Market Update: Stock Market Isn’t The Economy

The S&P 500 turned positive year to date (red), while the small caps (blue) and international (green) continue to lag.

While the economy contracted by a record 33% in Q2, the biggest companies within the S&P 500 grew revenues at a combined rate of 18%. Here’s the breakdown below:

Apple AAPL:11% growth

Microsoft MSFT: 13% growth

Amazon AMZN: 40% growth

Facebook FB:11% growth

Google GOOGL: -1.5% decline

When you combine these results with 0% interest rates and historic fiscal and monetary policy responses, it's easier to see why the S&P 500 has turned positive in a year with a pandemic and record-high unemployment. Unfortunately, we are all feeling the effects of the shutdowns. Hopefully, we can return to some semblance of normalcy soon.

A quick review of some of the key data points:

(Click on image to enlarge)

Small business confidence beat expectations and an increase over the prior month.

(Click on image to enlarge)

Core retail sales also beat expectations and well in expansion territory.

(Click on image to enlarge)

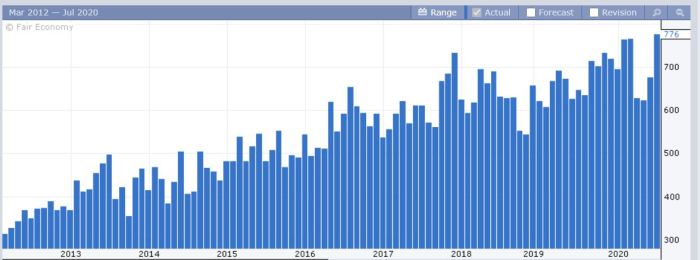

New home sales beat expectations and actually made a new cycle high for the expansion.

(Click on image to enlarge)

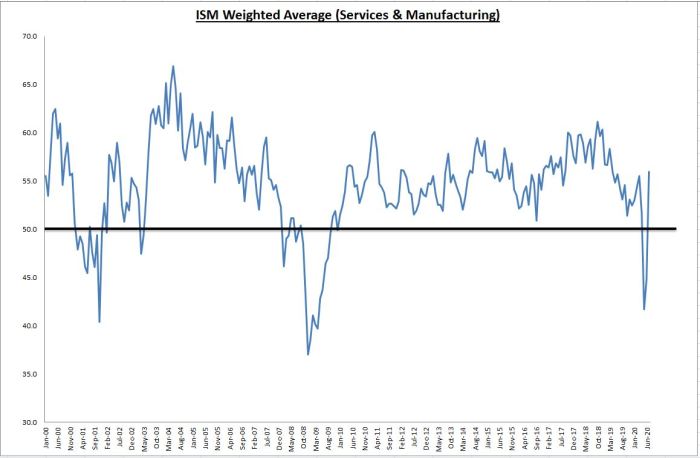

Weighted ISM comes in at 57.1, which is the highest reading since March 2019. This is comprised of the monthly Manufacturing reading of 54.2, and the monthly Services reading of 58.1. Both beating expectations.

Overall the economy is doing pretty well given the circumstances. Unemployment remains elevated and will likely remain so for a while. Extension of fiscal support is still up in the air and the two sides remain at a stalemate.

Everyone appears focused on the deflationary forces, but there is some evidence that those forces are being overestimated. Stay tuned!

(Click on image to enlarge)

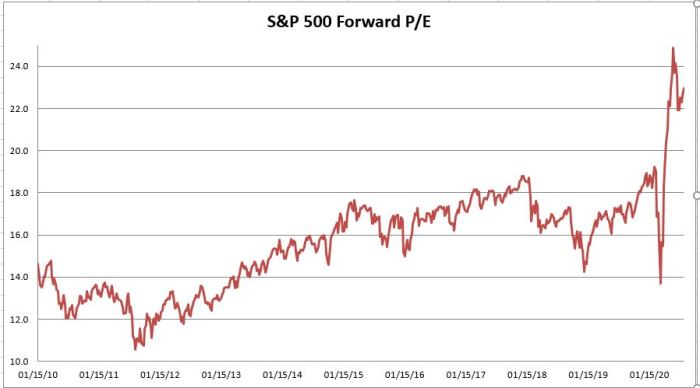

The S&P 500 trades at 23x forward earnings, so the market is already pricing in optimism. This may be reasonable with 0% rates and a 10 year below 1%, (current earnings yield of 4.35% still looks attractive) but it's still above historical averages.

(Click on image to enlarge)

Of note this month was the breakout to all-time highs in Gold after many years of under-performance. Expect the breakout points to be tested. If they should hold, one can estimate a target of $3000, which would roughly match the size of the 2008-2011 rally.

I contribute the negative real interest rate environment as a big factor in the breakout. I’ve owned IAU since the Fed announce ZIRP was back on. The Fed is essentially saying you aren’t getting paid to be safe. You either have to accept that or take on more risk in an attempt to keep up with inflation. It’s not a good place to be and I feel for those living on fixed income with no tolerance to take on risk.

This is why the stock market multiples are elevated, why gold and silver is breaking out, and why high yield stocks and junk bonds are catching bids. Money will go where it's treated the best. When you can get a reasonable rate of return on “safe” investments like money markets and bank accounts, there is little incentive to move out into the risk spectrum. But when those “safe” investments yield nothing (and negative when you factor in inflation), well that’s when the tough decisions need to be made.

The long term ramifications of these policies worry me. But for now, there are no alternatives. The important thing for investors is to focus on time frames and risk tolerances. Avoid the urge to chase market returns, especially with money deemed for short term purposes (less than 5 years).

In summary, the economy is actually doing better than advertised. But valuation already reflects this sense of optimism. Is it priced in already? No one really knows. I’m more concerned with factors like future inflation and US-China relations than I am with the more publicized risks like COVID and the election.

Disclosure: None.

Nothing on this article should be misconstrued as investment advice. Trading and investing is very risky, please consult your investment advisor before making any ...

more