming weeks.

(Click on image to enlarge)

Disclaimer: The information is not to be construed as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product, or instrument; ...

more