May USDA Soybean S&D Updates - Smaller Brazilian Crop Supports Corn While Protein Demand Supports Soy

Market Analysis

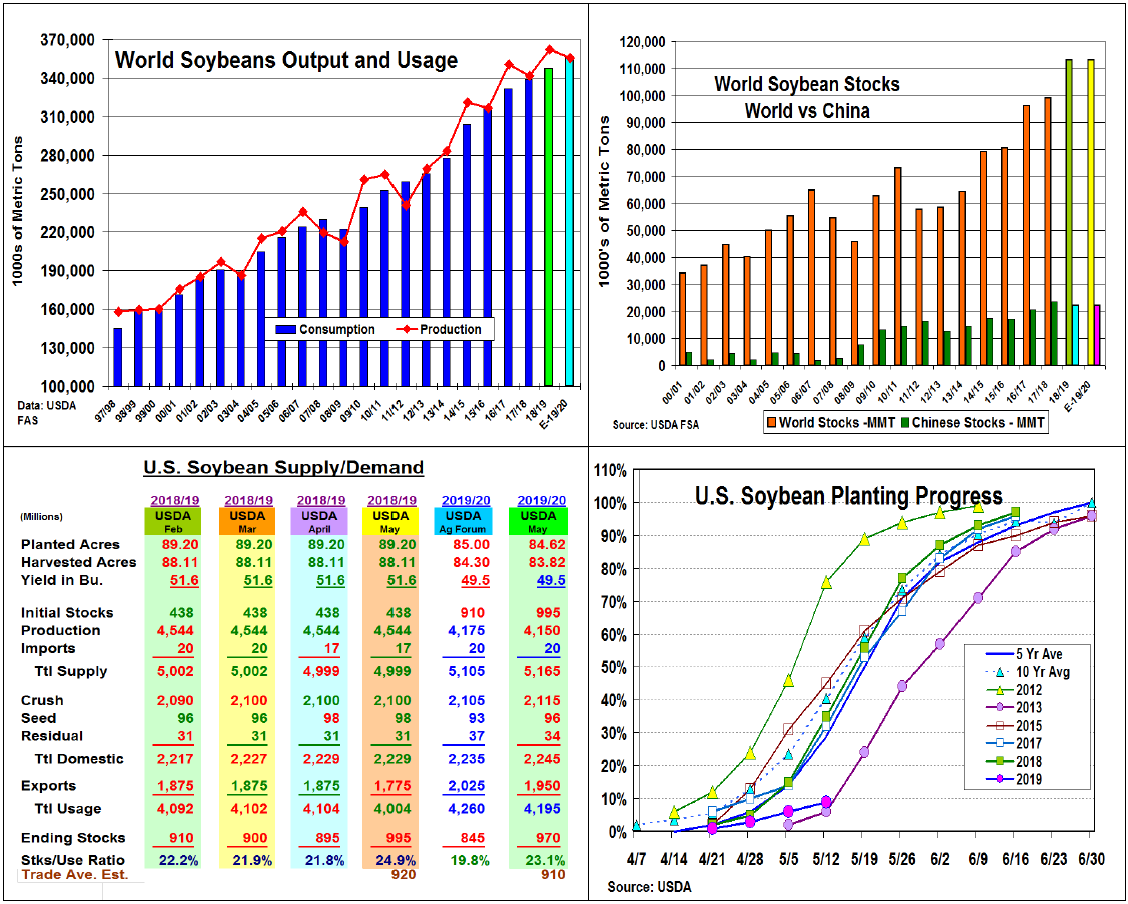

The USDA’s latest supply/demand revisions had some twists in both soybeans old and new crop balance sheets in their US and World updates. Each year in May, the USDA issued its first new-crop supply/demand forecasts for the upcoming year. This sets the basic parameters that are molded into the final bean crop data 16 months later. Similar to corn, the USDA uses its Ag Forum bean yield & their March planting intentions to produce its initial crop outlook for the upcoming year

This month’s S. American crops had only a modest uptick with the USDA leaving Brazil unchanged at 117 mmt and raising Argentina by 1 mmt to 56 mmt. However, the combination of a slightly higher beginning stocks and output along with a modest 2 mmt cut in demand boosted the USDA’s current year World ending stocks by 6 mmt to 113 mmt. This slippage in protein demand was also reflected in soybeans US 2018/19 export demand that was cut by 100 million to 1.775 billion bu. This change upped soybean’s stocks to 995 million bu.

This month’s twists occurred in 2019/20 US & World balance sheets. This spring’s 4.6 million acre drop in US bean plantings cut the USDA’s new crop size by about 400 mil-lion to 4.15 billion bu. Despite a 75 million cut in 2019/20’s US oversea demand, expanding world livestock numbers to cover China’s likely jump in meat imports kept DC’s new crop stocks slightly lower at 970 million bu. Internationally, the USDA projecting 2.35% rise in soy demand, similar to past 2-year average, will likely meet reduced US (-10 mmt) Canada (-1.0) & Argentina (-3 mmt) output. This could keep world stocks unchanged at 113 mmt for 2019/20.

US soybean plantings at only 9% this week vs. their 5-year average of 29% on this date have also been impacted by 2019’s weather. Acreage switches from corn & soybean's shorter growing season keeps this crop’s output outlook fluid until late May or early June.

(Click on image to enlarge)

What’s Ahead

After an initial price break on the breakdown of the US/China trade talks and higher May soybean stocks last week, Trump holding the expansion of tariffs on $300 billion of Chinese exports and calling for renewed talks has prompted a near-term price recovery. Producers with old-crop supplies should advance old-crop sales to 80-85% on July soybean price strength in the $8.30-$8.43 range.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of its ...

more