May US/World Wheat Update - World Output Rebounds Lies Outside Of China Lowest Since 2013

Market Analysis

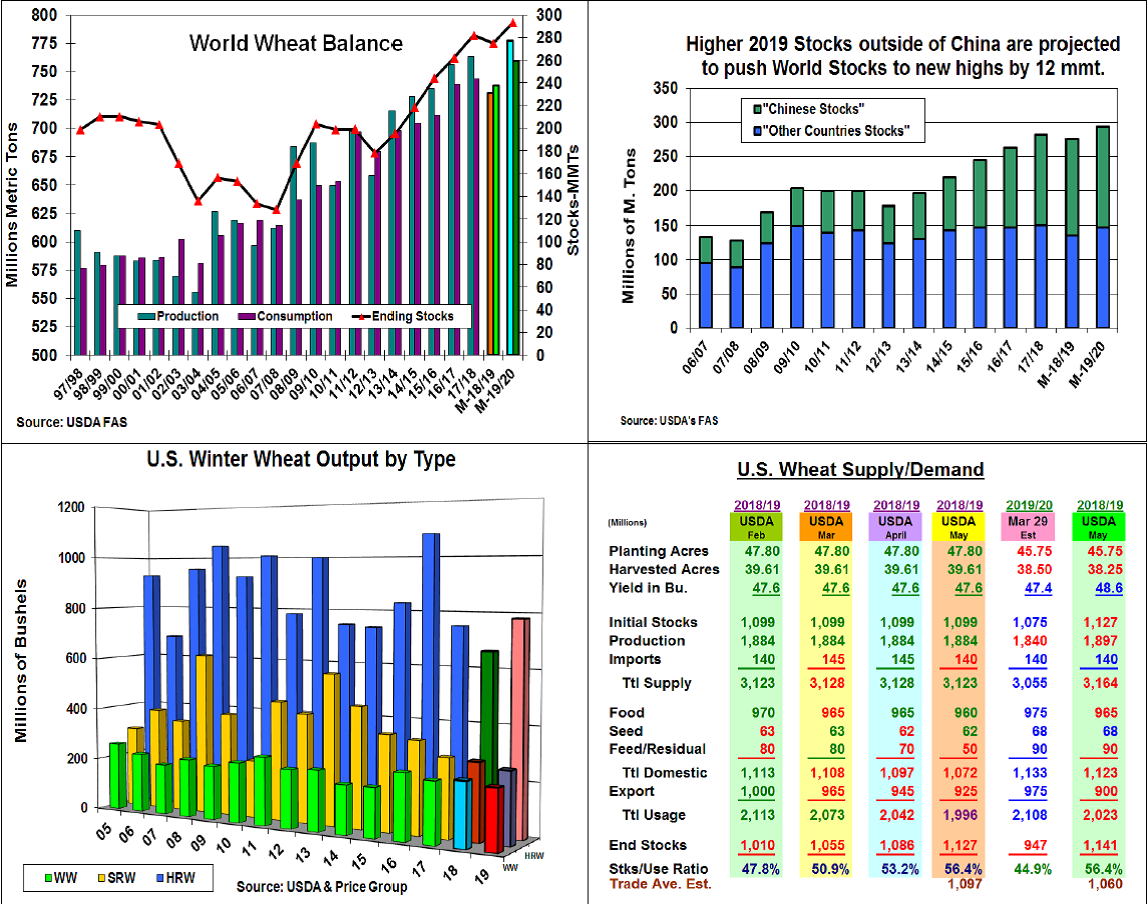

This month’s initial USDA 2019/20 world wheat stocks forecast showed a dramatic recovery from last year’s first setback since the 2012/13 crop year last week. As suspected, the Ag Department jumped its world output forecast because of projected improved growing conditions in our major world competitor’s crops. The EU’s output is forecast to jump 12% (+16.6 mmt) to 153.8 mmt while Russia (+5.3 mmt), Australia (+5.2 mmt) and Ukraine (+3.94 mmt) all are expected to have larger crops. Overall, the USDA is forecasting a 46 mmt increase to 777.5 mmt with virtually all of 2019’s added supplies coming from our major competitors. The USDA did raise its 2019/20 world demand by 21 mmt to 759 mmt this year, but the World Board’s world carryover outlook rose by 18 mmt to 293 mmt this month, a new record.

The USDA did separate China out of its 2019/20 world data to help provide clarity to wheat’s tradable supplies. However, the world’s larger output will likely increase supplies available outside of China by 12 mmt to 147.4 mmt. Overall, tradable supplies of wheat are back to their recent 150 mmt level (4 of the last 5 years).

As expected, 2019’s plentiful rainfall in the US Plains boosted this month’s first winter wheat crop estimate for 2019/20 year by 7%.to 1.268 billion bu. Production improvement in the Central Plains led by Kansas’ 46 million bu. to 323 million along with CO (+18 million) and OK (+35 million) larger crops were behind this year’s 118 million bu. rise in hard red output. This year’s cold, wet weather in the eastern US has left soft red wheat’s prospects lower at 265 million (-20 million). PNW early season heat and dryness hurt white wheat’s tiller counts prompting the USDA to cut 12 million bu. vs 2018’s crop.

Overall, the USDA slicing wheat’s US export outlook for both old and new crops this month left very adequate US ending stocks as the US harvest begins in 25-35 days.

(Click on image to enlarge)

What’s Ahead

Some recent dryness in the Black Sea wheat areas and the very oversold condition of all grain markets from the investor community has provided some post-report price stability for wheat. Overseas wheat prospects will likely be wheat’s major price factor near-term. Utilized any 12-20 cent rallies to clear any remaining old crop bushels so you can adequately store your new crop supply for a post-harvest rally.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of its ...

more